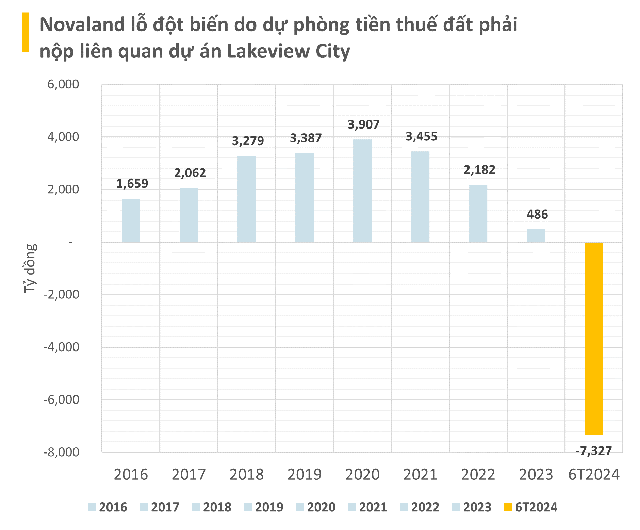

Novaland (stock code: NVL) has just released its reviewed semi-annual financial statements for 2024. Specifically, Novaland’s consolidated after-tax profit for the first six months of 2024 reported a loss of 7,327 billion VND, compared to a positive profit of 345 billion VND in the self-prepared financial statements.

The company attributed the loss primarily to the provision for land rent and land use fees payable, based on the 2017 pricing plan for the 30.106-hectare project in Nam Rach Chiec, An Phu Ward, Thu Duc City, Ho Chi Minh City (Lakeview City project – the investor is Century 21 International Development Company Limited), as per the tax authority’s notification on January 8, 2021. The provision established for this payable amount is 4,358 billion VND.

In addition to the additional provision, Novaland had to reduce its after-tax profit by another 3,046 billion VND due to adjustments in financial activities of 2,991 billion VND and other income of 55 billion VND for contract violations that occurred during the period but had not been collected by June 30. These amounts will be recognized upon completion of the collection. As of the date of issuance of the financial statements, these amounts had been fully recovered.

Finally, Novaland’s profit was further reduced by 268 billion VND due to provisions for inventory markdowns and adjustments to other expenses.

It is understood that Lakeview City is a project that the Company exchanged for a 30.224-hectare project in Binh Khanh Ward, Thu Duc City – a project for which the Company had completed site clearance and compensation in 2008 according to the land allocation decision in 2004. In 2016, the People’s Committee of Ho Chi Minh City issued a decision approving the land price scheme at market prices for the 30.224-hectare site in Binh Khanh Ward and the Lakeview City project to resolve the exchange for the Company, with the same time point for determining the land price for both projects in 2008. As a result, after determining the land use rights value and the location differential value between the two sites, the Company had to pay an additional amount of nearly 52.7 billion VND after the project exchange. The Company recorded this financial obligation in its accounting books in 2016.

However, on December 29, 2020, the People’s Committee of Ho Chi Minh City issued Decision No. 4777/QD-UBND approving the land price scheme for the 30.106-hectare site in Nam Rach Chiec, An Phu Ward, District 2, with the land price scheme at the time of April 2017 (instead of 2008 as mentioned above). Accordingly, the Ho Chi Minh City Tax Department issued Notice No. 268/TB-CTTPHCM on January 8, 2021, and Notice No. 269/TB-CTTPHCM on land use fee payment on the same day, with a total land rent and land use fee of nearly 5,176 billion VND. The company disagrees with the determination of the land use fee calculation period as April 2017, as it had completed compensation in 2008.

At the same time, according to regulations, when the State revokes land, it must compensate with land of equivalent value, or with money if no land is available. Novaland believes there is sufficient basis to determine that the time point for calculating the land exchange price for the Lakeview City project is 2008. Currently, Novaland is continuing to petition the People’s Committee of Ho Chi Minh City and other departments to consider a thorough resolution for the Company.

Notably, at the time of issuing the reviewed financial statements, the Ho Chi Minh City Tax Department and Thu Duc City Tax Department had issued decisions to terminate the validity of the decisions on the enforcement of administrative decisions on tax management, pending the results of the resolution on land use fees and land use fees by competent authorities, based on the Public Security of Ho Chi Minh City.

In addition, Novaland explained that, according to the independent auditor’s perspective, they adjusted to reduce financial income from lending, joint venture activities, and other income from contract violation penalties that occurred during the period but had not been collected by June 30, 2024. As of the date of issuance of the reviewed semi-annual financial statements (September 26, 2024), all these amounts had been fully recovered. Therefore, these income amounts will be recognized again in the 2024 financial statements.

Also in the semi-annual financial statements, the independent auditor expressed an opinion on the Group’s assumption of continuous operations. Regarding this, Novaland stated that it continues to implement multiple solutions to generate sufficient cash flow to finance the Company’s operations. In the first six months of 2024, the value of deliveries recognizing revenue reached 1,891 billion VND, up 37% over the same period, recognized from deliveries at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, and Palm City…

Novaland Appoints Duong Van Bac as Deputy CEO

On September 6, the Board of Directors of Novaland Investment Group Joint Stock Company (Novaland, HOSE: NVL) announced the appointment of Mr. Duong Van Bac as Deputy General Director and Chief Financial Officer of the company.