Selling pressure did not intensify in the afternoon session, but buyers seemed to retreat. The market slipped in terms of both indices and breadth, and value also declined, indicating a weakening of confidence. Bank stocks remained mostly in the green, but the largest caps underperformed, causing the VN-Index to close in the red.

The index closed with a marginal loss of 0.57 points (-0.04%), slipping below the 1290.92 mark. From challenging the 1300 peak, the VN-Index concluded weakly, confirming today’s efforts had failed.

Investors’ belief in the chance of breaking the high has been eroded, most evident in the market breadth narrowing rather swiftly. At the morning close, the VN-Index had 182 gainers and 190 losers, but by the end of the day, only 148 stocks advanced while 228 declined. The number of stocks falling over 1% increased to 69, up from 43 in the morning session.

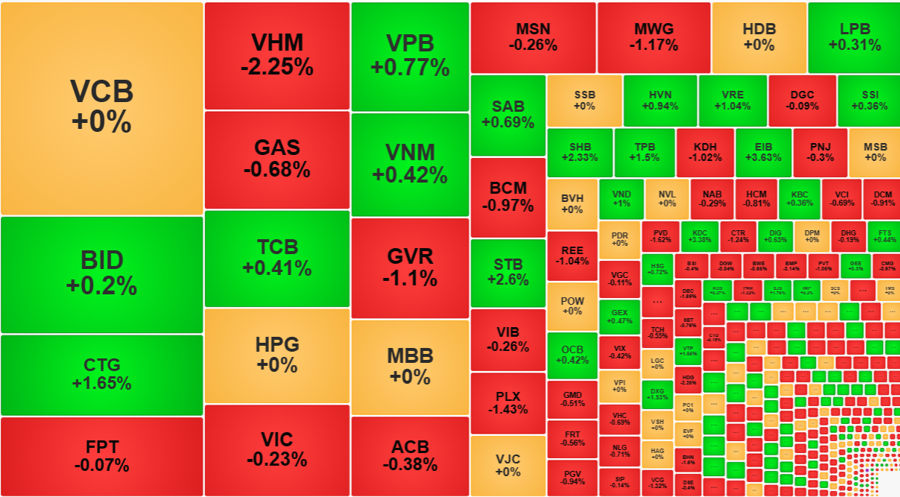

Bank stocks still held 8 out of the top 10 spots for the most significant contributors to the VN-Index, but the overall upward momentum weakened. Of the 27 stocks in the basket, 16 advanced, but the leading names lagged. VCB was pushed back to the reference price at the close, while BID fell by 0.99% compared to the morning session’s close, ending just 0.2% above the reference. VPB also lost steam, closing up only 0.77%. The best-performing stocks, such as ABB, KLB, EIB, and VBB, lacked influence. CTG was the only notable exception, rising 1.65%, but this gain was already achieved in the morning. STB was the standout performer in the afternoon, surging another 1.66% to close 2.6% higher. Unfortunately, STB didn’t even make it into the top 20 by market cap. Inflows into the banking group on HoSE also decreased by over 14% from the previous session, totaling VND 7,023 billion.

Along with the weakening of the banking sector, several other large-cap stocks faltered. VHM performed the worst and had the most negative impact on the index. By the morning close, VHM had already shed 1.24%, and it fell a further 1.03% in the afternoon. VHM alone took away over one point from the VN-Index. The VN30 basket still managed a slight gain of 0.13% in index terms, even though the breadth was balanced with 11 advancers and 11 decliners. This was due to the high market cap of the banking sector within this index. Of the 30 stocks, four fell by more than 1%: VHM, PLX, MWG, and GVR.

However, the magnitude of the price declines among large-caps in the afternoon wasn’t significant. Compared to the morning session’s close, VHM and VPB were the only two stocks that fell by more than 1%. Nonetheless, due to the broad-based correction, the pull on the indices also weakened. Seventeen of the VN30 stocks declined in the afternoon compared to the morning session, while only nine improved. Besides STB, none of the gainers made a substantial impact.

The lack of consensus among large-caps was the primary reason for the VN-Index’s failure to breach the 1300 mark. At this point, bank stocks are the only hope. If they had plunged like some of the other large-caps today, the psychological selling pressure would likely have been more intense.

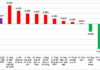

A positive aspect of the afternoon’s decline was that it seemed more driven by a lack of demand rather than aggressive selling. HoSE’s liquidity decreased by 12.4% from the morning session, reaching VND 9,011 billion. Including HNX, the afternoon session’s liquidity fell by 11.2%. Additionally, the magnitude of declines wasn’t severe when considering the liquidity. Of the 69 stocks falling over 1%, six had liquidity exceeding VND 100 billion: MWG, VHM, HDG, DBC, VCG, KDH, and PVD. Their combined liquidity accounted for only 15.4% of HoSE’s total.

Among the stocks rising over 1%, 45 were recorded, and their liquidity made up 25% of the exchange. Bank stocks took the top five spots: TPB, STB, CTG, SHB, and EIB. Other notable gainers included DXG, up 1.53% with VND 419.9 billion in liquidity; VND, rising 1% with VND 370.8 billion; VRE, climbing 1.04% with VND 226.6 billion; and HDC, advancing 1.52% with VND 124.6 billion.

Overall, the turnaround in the indices and individual stocks, regardless of whether they ended in the red or not, reflected the dominance of selling pressure. Investors are perceiving heightened risks and seeking to offload positions. The market may need more time to absorb this selling volume.

The Capital Stampede: A Rush to Invest

The market witnessed a strong comeback today (September 25th) with the VN-Index surging over 10 points at the closing bell. Domestic and foreign investors ramped up their buying activity, pushing the benchmark index towards the old peak of 1,300 points.