The VN-Index continued its recent recovery trend, breaching the 1,290-point mark at the opening bell. The benchmark index extended its gains, led by banking stocks.

Banking stocks dominated the market’s leaders.

TPB hit the daily limit-up, while MSB, HDB, OCB, ABB, and EIB saw robust buying interest. Both domestic and foreign investors actively poured money into TPB, with net foreign buying exceeding VND128 billion, the highest on the exchange.

TPBank recently concluded its dividend payout in shares at a ratio of 20%. Prior to this, in late August 2024, the State Bank of Vietnam approved the bank’s plan to pay dividends in shares to increase its charter capital.

Following the completion of this plan, the bank’s charter capital will increase from over VND22,016 billion to approximately VND26,420 billion. In mid-July, the bank also paid 2024 cash dividends at a rate of 5%.

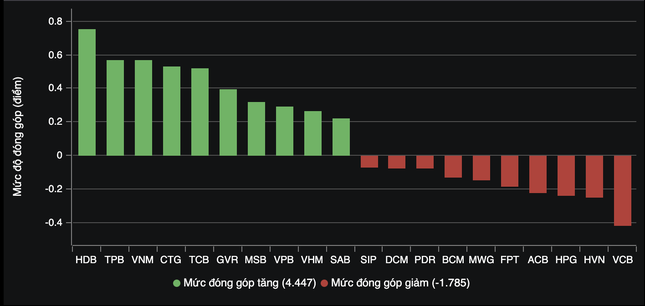

While the banking sector buoyed the market, a pullback in real estate, oil and gas, and steel stocks curbed the index’s gains towards the end of the trading session. Large-cap real estate stocks, including NVL, DXG, VHM, and TCH, failed to sustain their intraday highs. PDR, KBC, and GEX ended in the red.

Not only large-cap stocks but also small and medium-cap stocks struggled to maintain their upward momentum. The market witnessed choppy trading at the 1,290 – 1,300-point range, which also acts as a strong psychological resistance level. Analysts suggest that breaking through these resistance levels would require supportive macroeconomic factors and exceptional earnings growth, heavily reliant on the performance of large-cap and banking stocks.

At the closing bell, the VN-Index advanced 4.01 points (0.31%) to 1,291.49. The HNX-Index edged up 0.08 points (0.03%) to 235.92, while the UPCoM-Index was almost unchanged at 93.5 points.

Trading liquidity was on par with the previous session, with the matching value on HoSE exceeding VND20,100 billion. Foreign investors significantly increased their net buying, reaching nearly VND975 billion, focusing on TPB, VNM, VHM, and HDB.