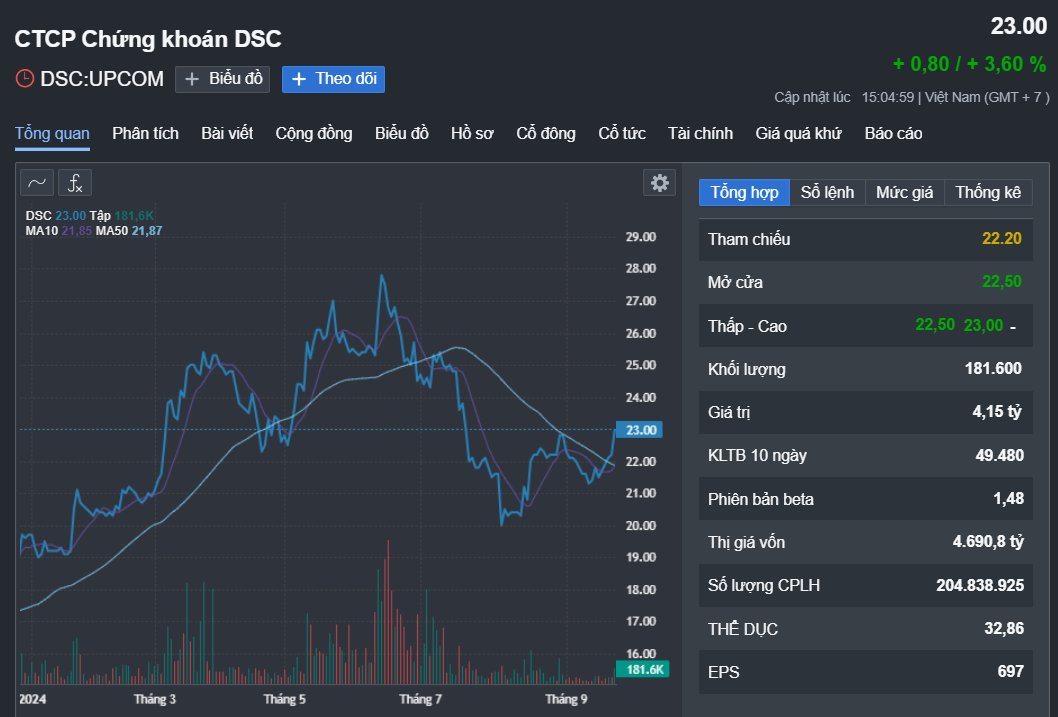

The Ho Chi Minh City Stock Exchange (HoSE) has recently approved the listing of 204.8 million DSC shares of DSC Securities Joint Stock Company. DSC shares are currently trading on the UPCoM exchange at VND 23,000 per share, an 18% increase since the beginning of the year.

DSC Securities Joint Stock Company, formerly known as Danang Securities Joint Stock Company, was established in 2006 with a chartered capital of VND 22 billion.

In the following years, the company underwent two capital increases, reaching VND 60 billion. In early 2018, the company’s shares were officially traded on the UpCoM exchange under the stock code DSC.

In August 2021, DSC Securities raised capital rapidly from VND 60 billion to VND 1,000 billion by issuing 94 million private placement DSC shares.

Mr. Nguyen Duc Anh, Chairman of the Board of Directors of DSC Securities Joint Stock Company. Source: DSC

DSC stock price movement from the beginning of 2024 until now. Source: Fireant

NTP Investment Joint Stock Company was one of the investors who participated in the private placement at that time. The company purchased 70 million DSC shares, becoming the parent company and a major shareholder. Prior to this transaction, NTP Investment Joint Stock Company did not own any DSC shares.

NTP Investment Joint Stock Company is chaired by Mr. Nguyen Duc Anh (born in 1995). Mr. Duc Anh is also the Chairman of DSC Securities Joint Stock Company (since 2021).

Mr. Duc Anh is known as the nephew of Mr. Nguyen Anh Tuan, Chairman of Thanh Cong Group (TC Group). TC Group is a well-known enterprise in Vietnam’s automotive industry. The group is also involved in various fields, including services, finance, and banking.

Last year, Thanh Cong Group unexpectedly announced that DSC Securities Joint Stock Company had joined the group’s ecosystem since the end of 2021.

At DSC Securities, Mr. Duc Anh holds nearly 73 million DSC shares (35.6% of capital), and NTP Investment Joint Stock Company holds 70 million shares (34.17% of capital). As of the closing price on September 25, 2024, at VND 23,000 per share, the value of the Chairman’s DSC shares is nearly VND 1,700 billion.

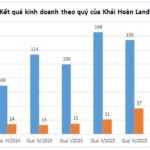

In terms of business results, in the first six months of 2024, DSC Securities recorded operating revenue of VND 246 billion, an increase of 27% compared to the same period last year. After expenses, the company’s post-tax profit was nearly VND 79 billion, a 41% increase year-on-year.

The First Securities Firm to Reveal Q3 Business Results: Estimated 73% Profit Increase, Prepares for HoSE Transfer

This securities company has announced that its plans to transfer its listing from the UPCoM to the HoSE are essentially finalized, and the shares will be listed on the HoSE in Q4 2024.