At the Vietnam Card Day event on the morning of September 26, Mr. Pham Anh Tuan, Director of the State Bank of Vietnam’s Payment Department, shared that the implementation of biometric authentication regulations according to Decision 2345 since July 1, 2024, has positively contributed to curbing fraud and deception in the online space.

According to Mr. Pham Anh Tuan, as of September 26, approximately 38 million accounts have had their biometric data collected for verification. He emphasized that almost all customers making transactions of 10 million VND per time and 20 million VND per day have voluntarily registered their biometric information for account and e-wallet verification. Mr. Tuan reaffirmed that the primary objective of Decision 2345 is to ensure account ownership when using services related to accounts, cards, and e-wallets, thereby curbing fraud and preventing money transfers to rented, bought, or borrowed accounts used by fraudulent individuals.

The SBV leader attributed the success to a significant reduction in fraud cases, with only 700 cases recorded, a 50% decrease compared to the average of the first seven months of 2024. Approximately 682 accounts were involved in fraud, a reduction of about 72% compared to the average of the first seven months of 2024. These figures highlight the positive and effective impact of Decision 2345 in combating online fraud and deception.

Regarding user experience, Mr. Tuan assured that there hasn’t been much impact on customers. After two months of implementation, the SBV recorded an average of over 25 million transactions per day, almost unchanged from the average before July. This indicates that Decision 2345’s enforcement hasn’t hindered the development of payments, particularly cashless payments.

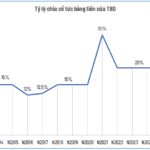

According to the SBV, there are now over 84 payment service providers offering internet payments and 50 providers for mobile payments nationwide. Internet, mobile, and QR code payments have achieved remarkable results, attracting a large number of users. As of the end of 2023, the proportion of adults with bank accounts reached 87.08%.

26 Commercial Banks Join Vietnam Card Day 2024

The Vietnam Card Day 2024 will feature six key activities, including a thematic workshop and a career orientation seminar for students at the beginning of October. The highlight of the event is the Song Festival, which will take place on October 5-6 at the Bach Khoa Stadium. This festival will be a hub of payment experiences for customers across various devices.

“Sophisticated Scam Alert: Uncovering the Deceptive Practice of Biometric Authentication Workarounds and Brand Name Bank Account Fraud”

The residents of Ha Tinh have fallen victim to a spate of scams, perpetrated by individuals who create fake companies and open bank accounts under the guise of well-known brands such as Mailisa cosmetics and ABX electric vehicles. These scammers exploit the reputation of popular names to deceive unsuspecting individuals online.

How Many Bank Accounts and Cards Are There in Vietnam?

The Vietnamese payment card industry has made significant strides, thanks to several enabling factors. With over 87% of adults now holding a bank account, the industry is experiencing a notable boom.