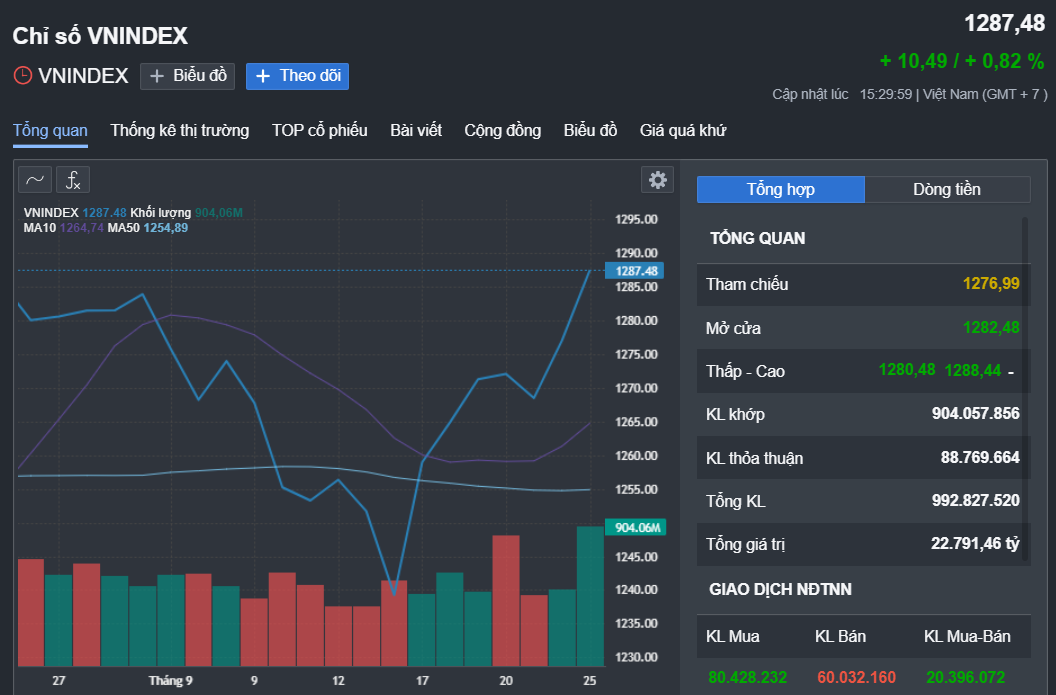

The Vietnamese stock market entered the trading session on September 25th in a state of contention at the 1,280 – 1,283-point region. The subsequent upward trend widened but slowed as it approached the 1,290-point threshold.

At the close, the VN-Index rose 10.49 points to settle at 1,287 points. Trading volume on the HoSE exchange increased, with 904.1 million shares traded.

The large-cap VN30 basket climbed 13 points to close at 1,344 points. Within this group, 23 stocks advanced, led by POW (+3.6%), SSI (+3.2%), and STB (+2.7%). On the flip side, seven stocks retreated, including VNM (-1%), BVH (-0.7%), and VJC (-0.5%).

In today’s session, foreign investors returned to net buying on the HoSE exchange, with a net purchase value of VND 524.8 billion. They actively bought shares of VCI (+VND 89.7 billion), MWG (+VND 84.3 billion), and TCB (+VND 79 billion). Conversely, they offloaded HPG (-VND 65.5 billion) and STB (-VND 60.8 billion).

Vietnam Dragon Securities Corporation (VDSC) noted that the higher trading volume compared to the previous session indicated strong contention between supply and demand forces. As the market strives to sustain its upward momentum, it is likely to advance toward the 1,290-point threshold.

Market performance over the past month. Source: Fireant

However, VDSC anticipated a continued rise in supply, exerting significant pressure on the market. Therefore, they advised investors to monitor supply and demand dynamics at the resistance zone to reassess market conditions and consider restructuring their portfolios to mitigate risks during this recovery phase.

Meanwhile, VCBS recommended that investors maintain their account weights, refrain from chasing sharp rallies, and capitalize on intra-session fluctuations to boost exposure in sectors attracting robust capital inflows, such as securities, banking, and steel.

Regarding sectors undergoing accumulation or rebounding from short-term lows, like oil and gas, public investment, and industrial real estate, VCBS suggested that investors consider partial allocation to anticipate capital rotation in the upcoming sessions.