The VN-Index failed to break through the 1,300 mark this week as profit-taking selling occurred throughout the session. The market sentiment was not highly consensus, and while everyone shouted their determination to hold, a large volume of stocks was still sold off. The index closed slightly lower, down 0.57 points, hovering at 1,290 points, despite briefly crossing the 1,300 mark in the morning.

The breadth worsened towards the end of the session, with 228 gainers and 148 losers. The banking group acted as a strong support, with outstanding performances from STB, CTG, TCB, and VPB. The securities group also witnessed notable gains, with MBS, CTS, SSI, and VND among the top performers. Meanwhile, the food and beverage sector kept pace, with SAB, MCH, and VNM leading the charge.

On the flip side, most other sectors witnessed significant declines. The real estate sector took a hit, with the Vin group stocks VHM and VIC falling by 2.25% and 0.23%, respectively. NLG and HDG also witnessed declines, collectively erasing over one point from the index. The telecommunications sector plunged, with CTR alone dropping by 1.24%. The materials, transportation, and energy sectors also faced substantial profit-taking pressure, leading to adjustments.

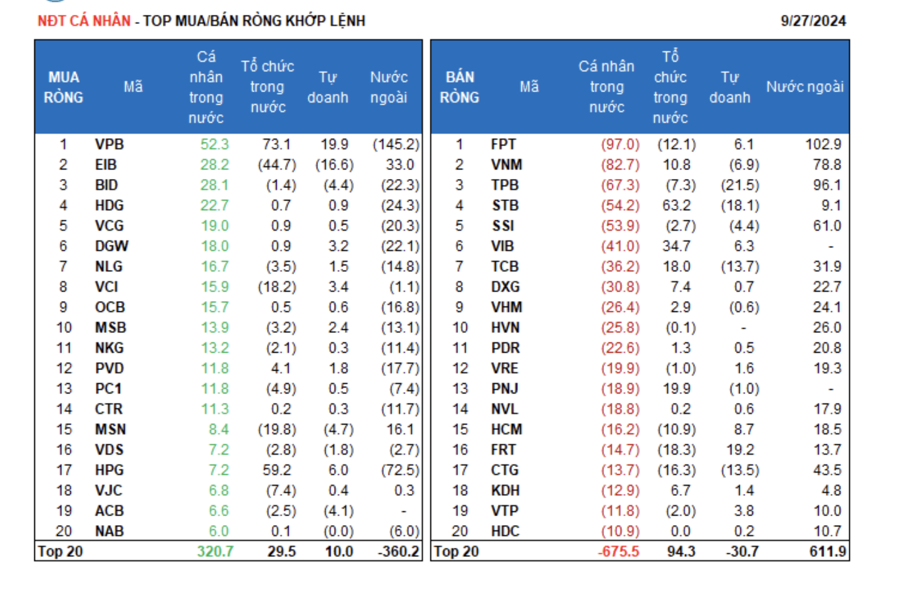

Market liquidity across the three exchanges surged to 24 trillion dong, with foreign investors net buying at 230 billion dong. Specifically, in matched transactions, they net bought 263.5 billion dong. Their top net bought sectors in matched transactions were financial services and information technology. The top stocks purchased by foreign investors in matched transactions included FPT, TPB, VNM, SSI, CTG, EIB, TCB, HVN, VHM, and FUEVFVND.

On the selling side, in matched transactions, foreign investors offloaded basic resources stocks. Their top sold stocks in matched transactions were VPB, HPG, MWG, HDG, BID, VCG, PVD, OCB, and NLG.

Individual investors net sold 365.8 billion dong, with a net sell value of 478.7 billion dong in matched transactions. In matched transactions, they net bought 6 out of 18 sectors, mainly focusing on construction and materials. Their top purchased stocks included VPB, EIB, BID, HDG, VCG, DGW, NLG, VCI, OCB, and MSB.

In terms of net selling in matched transactions, they offloaded 12 out of 18 sectors, primarily focusing on real estate and information technology. The top sold stocks by individual investors included FPT, VNM, TPB, STB, SSI, VIB, DXG, VHM, and HVN.

Proprietary trading accounts net sold 125.9 billion dong, with a net buy value of 6.2 billion dong in matched transactions.

In matched transactions, proprietary trading accounts net bought 12 out of 18 sectors. The top purchased sectors were retail and real estate. The top stocks bought by proprietary trading accounts today included VPB, FRT, MWG, VIC, HCM, VIB, FPT, HPG, GVR, and BMP. On the selling side, they offloaded bank stocks. The top sold stocks included TPB, STB, EIB, TCB, CTG, VCB, MBB, VNM, SHB, and MSN.

Domestic institutional investors net bought 241.7 billion dong, with a net buy value of 209.0 billion dong in matched transactions.

In matched transactions, domestic institutions net sold 8 out of 18 sectors, with the largest value in financial services. Their top sold stocks included EIB, MSN, FRT, VCI, FUEVFVND, CTG, FPT, HCM, VIC, and VJC. On the buying side, they focused on the banking sector. The top purchased stocks included VPB, STB, HPG, MWG, VIB, PNJ, TCB, DBC, VNM, and HDB.

Today’s matched transactions volume reached 2,848.0 billion dong, up 48.1% from the previous session and contributing 11.8% of the total trading value.

Notably, there was a large matched transaction in MSN stock, with over 13.6 million units worth 1,037.2 billion dong changing hands between individual investors.

Additionally, there was a matched transaction of over 8.6 million EVF shares (valued at 111.8 billion dong) sold by proprietary trading accounts to individual investors.

The money flow allocation increased in real estate, steel, agricultural and marine products, retail, and software sectors, while it decreased in banks, securities, construction, chemicals, food, petroleum, and textiles sectors.

In matched transactions, the money flow allocation increased in the mid-cap VNMID sector but decreased in the large-cap VN30 and small-cap VNSML sectors.