The share price of this stock doubled in just over a week, surging to 3,700 VND per share, a whopping 106% increase from its 1,900 VND price on September 18th. This also marked the highest price VE9 has seen in over two years. Trading volume for this stock skyrocketed as well, with hundreds of thousands of matched orders per session, far surpassing the previous period.

The management of VNECO 9, formerly known as Construction and Investment Joint Stock Company, has submitted a report to the Securities Commission regarding VE9’s consecutive five session-long streak of reaching the ceiling price from September 18th to 24th.

VNECO 9 attributed this phenomenon to factors beyond the company’s control, stating that share prices are dictated by market supply and demand. They assured that the company’s operations remain unchanged and that there are no significant developments to account for this surge.

However, during the trading session on the morning of September 26th, VE9’s share price underwent a correction, plunging to the floor price of 3,200 VND.

Despite the consecutive ceiling-reaching increases, the value of VE9’s shares remains extremely low, not even equivalent to a glass of iced tea.

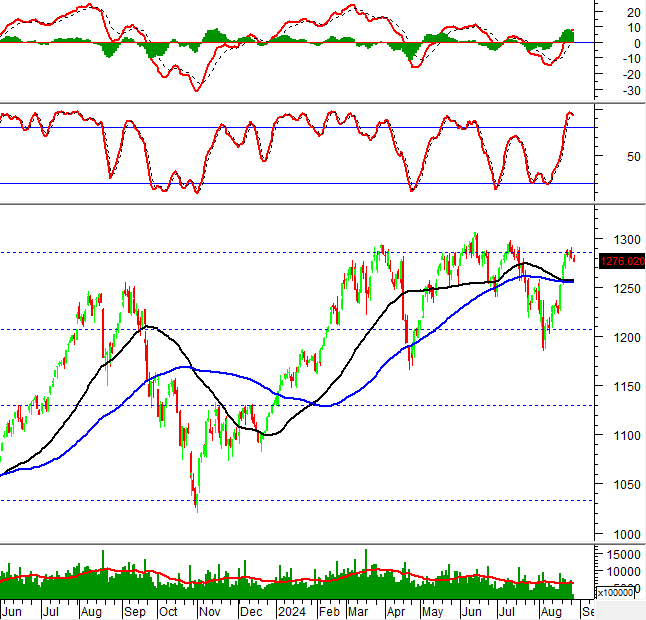

An illustration of a construction stock surging to the ceiling for six consecutive sessions.

VNECO 9, formerly known as Electric Installation Company 3.9, was established through the privatization of a state-owned enterprise. In 2006, the company was renamed VE9, with an initial charter capital of 4.1 billion VND, which has since increased to over 125 billion VND.

Their primary business activities include the installation of power grid systems and substations up to 500KV, as well as the construction of power plants, industrial, civil, and transportation infrastructure. They also trade in construction materials and interior decoration items.

As of June 30, 2024, the company’s total assets stood at 18.6 billion VND, unchanged from the beginning of the year. Their cash and cash equivalents were a mere 169 million VND, while their payables showed a slight decrease to 9.3 billion VND. Notably, the company’s retained earnings as of the end of June were negative, at -120 billion VND.