Delegates attending the meeting. Photo: TT&QHCC

|

The Huatai Securities Company delegation also included several senior leaders from the company. Representatives from the SSC, including leaders from the Securities Business Management Department, the Office, and the International Cooperation Department, attended the meeting and hosted the working delegation.

Willing to introduce, support, and consult customers and partners investing in Vietnam

According to Mr. Zhou Yi, the Vietnamese stock market is an open market with great potential for investment and is a key investment destination in the coming time for foreign investors, including Huatai Securities’ customers.

“Huatai wishes to contribute to the development of Vietnam’s capital market. In the future, Huatai is ready to introduce, support, and consult many of its customers and partners to invest in the Vietnamese stock market,” emphasized the General Director of Huatai.

In addition, with Huatai’s experience and development in the Chinese and international markets, Mr. Zhou Yi believes that the company can share its expertise in trading systems, IT systems, and transaction security solutions with Vietnamese companies.

The representative of Huatai also highly appreciated the policies to support foreign investors in the past time of the securities management agencies in Vietnam, including the issuance of documents relaxing the regulations on pre-funding. He hopes to receive more information and support from the SSC during the investment process in Vietnam.

Mr. Zhou Yi, CEO of Huatai Securities, shared information at the meeting. Photo: TT&QHCC

|

Huatai Securities is headquartered in Nanjing, China, established in 1991, and was one of the first companies founded with the birth of the Chinese stock market. Huatai was listed on the Shanghai Stock Exchange in 2010, the Hong Kong Stock Exchange in 2015, the London Stock Exchange in 2019, and was recently licensed to operate in the US market.

General Director Zhou Yi said that Huatai is one of the largest securities companies in China, providing a full range of professional and diverse financial and securities services to both individual and institutional clients, such as securities brokerage, asset management, investment banking, and market research.

During its operation, Huatai has supported many enterprises to be listed on stock exchanges in different markets. Huatai’s activities take place in many major markets, including Singapore, Hong Kong, the UK, and Europe.

The company has several wholly-owned subsidiaries, including Huatai United Securities Co Ltd, Huatai Securities (Shanghai) Asset Management Co Ltd, Huatai International Financial Holdings Co Ltd, Huatai Zijin Investment Co Ltd, Huatai Innovation Investment Co Ltd, and Huatai Futures Co Ltd.

In addition, the company also holds controlling stakes in Jiangsu Equity Exchange Co Ltd and owns stakes in China Southern Asset Management Co Ltd, Huatai – PineBridge Fund Management Co Ltd, Bank of Jiangsu Co Ltd…

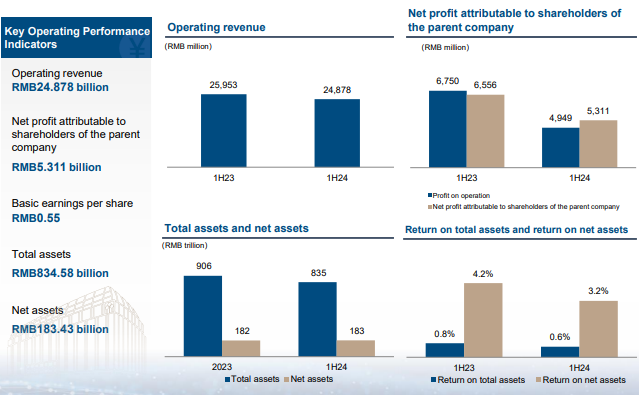

In the first half of 2024, Huatai earned nearly RMB 24.9 billion, down 4% over the same period last year. After deductions, Huatai’s net profit was over RMB 5.3 billion, down 19%. As of the end of the second quarter, the company’s total assets were nearly RMB 835 billion, with net assets of more than RMB 183 billion.

Unit: RMB – Source: Huatai Securities

|

Removal of pre-funding requirements receives positive feedback

Speaking at the meeting, SSC Chairman Vu Thi Chan Phuong said that the Vietnamese stock market has been formed and developed for more than 20 years with remarkable growth. The SSC always attaches great importance to improving the legal framework, and accordingly, the amendment and supplementation of the Securities Law and other documents related to securities and the stock market have been and are being built on the basis of referring to IOSCO principles, international practices, and studying international experiences, including those of China.

According to the Chairman, Vietnam’s stock market now has all the components, including the stock market, a specialized bond market, and a derivatives market. The market capitalization is currently around 70% of GDP, with many large state-owned enterprises equitized and listed on the stock exchanges.

The SSC has also issued many documents regulating risk management of securities companies and sustainable governance according to OECD standards, requiring listed companies to publish sustainability reports according to ESG standards. Regarding transparency, the SSC has also issued many regulations related to the publication of financial statements and corporate governance reports in both Vietnamese and English for listed companies.

The Chairman also said that the Minister of Finance had signed and issued Circular No. 68/2024/TT-BTC dated September 18, 2024, on removing the pre-funding requirement, which has received positive feedback from market members, foreign investors, and international organizations. The SSC Chairman affirmed that the SSC is always ready to support and share information about policies and mechanisms with foreign organizations during their investment process in Vietnam.

SSC Chairman Vu Thi Chan Phuong speaks at the meeting. Photo: TT&QHCC

|

The Stock Market Rally: HCM and MBS Duo Soar to New Heights

A flurry of trading activity has ignited the stock market, with a surge of cash flow fueling frenzied transactions in numerous stocks. This has catapulted these stocks to the pinnacle of liquidity across the market, capturing the attention of investors and traders alike.