Governor of the State Bank of Vietnam (SBV), Nguyen Thi Hong, reported at a conference held last weekend to assess and address the consequences of Typhoon No. 3 that the total affected debt in the entire banking system as of September 25 reached VND165,000 billion, with over 94,000 customers impacted.

SBV Governor Nguyen Thi Hong speaks at the conference. Photo: VGP

|

According to Cao Tuong Huy, Chairman of the People’s Committee of Quang Ninh province, the province hardest hit by the typhoon, there were about 17,500 affected customers with a total debt of VND46,425 billion.

Governor Nguyen Thi Hong informed that 32 credit institutions in 26 northern provinces and cities had announced credit packages to support customers, with a total value of VND405,000 billion and interest rates 0.5-2% lower than normal.

To increase credit support for businesses and people, the State Bank proposed that competent authorities allocate capital for the ongoing credit policy programs at the Social Policy Bank. If necessary, Governor Nguyen Thi Hong suggested that ministries and branches submit to the Prime Minister for approval to supplement the credit growth target for the Social Policy Bank in 2024-2025.

The banking industry management agency also proposed that the provincial People’s Committees and banks grasp the situation, complete loan procedures, and consider debt restructuring for businesses and people affected by the typhoon.

Tung Phong

The Great Bank Heist: Unraveling the Mystery.

On September 28, the Police Investigation Agency of Phu Quoc City Police (Kien Giang) announced that they had executed an emergency arrest warrant and conducted a search of the residence of Le Van Duc (born 1988, permanent residence: Duong Bao hamlet, Duong To commune, Phu Quoc City) due to his involvement in fraudulent activities and appropriation of property.

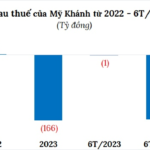

“A Troubling Loss for My Khanh Development Investment: $164 Million in Tax Losses”

Investment and Development Company My Khanh suffered a loss of 164 billion VND in the first half of 2024, compared to a loss of 1 billion VND in the same period last year. Notably, its debt soared to 2,590 billion VND, an alarming 36 times its equity.