Thăng Long Thermal Power Issues Unsecured Bonds Amidst Financial Losses

Thăng Long Thermal Power reported a post-tax loss of VND 528 billion in the first half of this year.

According to the Hanoi Stock Exchange (HNX), Thang Long Thermal Power Joint Stock Company has recently completed the issuance of TLPCH2427001 bonds, raising nearly VND 900 billion with a 3-year term.

Specifically, the company issued 8,995 bonds in the domestic market, each with a face value of VND 100 million, resulting in a total issuance value of VND 899.5 billion. The issuance took place on August 22, 2024, and the maturity date is set as August 22, 2027. Notably, these bonds are of the “triple-non” type, meaning they are non-convertible, non-warrant-attached, and unsecured.

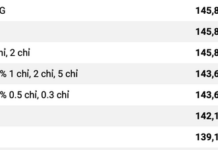

In terms of interest rates, the TLPCH2427001 bonds offer a combined interest rate. For the first interest period, the applicable interest rate is 10% per annum. For subsequent interest periods, the interest rate is determined by taking the average of 12-month personal savings deposit interest rates in Vietnamese Dong offered by four major joint-stock commercial banks, including Vietnam Foreign Trade Joint-Stock Commercial Bank (Vietcombank), Vietnam Joint-Stock Commercial Bank for Industry and Trade (VietinBank), Vietnam Joint-Stock Commercial Bank for Industry and Trade (VietinBank), Vietnam Joint-Stock Commercial Bank (Indovina Bank), and the Vietnam Bank for Agriculture and Rural Development (Agribank), plus a margin of 3.5% per annum. The actual interest rate received by investors in subsequent interest periods will not be lower than 10% per annum.

An Binh Securities Joint Stock Company (ABS) serves as the bond registrar, and ASC Securities Joint Stock Company (ASC) is a related organization.

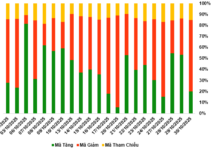

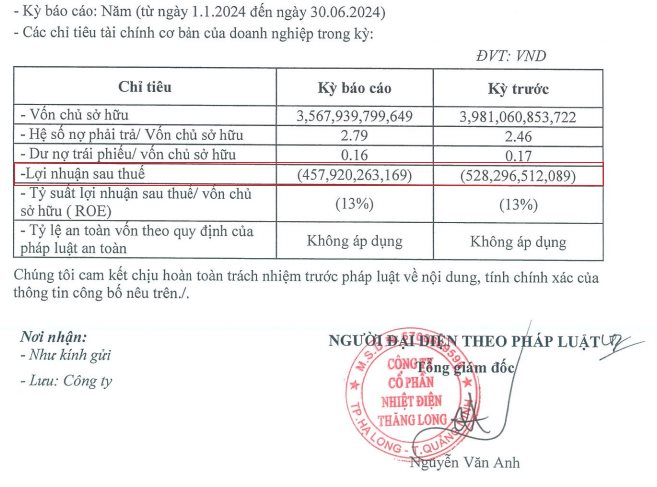

Regarding the company’s financial performance, Thang Long Thermal Power reported a post-tax loss of VND 528 billion for the first six months of this year, compared to a post-tax loss of VND 458 billion in the same period last year.

Looking back at previous financial years, the company reported a post-tax loss of VND 528 billion in 2022 but surprisingly turned a profit of VND 122 billion in 2023.

As of June 30, 2024, Thang Long Thermal Power’s equity stood at VND 3,981 billion. The debt-to-equity ratio was 2.46, corresponding to a debt balance of VND 9,794 billion. Out of this, the bond debt amounted to VND 677 billion.

According to HNX data, the company currently has two bond issues outstanding: TLPCH2427001 with a value of VND 899.5 billion and TLPCH2126001 with a value of VND 1,125 billion. The TLPCH2126001 bonds were issued on December 30, 2021, with a 5-year term, maturing on December 30, 2026.

After 12 partial repurchases prior to the maturity date, the outstanding value of the TLPCH2126001 bonds is now VND 522 billion.

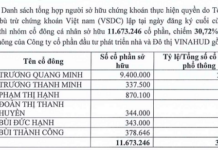

Thang Long Thermal Power Joint Stock Company was established in August 2007 and specializes in electricity production, transmission, and distribution. Its headquarter is located in Le Loi ward, Ha Long city, Quang Ninh province. The company’s chartered capital currently stands at VND 3,800 billion, and its legal representative is Mr. Nguyen Van Anh, the General Director.