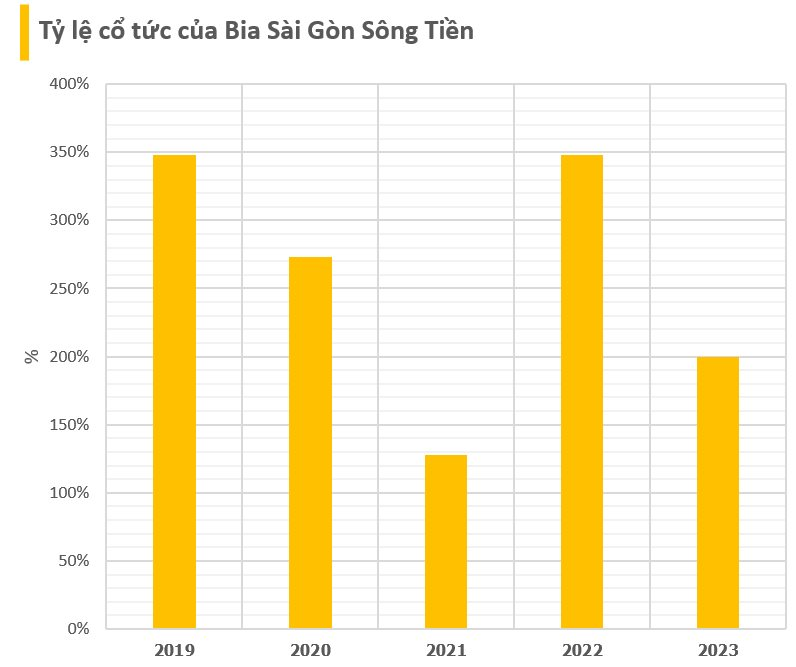

Vietnam’s Saigon Beer Corporation has announced a cash dividend payout of 199.84%, meaning shareholders will receive VND 19,984 per share. The company will finalize the list of shareholders on October 8, with dividend payments expected to be made on October 24.

For the past seven years, Saigon Beer Corporation has consistently maintained a high dividend payout ratio of several hundred percent annually. Notably, in 2020 – the first year impacted by the Covid-19 pandemic, the company distributed dividends at a rate of 347.6%. Most recently, the 2022 dividend was set at 278%.

Saigon Beer Corporation, formerly a branch of the Saigon Beer, Alcohol and Beverage Joint-Stock Corporation (Sabeco), adopted a joint-stock company model in March 2006 with an initial charter capital of VND 10 billion. In 2009, the company increased its capital to VND 40 billion. Its business operations cover the provinces of Long An, Tien Giang, Ben Tre, Tra Vinh, Vinh Long, and Dong Thap.

Sabeco remains the parent company of Saigon Beer Corporation, holding 90% of its capital, equivalent to 3.6 million shares. As a result, Sabeco is set to receive nearly VND 72 billion in dividends from the upcoming payout.

Looking ahead to 2024, Saigon Beer Corporation has set a target of VND 4,822 billion in revenue, an 11% increase from the previous year. However, net profit is projected to decrease significantly by 84% to VND 13.4 billion. The planned dividend payout ratio for this year is 264.6% in cash.

“The Birth of a Titan: A Shark’s Tale of Standing on the Shoulders of Giants”

“The glaring flaw in this business model is its lack of sustainability,” remarked Shark Binh. Twelve years ago, he founded Ship Chung, operating by riding on the backs of giants. After 4–5 years of stellar performance, this startup was pushed down by the very giants it relied on.