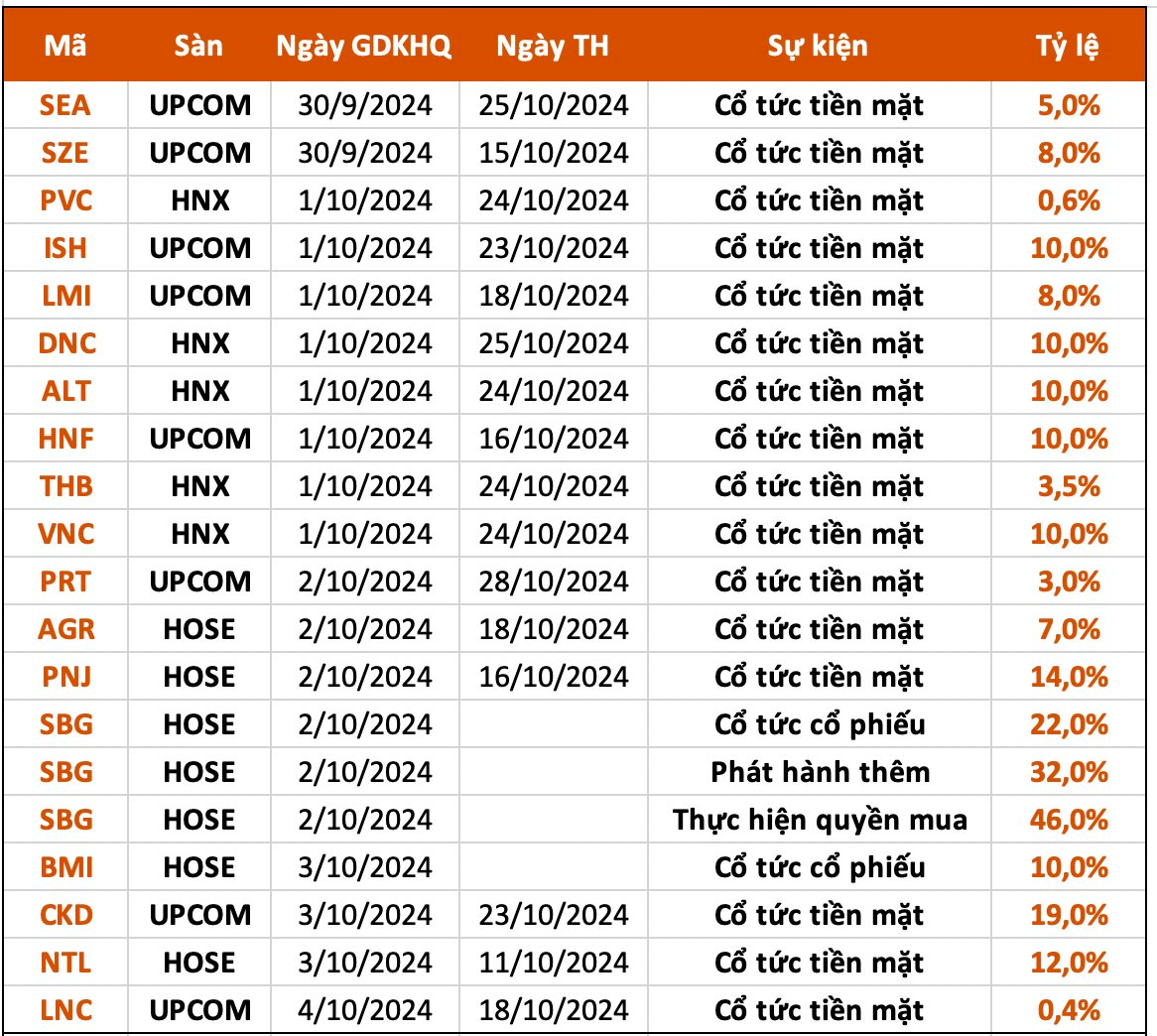

Fig 1. Dividend payout statistics for the week of September 30 – October 4

CTCP Thuy Dien Srok Phu Mieng IDICO (code: ISH) announced a dividend lock-in for the remaining 2023 dividend in cash. The ex-dividend date is October 1, 2024.

The implementation rate is 10%, meaning that for every share owned, shareholders will receive VND 1,000. With 45 million shares currently in circulation, ISH is expected to spend VND 45 billion on this dividend payout.

Earlier in July, ISH also paid an interim dividend for 2023 of VND 45 billion (10%). If successful, the total dividend payout ratio for ISH in 2023 will be 20%, equivalent to VND 90 billion. This will be the third consecutive year that the company has maintained a 20% dividend payout ratio. For 2024, ISH plans to continue with a 20% dividend payout.

Agribank Securities Joint Stock Company (code: AGR) announced that October 3, 2024, is the record date for determining the list of shareholders to pay 2023 dividends in cash, at a rate of 7% per share (1 share will receive VND 700). The expected payment date is October 18, 2024. With nearly 215.4 million shares currently in circulation, AGR is expected to spend nearly VND 151 billion on this dividend payout.

As of the end of Q2 2024, the State Bank of Vietnam, the parent company of Agribank Securities, holds over 161 million AGR shares (74.92% of capital) and is expected to receive nearly VND 113 billion in dividends.

On October 3, 2024, Phu Nhuan Jewelry Joint Stock Company (PNJ) will finalize the list of shareholders to pay the second 2023 dividend in cash. The dividend payout ratio is 14%, meaning that for every share owned, shareholders will receive VND 1,400.

PNJ plans to pay dividends to shareholders just 13 days after finalizing the list, on October 16. With nearly 335 million listed and circulating shares, PNJ will spend about VND 470 billion on this dividend payout.

Previously, in April, PNJ paid an interim cash dividend for 2023 at a rate of 6%. Thus, with the completion of the upcoming payment, the total dividend payout ratio for 2023 will be 20% – in line with the plan approved at the annual general meeting of shareholders. The expected dividend payout ratio for 2024 remains at 20%.

Lideco – Urban Development Joint Stock Company (NTL) has just announced a dividend lock-in date of October 4, 2024, for the 2024 interim dividend. The expected payment date is October 11, 2024. Accordingly, Lideco will distribute cash dividends at a rate of 12%, meaning that for every share owned, shareholders will receive VND 1,200.

With nearly 122 million shares currently in circulation, Lideco is expected to spend approximately VND 146 billion on this dividend payout. Mr. Dinh Quang Chien, Vice Chairman of Lideco’s Board of Directors and the company’s largest shareholder with a 12.74% stake, is expected to receive VND 19 billion.

The Ultimate Guide to This Week’s Dividend Payouts: A Top Bank Prepares to Release a Generous 50% Cash Dividend

This week, a total of 25 businesses will be distributing cash dividends, with rates ranging from a substantial 50% to a more modest 1%.