In the international market, the DXY index fell by 0.32 points over the week, reaching 100.42 – the lowest level for the index in over a year.

The downward trend of the USD shows no signs of abating as the Personal Consumption Expenditure (PCE) index continued to rise weaker than expected in August 2024 – increasing by just 2.2% year-over-year.

The inflation index continues to show signs of cooling, further reinforcing the belief that the Federal Reserve will maintain its loose monetary policy to focus on supporting the labor market. Continuing to cut interest rates will reduce the appeal of holding the US dollar.

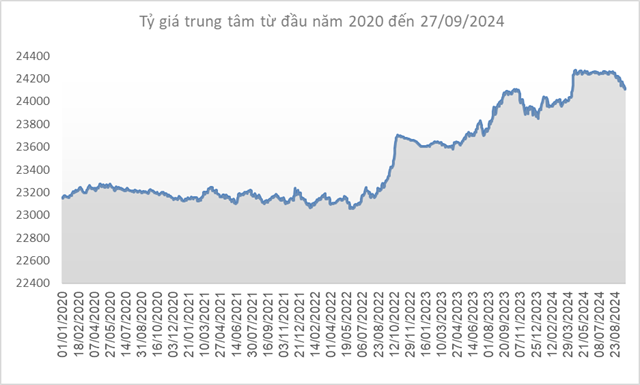

Source: SBV

|

Domestically, the Vietnamese dong to USD mid-point exchange rate fell by 30 VND/USD compared to the previous week (September 20), reaching 24,118 VND/USD in the September 27 session. This marks the seventh consecutive week of decline for the mid-point exchange rate, with a total decrease of 142 VND/USD.

The State Bank of Vietnam (SBV) kept the immediate buying price unchanged at 23,400 VND/USD. Notably, after nearly five months of keeping the immediate selling price fixed at 25,450 VND/USD, the central bank switched to adjusting the immediate selling price according to the movement of the mid-point exchange rate from August 30. On September 27, the immediate selling price stood at 25,273 VND/USD, down 32 VND/USD from the previous week.

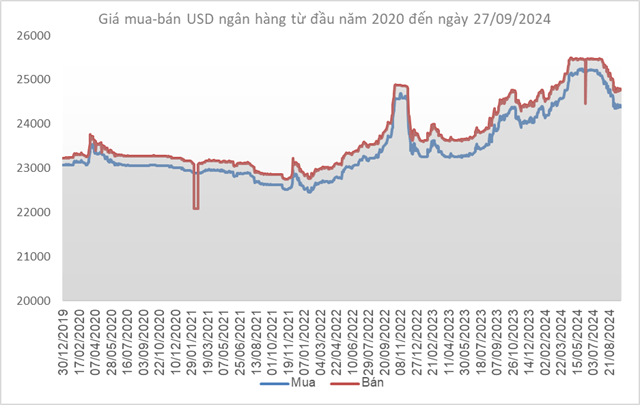

Source: VCB

|

In contrast, Vietcombank’s quoted exchange rate was at 24,390-24,760 VND/USD (buying – selling), up 20 VND/USD in both directions – marking the second week of increase for the USD/VND bank exchange rate.

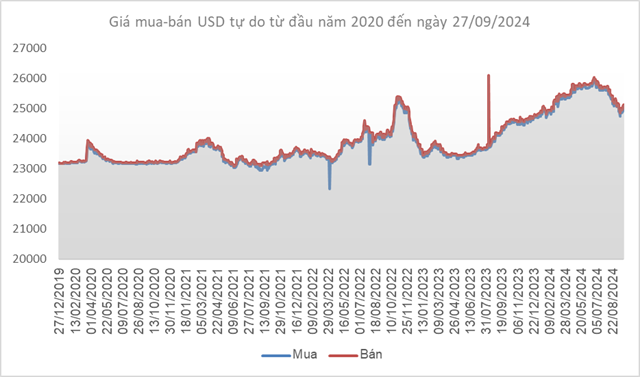

Source: VietstockFinance

|

Notably, the USD/VND exchange rate in the free market surged by 130 VND/USD in both directions compared to the previous week, reaching 25,030-25,130 VND/USD (buying – selling).