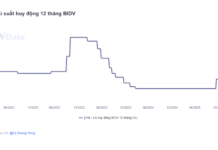

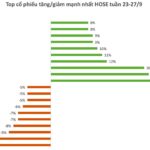

After more than 3 months since mid-June, Vietnamese stocks once again witnessed the VN-Index touching the 1,300-point mark. However, the joy was short-lived, as the index only managed to stay above this level for 5 minutes (from 9:43 am to 9:48 am) during the September 27th session before retreating back to around 1,290 points.

VN-Index 1-minute chart

In reality, the VN-Index has struggled to breach the 1,300-point threshold multiple times this year. This has had an impact on the short-term psychology of investors. Coupled with profit-taking pressure after a strong rally, it’s understandable that the market would undergo a correction.

Prior to the VN-Index reaching 1,300 points, the Vietnamese stock market had been on a strong upward trajectory since mid-September. This momentum was primarily driven by the banking sector, along with a stream of relatively positive information both domestically and internationally.

VN-Index 1-day chart

Externally, the Federal Reserve’s decision to cut interest rates by 0.5 percentage points in mid-September raised hopes for a more accommodative policy stance. Dragon Capital assessed this move as a factor that would ease pressure on exchange rates and pave the way for more stable deposit and lending interest rates in Vietnam.

In a similar move, the People’s Bank of China (PBoC) recently announced a set of policies to support the economy on a scale not seen since the COVID-19 pandemic. These measures included: (1) Monetary policy easing; (2) Addressing difficulties and supporting the housing market; (3) Supporting the stock market.

With China unleashing a massive stimulus package, Agriseco Securities anticipated that other countries in the region, including Vietnam, could continue to maintain and enhance accommodative monetary policies to boost economic growth. Additionally, the boost from this stimulus is expected to increase the appeal of stock markets, and analysts predict it will be a driving force behind a reversal in foreign capital flows from a net selling to a net buying position in Asian markets towards the end of the year.

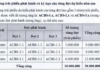

Domestically, on September 18th, the Ministry of Finance issued Circular No. 68/2024/TT-BTC, amending and supplementing a number of articles in various circulars related to securities trading, clearing and settlement, securities companies’ operations, and information disclosure in the securities market. This circular will take effect from November 2nd, 2024.

According to SSI Research, this move brings the Vietnamese stock market a step closer to meeting the requirements for an upgrade to emerging market status by FTSE Russell. With this potential upgrade, it is estimated that inflows from ETF funds alone could reach up to $1.7 billion, excluding active funds.

Sharing a similar view, VNDirect highlighted three expected impacts of the approval of order placement without sufficient funds on the Vietnamese stock market: (1) Attracting more foreign institutional investors as Vietnam’s regulations move closer to international standards; (2) Anticipated increase in foreign capital inflows into the Vietnamese stock market; and (3) Improved market liquidity.

However, VNDirect also pointed out potential risks, such as the possibility of foreign institutional investors failing to make timely payments after T+2 upon purchase. In such cases, securities companies might be forced to sell pledged stocks, creating significant selling pressure, increasing stock price volatility, and negatively affecting market stability.

Overall, the Vietnamese stock market is currently benefiting from several favorable factors that support a continued positive trend. Nevertheless, short-term fluctuations are inevitable. VN-Index milestones sometimes serve only as reference points and may not fully reflect the market’s dynamics. The key lies in investors’ stock selection and risk management strategies.

The Power of Words: Unleashing Stock Market Insights

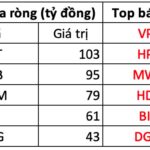

The market spotlight is on a particular bank stock that has skyrocketed over 9% in a week, an impressive surge that has taken it tantalizingly close to its all-time high.