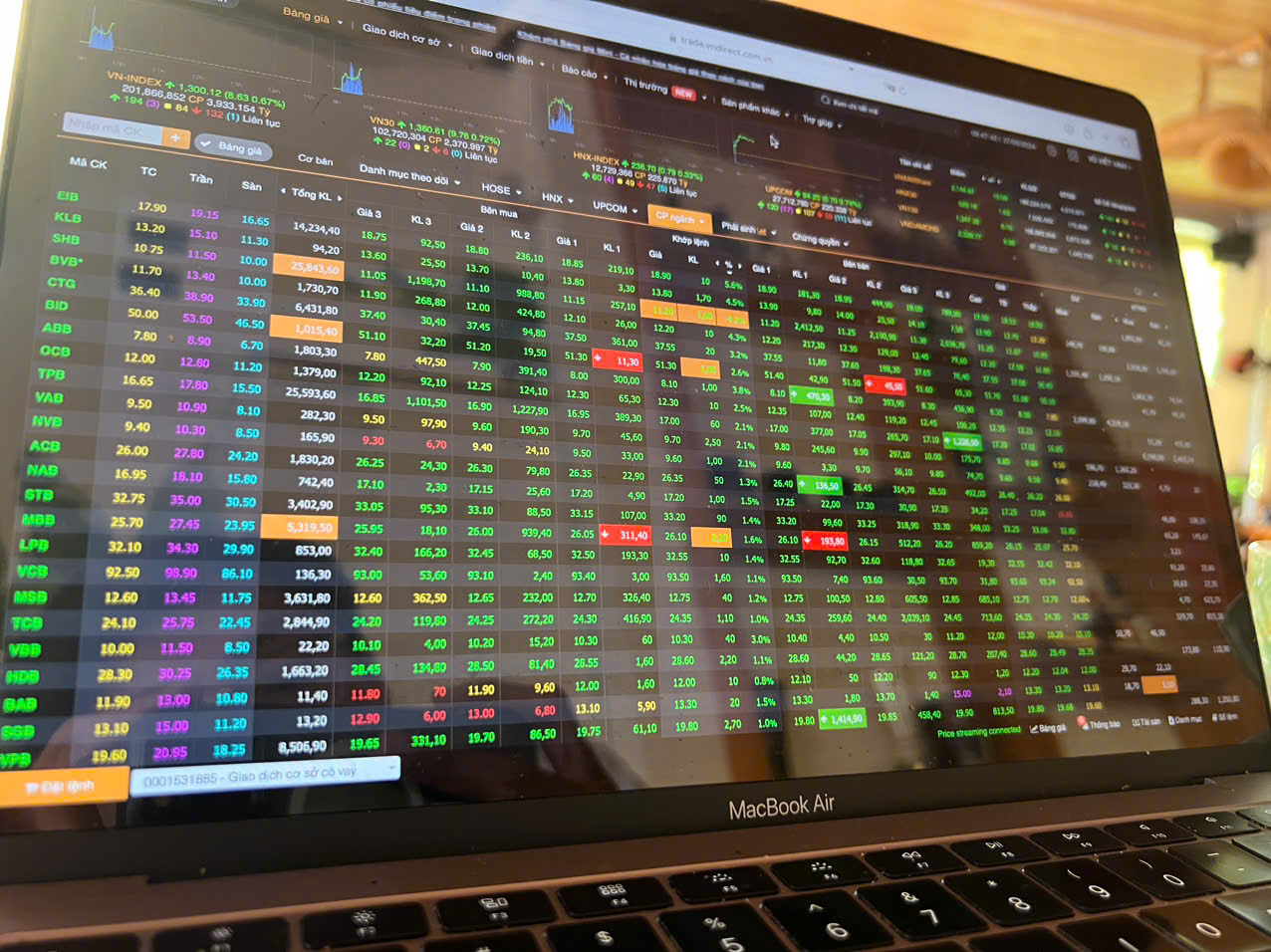

In the first 45 minutes of the trading session on September 27, the consensus among bank stocks pulled the VN-Index to 1,300 points after several failed attempts to conquer this milestone.

Observing the market at 8:45 am, the VN-Index rose 8.5 points to 1,300.08 points as all bank stocks surged. Notably, EIB and KLB witnessed the most significant gains, increasing by 5.6% and 4.5%, respectively. Other stocks, including SHB, BVB, CTG, BID, and ABB, also recorded increases of over 3% each, while the remaining stocks in this sector saw gains of more than 1%.

Many individual investors feared being left behind and rushed to invest in this group of stocks, causing the trading value to soar.

VN-Index touches 1,300 points shortly after the market opens on September 27.

Other industry groups, such as securities, real estate, and steel, also witnessed positive momentum, contributing to a dominant number of rising stocks in the market compared to declining ones.

The trading value increased considerably from the previous session, with the HoSE exchange alone reaching nearly VND4,000 billion.

However, after the VN-Index surpassed the 1,300-point mark, profit-taking pressure emerged, causing the index to narrow its gains. By 10 am, the increase had shrunk to approximately 5 points, with the VN-Index trading around 1,296 points.

According to the Vietnam Foreign Trade Joint Stock Commercial Bank Securities Company (VCBS), the market is exhibiting caution as the VN-Index approaches the 1,300-point region.

The company recommends that investors refrain from chasing high-priced stocks, especially those at their peaks or showing signs of strong selling. Instead, investors can consider holding stocks that attract capital flows from sectors like banking and real estate. They can also take advantage of intra-session fluctuations to invest in a few oil and gas, investment, and public investment stocks…