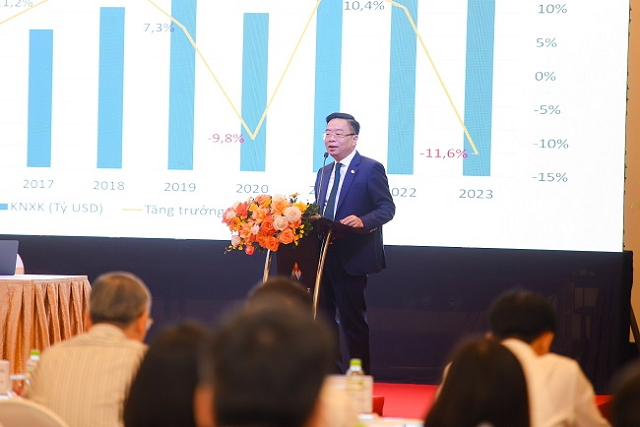

This information was shared by Le Tien Truong, Chairman of the Board of Directors of the Vietnam Textile and Apparel Group (Vinatex, UPCoM: VGT), at a Party Executive Committee Conference held last week.

According to a preliminary report on the business results for the first nine months of 2024, Vinatex estimated consolidated revenue of VND 13,036 billion, a nearly 1% increase compared to the same period last year, and a pre-tax profit of VND 490 billion, an over 70% surge. With these results, the Group has achieved nearly 73% of its revenue target and more than 89% of its profit goal for the year.

“The context of the market remains challenging and unstable in 2024,” noted Vinatex Chairman, Le Tien Truong. The only difference between 2024 and 2023 is that the market has become more favorable quarter by quarter.

In the first six months of 2024, the entire textile and garment industry only exported approximately $20 billion. However, subsequent instabilities in competing countries like Bangladesh and Myanmar created short-term advantages for Vietnam’s textile industry.

Illustrative image

|

“Businesses need to continue taking decisive actions, enhancing production capacity, and practicing savings to ensure stable production and business operations, especially for companies producing raw materials that have been facing difficulties for the past 30 months,” emphasized Mr. Truong.

Tapping into a niche market with flame-retardant fabric

To achieve the goal of $44 billion in exports for 2024, a 10% increase compared to 2023, Mr. Le Tien Truong remarked in a recent article on the Vinatex website that “it heavily depends on the market signals in the fourth quarter of 2024.”

Based on his experience, Mr. Truong observed that long-term forecasts of 6 to 12 months have been highly inaccurate since 2022. Therefore, the biggest challenge for Vietnam’s textile industry is the uncertainty of future predictions.

“We may experience excellent months, but right after, there could be one or two terrible months,” said the leader of Vinatex. The market’s fluctuations since 2022 have taught the industry’s managers an important lesson: always make shorter-term forecasts, update them frequently, and make management decisions more swiftly and flexibly to ride the waves of short-term growth spurts in the global market.

Vinatex Chairman Le Tien Truong sharing at an event in May 2024

|

To meet their annual targets, Vinatex and its member companies have devised unique solutions and strategies. One such approach is to venture into niche markets by trading in and manufacturing flame-retardant clothing, thereby increasing the value of their products.

To this end, Vinatex has entered into a joint venture with Coats Group to invest in producing flame-retardant fabric. They are expediting production and plan to export the first batches to Indonesia, India, the Middle East, and the USA in the third quarter and the beginning of the fourth quarter.

“For this collaboration, Vinatex aims for a revenue target of $2-2.5 million in 2024 and expects to double this figure annually over the next five years. The primary goal is to meet the demands of the US market, and from there, it will be easier to penetrate the EU, Japanese, South Korean, and other global markets,” shared Mr. Truong.