Vietcap Joint Stock Company (code VCI-HOSE) announces Resolutions No. 18/2024 & 19/2024 approving the deployment of the plan to offer private placement of shares.

Accordingly, the VCI Board of Directors has approved the issuance of 143.6 million private placement shares, representing 25% of the circulating shares, at a price of VND 28,000/share. The expected proceeds amount to over VND 4,020 billion, which will be used to supplement capital for margin lending (VND 3,523 billion) and proprietary trading (VND 499 billion).

At the same time, VCI also announced the list of prospective investors participating in this offering, including 66 individuals and organizations. Notably, several leading foreign funds in the Vietnamese stock market, such as Dragon Capital, Pyn Elite Fund, and KIM Vietnam, are among the participants. Additionally, Prudential Vietnam has also registered to buy in this offering by Vietcap.

Pyn Elite Fund, a foreign fund from Finland, registered to purchase the largest volume with 21.5 million shares (15% of the total offer), equivalent to a 2.99% stake post-issuance. Several other funds also participated in this round with significant volumes, including Apolo Asia Fund (12.7 million shares), ACM Global Fund (8.5 million shares), VEIL (7.5 million shares), Amersham Industries Limited (6.8 million shares), and DC Developing Markets Strategies Public Limited Company (5 million shares), to name a few.

Moreover, numerous individual investors also participated in Vietcap’s offering with substantial amounts. Some notable participants include Huynh Ngoc Thuong (6.5 million shares), Nguyen Tan Minh (6 million shares), Nguyen Yen Linh (5 million shares), and Luu Cong Toai (4.9 million shares). Based on the offering price, these individuals will have to spend hundreds of billions of VND.

Prior to this, on September 13, Vietcap had finalized the shareholder list for the bonus issue of 132.57 million shares, equivalent to a 30% ratio (each shareholder owning 100 shares will receive 30 new shares). Following this issuance, Vietcap’s charter capital increased from VND 4,419 billion to VND 5,744.7 billion, and if the private placement share offering is successful, the company’s charter capital will further increase to over VND 7,180 billion.

The private placement share offering is expected to be implemented within 2024 and the first quarter of 2025, and these shares will be restricted from transfer for one year.

In the market, the VCI share price is currently down 0.69% to VND 35,900/share. Thus, the private placement offering price is about 28% lower than the market price.

Regarding Vietcap’s business performance, in the second quarter of 2024, the company recorded a pre-tax profit of VND 344 billion, up 163% over the same period last year. In the first half of 2024, pre-tax profit reached VND 571 billion, up 170% year-on-year, completing 82% of Vietcap’s plan for 2024 of VND 700 billion.

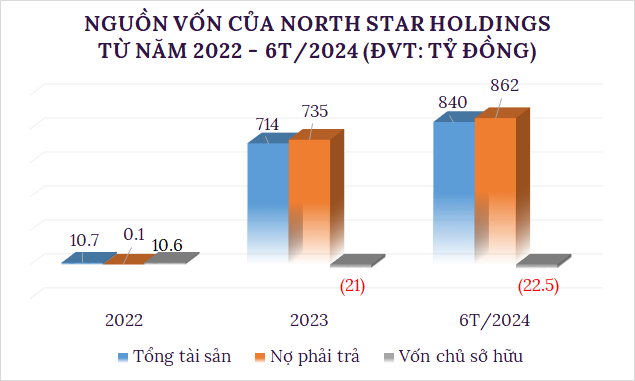

As of the end of June 2024, Vietcap’s total owners’ equity reached VND 8,859 billion, a 20% increase compared to the end of 2023.

For the full year 2024, Vietcap targets revenue of VND 2,511 billion and pre-tax profit of VND 700 billion, up 2% and 23%, respectively, from the previous year. As such, after the first half, the company has accomplished 81% of its profit target.

Vietbank Reports Positive Performance for the First Half of the Year

The Shareholders’ Meeting of Vietbank has approved a “prudent and realistic” business direction and growth plan for 2024, comprising two sets of targeted plans (KHCS and KHPD). These well-calibrated strategies, which aptly reflect the market conditions and the efforts of the entire system, have paid off. Vietbank’s 2024 Consolidated Semi-Annual Financial Report shows that 3 out of 5 financial goals were achieved ahead of schedule.