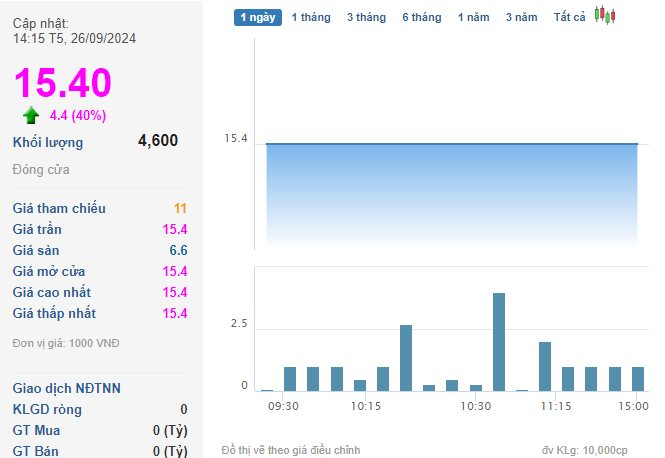

On September 26th, 2024, 50 million VDG shares were introduced on the UPCoM exchange at a price of 11,000 VND per share. This newly listed stock surprised the market with an impressive performance on its debut.

By the end of the trading session, the share price had soared to 15,400 VND, a remarkable 40% increase from the opening price, with 4,600 units traded. Furthermore, there was a significant buy order at the ceiling price, totaling 105,700 units.

This sharp rise in share price resulted in a substantial increase in the market capitalization of VDG, elevating it from 55 billion VND to 77 billion VND.

Prior to this event, in May 2024, Van Dat Group officially became a public company, with all its common shares registered for centralized depository at the Vietnam Securities Depository.

VDG Shares Surge on UPCoM Debut. (Source: Cafef)

Van Dat Group, formerly known as Van Dat Architecture Corporation, was established in August 2019 with an initial capital of just 1 billion VND, founded by three shareholders.

In 2021, the company increased its capital to 50 billion VND, which has been maintained to the present. Notably, Mr. Tran Van Anh, the Chairman of the Board of Directors of Van Dat Group, holds 61% of the capital, while Mr. Lai A Chanh owns 27.3%. Around this time, the company decided to expand its business scope and changed its name to Van Dat Group Joint Stock Company.

To strengthen its production activities, in 2022, Van Dat Group acquired a 16% stake in Van Dat Textile Material Production Co., Ltd., a company specializing in the production of fabric bags.

Mr. Tran Van Anh (born in 1977) has been associated with Van Dat Group since its early days, serving as the Chairman of the Board of Directors and General Director of the company. From March 2022 to August 2023, Mr. Anh held the position of Director, and he has been the Chairman of the Board of Directors since August 2023.

Presently, Van Dat Group is heavily focused on real estate projects in Binh Duong, including villa and townhouse developments. Additionally, the company plans to expand into the production and export of nutritional supplements.

Notably, this diversified enterprise is also considering a share issuance to raise capital and aims to list on the HoSE exchange in the future.

In terms of financial performance, while the company’s revenue has increased significantly in recent years, rising from 164 billion VND in 2022 to 213 billion VND in 2023 (a 30% increase), its after-tax profit decreased from 3.2 billion VND to 2.6 billion VND (a 19% drop).

In the first half of 2024, Van Dat Group achieved revenue of 110.5 billion VND, a 33% increase compared to the same period last year. However, gross profit decreased by 22% due to a decline in profit margin from 5% to 3%. The company also recorded a pre-tax profit of 1.25 billion VND, slightly lower than the same period in 2023.

Van Dat Group plans to issue 500,000 shares as a dividend payment for the year 2023, representing a 10% dividend ratio. Additionally, the company intends to issue 275,000 ESOP shares to employees at a price not lower than 10,000 VND per share, expected to take place in 2024. Following these two issuances, the company’s charter capital will increase from 50 billion VND to 57.75 billion VND.

The Capital Stampede: A Rush to Invest

The market witnessed a strong comeback today (September 25th) with the VN-Index surging over 10 points at the closing bell. Domestic and foreign investors ramped up their buying activity, pushing the benchmark index towards the old peak of 1,300 points.