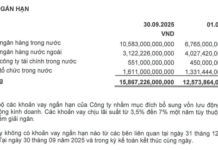

Data from VietstockFinance reveals a decrease in foreign ownership in Loc Troi, from 44% to 36.6% between May and September. This corresponds to a net sell-off of nearly 7.46 million shares.

During this period, the LTG stock price declined by 42.5%, resulting in a loss of VND 1,030 billion in market capitalization for the company.

The exodus of foreign shareholders coincided with negative governance-related developments. Specifically, on September 23, Loc Troi sent a dispatch to the People’s Committee of An Giang province, accusing former CEO Nguyen Duy Thuan of deceitful conduct and causing losses to the company. The company requested the authorities to take preventive measures against Mr. Thuan.

Earlier, on July 24, Loc Troi had also sent a document to the People’s Committee of An Giang province, requesting temporary suspension of Mr. Thuan’s overseas travel.

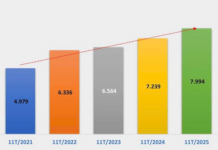

| Loc Troi’s net profit declined sharply in 2023 |

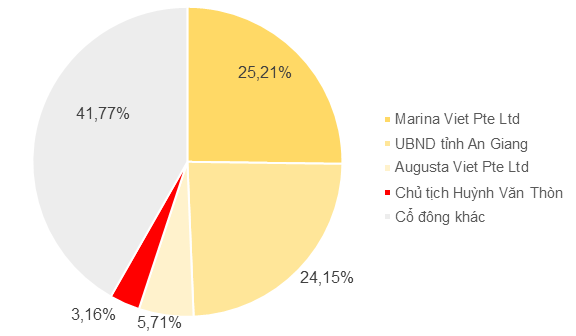

LTG was once a favorite among foreign investors, with ownership peaking at 42.4% (the maximum allowed is 49%) by the end of 2023. Marina Viet Pte Ltd., the largest shareholder, held a significant 25.2% stake.

In addition, Loc Troi had two other large shareholders: The People’s Committee of An Giang province and the foreign organization Augusta Viet Pte Ltd.

|

Shareholder structure of Loc Troi

Data as of October 8, 2024. Source: VietstockFinance

|