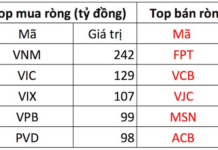

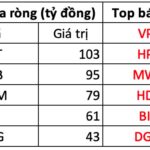

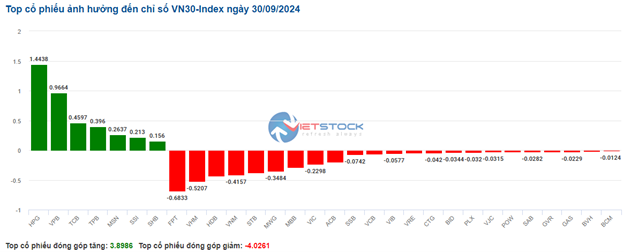

The stocks in the VN30 basket are currently leaning towards the red, with 23 decliners and 7 gainers. Notably, FPT, VHM, HDB, and VNM had a fairly negative impact on the index, deducting 0.68, 0.52, 0.44, and 0.42 points, respectively. On the supportive side, the index was lifted by most of the banking stocks, including VPB, TCB, TPB, and SHB, which contributed almost 2 points to the VN30-Index.

Source: VietstockFinance

|

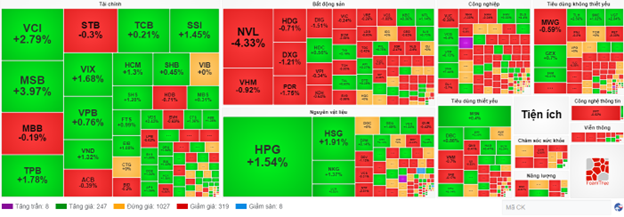

The real estate sector continued to face headwinds, with most stocks in the sector seeing red and experiencing the sharpest decline in the market, at 0.63%. Specifically, VHM fell by 1.04%, HDG dropped by 0.89%, DXG decreased by 0.91%, and notably, NVL plunged by 4.33% after announcing its reviewed consolidated financial statements for the first six months of 2024, reporting a loss of over 7,300 billion VND.

The reason for Novaland’s significant loss was the independent opinion of the auditor, who requested a provision for land rent and land use fees to be paid, and an adjustment to reduce financial revenue. Specifically, this provision stems from the expected land rent and land use fees to be paid based on the 2017 land price scheme for the 30,106 ha Nam Rach Chiec project in An Phu ward, Thu Duc City, Ho Chi Minh City (Lakeview City project – developed by Century 21 International Development Co., Ltd.), as per the tax authority’s notification dated January 8, 2021.

Following a similar trend, the telecommunications group continued to face mild selling pressure across most stocks. Specifically, VGI fell by 0.77%, CTG decreased by 0.08%, ELC dropped by 0.41%, and YEG declined by 0.43%…

In contrast, the materials sector demonstrated a robust recovery, despite a strong divergence within the industry. On the upside, buying interest focused mainly on the three largest steel stocks: HPG rose by 1.54%, HSG climbed by 1.91%, and NKG increased by 1.37%. Conversely, plastic stocks like BMP, down 3.33%, NTP, down 2.81%, and AAA, down 0.31%, remained lackluster due to persistent selling pressure.

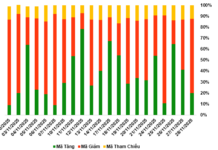

Compared to the opening, sellers maintained their dominant position. There were 319 declining stocks versus 247 advancing stocks.

Source: VietstockFinance

|

Opening: Cautious Start

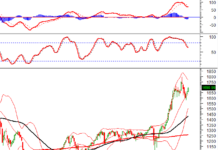

On September 30, as of 9:30 am, the VN-Index hovered around the reference level, near 1,289 points. The HNX-Index also witnessed a slight decline, hovering around 235 points.

On September 29, in Da Bac district, Hoa Binh province, Prime Minister Pham Minh Chinh attended the groundbreaking ceremony for the Hoa Binh – Moc Chau expressway (from Km19 to Km53 in Hoa Binh province) with a total investment of nearly VND 10,000 billion.

The Hoa Binh – Moc Chau expressway project in Hoa Binh province has a length of approximately 34 km and a total investment of VND 9,997 billion. The project is expected to be completed between 2022 and 2028. The land clearance phase for the 4-lane road project requires a total area of approximately 354.37 ha.

As of 9:30 am, the VN30 basket witnessed a slightly negative sentiment, with 21 decliners, 2 gainers, and 6 stocks remaining unchanged. Among them, ACB, BCM, BID, and BVH were the top losers. Conversely, HPG, SHB, TPB, and MSN were the biggest gainers.

The VN-Index: A Race to 1,300?

Today (September 27th), the VN-Index touched the 1,300-point mark. This benchmark index has, on several occasions this year, conquered this threshold, but the gains have proven fleeting.