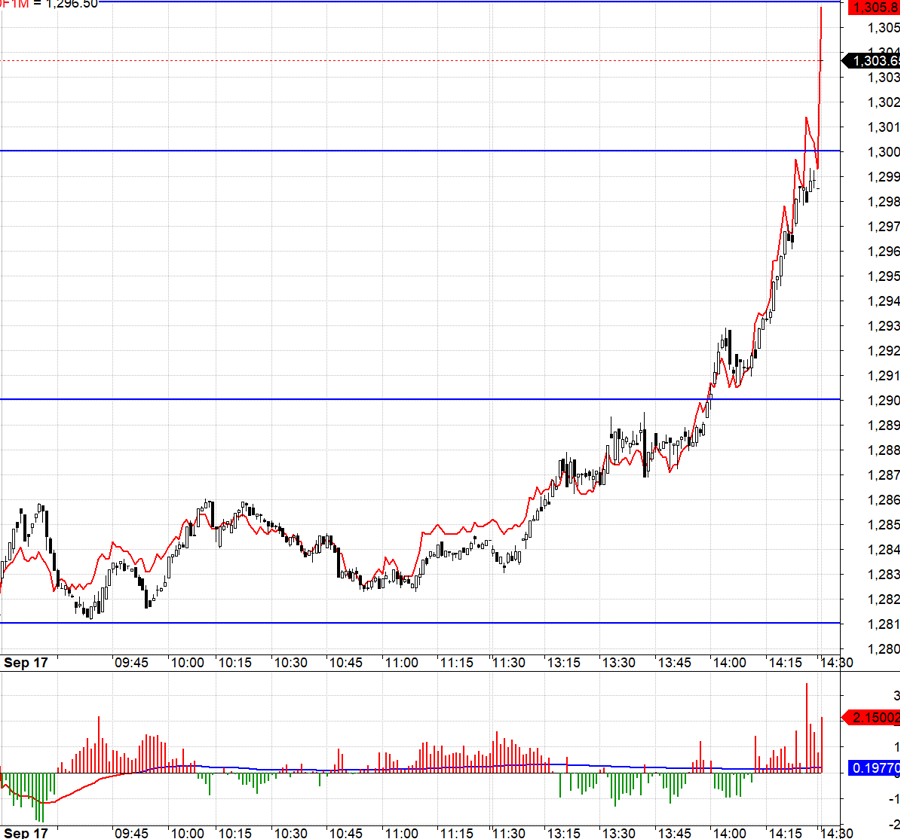

The trading session was dominated by bullish sentiment, with the VN-Index trading in positive territory throughout. The market’s momentum gained strength as the benchmark index extended its gains, accompanied by a corresponding increase in trading volume. By the end of the session, the HoSE witnessed robust trading activity, with over VND20.5 trillion in matching value, nearly double the previous day’s volume.

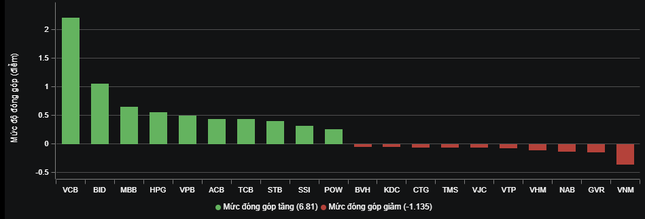

Leading the market rally were banking stocks, with VCB, BID, and MBB at the forefront. Notably, VCB alone contributed more than two points, making it the most actively traded stock. Across the board, banking stocks listed on the HoSE climbed higher, with the exception of CTG, which slightly dipped below the reference price.

Banking stocks take the lead in the stock market on September 25.

The upward trend among the market’s largest capitalized stocks instilled a sense of optimism among investors. Money flowed back into various sectors, notably securities. Not a single securities stock witnessed a decline during today’s session. Leading securities stocks in terms of liquidity, including VIX, SSI, VND, HCM, VCI, and SHS, were all in the green.

In the steel sector, HPG stood out with a trading value surpassing VND1,000 billion, the highest during the session. Other steel stocks such as HSG, NKG, VGS, TVN, and TLH also joined the rally.

Despite the broad-based market advance, even less-than-favorable business results failed to significantly dampen the upward momentum of certain stocks. Notably, MWG, which recently disclosed its August business results and the closure of 70 stores within a month, still managed to climb nearly 1% to VND68,700 per share, its intraday high.

After yesterday’s abrupt net sell-off in the trillions, foreign investors resumed net buying today, with a net purchase value of nearly VND540 billion, focusing on VCI, MWG, and TCB. The reason behind the sudden net withdrawal of VND2,700 billion from VIB by foreign investors remains undisclosed.

At the close, the VN-Index climbed 10.49 points (0.82%) to reach 1,287.48 points. The HNX-Index rose 1.52 points (0.65%) to 235.84 points, while the UPCoM-Index dipped 0.31 points (0.33%) to 93.5 points. Trading volume surged, with matching value exceeding VND20.5 trillion.

Stock Market Outlook for September 27: Will Bank and Real Estate Stocks Keep Surprising?

In Thursday’s trading session, bank and real estate stocks witnessed a surprising surge in their prices towards the closing bell. Investors are optimistic that this trend is here to stay and are eagerly anticipating further gains in the coming sessions.