The Vietnamese stock market has just witnessed a vibrant trading session. The main index’s upward trajectory was supported by pillar industry groups, with securities stocks taking center stage and attracting positive cash flow.

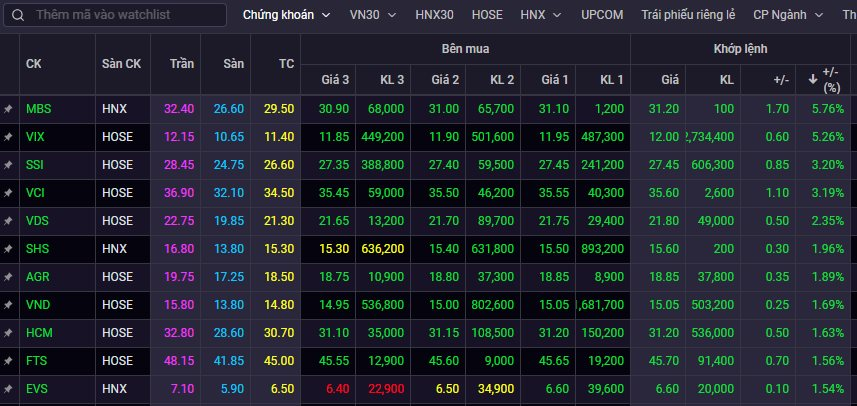

Notably, MBS and VIX stocks witnessed a sharp increase of nearly 6%. Following suit, a series of other codes such as SSI, VCI, VDS, SHS, AGR, VND, HCM, and more, all closed with a positive increase of nearly 2% to over 3% in value.

Even MBS and HCM stocks rose in tandem, both closing at the milestone of VND 31,200/share, thereby simultaneously setting a historical peak.

MBS and HCM stocks reach new highs

The influx of cash into securities stocks boosted trading activity for many codes, with VIX, SSI, VND, HCM, and VCI among the top liquidity leaders in the overall market. These stocks witnessed a sudden surge in matched volume, ranging from over ten million to nearly 40 million units traded.

One of the driving forces behind the recent rally in securities stocks is the issuance of Circular No. 68/2024/TT-BTC, which officially allows securities companies to provide services for foreign institutional investors to place orders without sufficient funds from November 2nd onwards.

Assessing the impact of this Circular, VNDirect Securities stated that there would be three main effects on the Vietnamese stock market: (1) Attracting more foreign institutional investors as Vietnam’s regulations move closer to international standards; (2) Anticipating an increase in foreign capital inflows into the market; and (3) Enhancing market liquidity.

Therefore, the VNDirect analysis team believes that the securities industry will benefit from serving more foreign institutional investors, resulting in increased brokerage revenue as liquidity improves.

Additionally, this is a significant step forward in the process of upgrading Vietnam’s stock market. Circular No. 68/2024/TT-BTC is expected to help Vietnam meet the essential requirements for an upgrade. VNDirect anticipates that the Vietnamese stock market will be classified as an Emerging Market by FTSE and MSCI in 2025 and 2026, respectively.

If the Vietnamese stock market is upgraded to Emerging Market status by FTSE and MSCI, investment funds that replicate these indices will allocate capital to Vietnam. The investment amount will depend on each fund’s allocation strategy. The stocks expected to benefit the most are those with the highest weights in the FTSE and MSCI indices.

On the other hand, addressing this critical bottleneck in the upgrade process is expected to become a catalyst for reversing foreign capital flows in the Vietnamese stock market.

Some analysts attribute the recent net selling by foreign investors to (1) profit-taking; (2) interest rate differentials causing capital outflows from emerging and frontier markets, including Vietnam; and (3) exchange rate pressure affecting the investment performance of foreign funds in the Vietnamese stock market.

In a recent statement, Mr. Dominic Scriven, Chairman of Dragon Capital, pointed out that domestic factors also influence foreign capital flows. Over the past two years, Dragon Capital analyzed 80 large companies representing over 80% of the market capitalization and found no profit growth. A market with no profit growth for two years (2022-2023) will drive investors away. This has been a significant factor in the perspective of foreign investors lately.

In a recent statement, Mr. Dominic Scriven, Chairman of Dragon Capital, pointed out that domestic factors also influence foreign capital flows. Over the past two years, Dragon Capital analyzed 80 large companies representing over 80% of the market capitalization and found no profit growth. With no profit growth for two years, investors will look elsewhere. This has significantly impacted the perspective of foreign investors lately.

The Capital Stampede: A Rush to Invest

The market witnessed a strong comeback today (September 25th) with the VN-Index surging over 10 points at the closing bell. Domestic and foreign investors ramped up their buying activity, pushing the benchmark index towards the old peak of 1,300 points.