Thăng Long Thermal Power Issues Unsecured Bonds, Reports Losses

According to the Hanoi Stock Exchange (HNX), Thang Long Thermal Power JSC has recently issued a batch of unsecured bonds, TLPCH2427001, valued at nearly VND 900 billion, with a three-year maturity.

Specifically, the company issued 8,995 bonds in the domestic market, each with a face value of VND 100 million, totaling VND 899.5 billion. The issuance took place on August 22, 2024, and the maturity date is set as August 22, 2027. Notably, these bonds are categorized as “triple-no” bonds, meaning they are non-convertible, non-warrant-attached, and unsecured.

In terms of interest rates, the TLPCH2427001 bonds offer a combined interest rate. For the first interest period, the applicable interest rate is set at 10% per annum. For subsequent interest periods, the rate is determined by taking the average of 12-month personal savings deposit interest rates in Vietnamese Dong offered by four major joint-stock commercial banks, including Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank), Vietnam Joint Stock Commercial Bank for Foreign Trade (Vietcombank), Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank), and Vietnam Joint Stock Commercial Bank for Agriculture and Rural Development (Agribank), plus a margin of 3.5% per annum. Investors are guaranteed to receive an interest rate of no less than 10% per annum for the following periods.

An Binh Securities JSC (ABS) serves as the bond registrar, and ASC Securities JSC is a related organization.

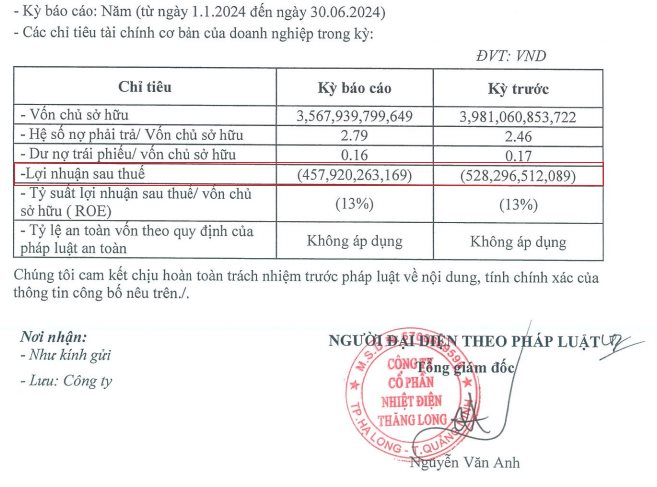

Thang Long Thermal Power reported a post-tax loss of VND 528 billion in the first half of this year.

In terms of business performance, Thang Long Thermal Power posted a post-tax loss of VND 528 billion in the first six months of this year, compared to a loss of VND 458 billion in the same period last year.

Previously, for the fiscal year 2022, the company reported a post-tax loss of VND 528 billion. However, surprisingly, in fiscal year 2023, the company reported a post-tax profit of VND 122 billion.

As of June 30, 2024, Thang Long Thermal Power’s equity stood at VND 3,981 billion. The debt-to-equity ratio was 2.46 times, corresponding to a debt balance of VND 9,794 billion. Out of this, the bond debt amounted to VND 677 billion.

According to HNX data, the company currently has two bond batches in circulation: TLPCH2427001 with a value of VND 899.5 billion and TLPCH2126001 with a value of VND 1,125 billion.

The TLPCH2126001 batch was issued on December 30, 2021, with a five-year maturity, and will mature on December 30, 2026. After twelve partial repurchases, the current outstanding value of this batch is VND 522 billion.

Established in August 2007, Thang Long Thermal Power JSC specializes in electricity production, transmission, and distribution. The company is headquartered in Le Loi ward, Ha Long city, Quang Ninh province. Its chartered capital stands at VND 3,800 billion, and the legal representative is Mr. Nguyen Van Anh, the General Director.