**Vietnam’s Trade Sector: Navigating Commercial Protectionism Challenges**

The Ministry of Industry and Trade’s report on the evaluation of the 2024 plan implementation and the 2025 plan projection for the industry and trade sector reveals that Vietnam faced 252 trade protection investigations from 24 markets, involving a diverse range of products. Additionally, foreign investigating authorities frequently review trade protection cases with complex procedures and requirements.

ENTERPRISES NEED TO BE MORE PROACTIVE IN RESPONSE

According to Deputy Minister of Industry and Trade Phan Thi Thang, in recent years, Vietnam has particularly focused on strengthening economic cooperation with countries in Asia, Africa, and Oceania to boost exports. Specifically, Vietnam has capitalized on opportunities arising from bilateral free trade agreements (FTAs) with individual partners such as Japan and South Korea, as well as multilateral FTAs through regional organizations like ASEAN and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

While exports to these markets have shown positive developments and there remains significant potential for market expansion, Vietnamese enterprises also face considerable challenges and constraints. One of the most significant challenges is the protectionist tendencies and barriers erected by importing countries and territories.

Alongside the benefits of trade liberalization and international economic integration, there exist political and economic constraints, and these tendencies are becoming increasingly prevalent. Some countries have shifted towards protectionism and import restrictions, even beyond what is necessary. In this context, trade protectionism has emerged as a legitimate and effective tool used by many WTO members.

According to statistics from the Ministry of Industry and Trade, 14 out of 24 countries in the Asian, African, and Oceanian markets have investigated 138 out of 256 different trade protection cases involving Vietnamese exports. The most active investigating countries include India, Turkey, Australia, Indonesia, and the Philippines. Within ASEAN alone, four countries—Malaysia, Indonesia, the Philippines, and Thailand—have investigated 48 trade protection cases involving Vietnam. In Oceania, Australia has investigated 18 cases involving Vietnamese exports.

Despite facing numerous trade protection cases, Vietnamese enterprises have not shown sufficient attention and proactive response. A 2023 survey by the Trade Defense Authority (under the Ministry of Industry and Trade) revealed that 36% of enterprises had a basic understanding, 17% had an in-depth understanding and were directly involved, 36% had heard but lacked detailed knowledge, and 11% were almost unaware.

Mr. Nguyen Thanh Toan, Director of the Department of Industry and Trade of Binh Duong province, emphasized that when a company is subjected to trade protection measures, an entire industry or products from a specific locality in Vietnam may face similar high tariffs. Therefore, coordination and proactive engagement between management agencies and enterprises are crucial not only to protect the legitimate rights and interests of the affected enterprise but also as a collective responsibility towards the business community.

“Building capacity to respond to trade protection measures is of paramount importance for Vietnamese enterprises to proactively adapt and respond to trade protection cases, thereby reasonably protecting Vietnamese exporters,” Mr. Toan asserted.

Deputy Minister Phan Thi Thang stated that in the future, the Ministry of Industry and Trade will continue to enhance the effectiveness of early warning systems for foreign trade protection cases involving Vietnamese exports. Simultaneously, the Ministry will intensify its efforts in disseminating information and providing training to raise awareness among relevant parties in the field of trade protection.

Enterprises need to take the initiative in enhancing their understanding and skills to respond promptly when faced with trade protection cases. Moreover, they should strengthen coordination with state management agencies, closely monitor the Ministry of Industry and Trade’s warning information, and prepare resources to initiate legal action if necessary.

STRENGTHENING THE TRADE PROTECTION REGIME

The Ministry of Industry and Trade acknowledges that new-generation FTAs offer opportunities for domestic enterprises to export to international markets, but they also open the door for a surge in imported foreign goods. Many foreign products in the Vietnamese market engage in unfair competitive practices, causing harm to domestic industries. Therefore, Vietnam has resorted to trade protection tools as a means to support local enterprises in coping with heightened competition from imported goods.

As of the end of June 2024, the Ministry of Industry and Trade had initiated investigations into 28 cases related to trade protection measures and applied 22 measures on imported goods. In the first six months of 2024 alone, the Ministry handled seven cases: continuing the investigation and review of seven cases initiated in 2023; initiating a new investigation; and receiving and processing seven new requests for investigation and review.

Currently, four trade protection measures are in effect for imported steel products, and one measure is in place for products related to steel (welding materials). Additionally, two cases are under investigation, concerning steel wire rope and wind turbine towers.

The Ministry of Industry and Trade is conducting a final review of the application of anti-dumping measures on cold-rolled stainless steel and coated steel products to assess the effectiveness of the measures and the possibility of extending them for another five years. The review results for these two cases are expected in October 2024.

In a short period, a series of trade protection-related cases have affected the steel production industry. On June 14, 2024, the Ministry of Industry and Trade issued Decision No. 1535/QD-BCT on the investigation and application of trade protection measures on certain galvanized steel products originating from China and South Korea. Simultaneously, the Ministry announced that it had received a complete and valid request to investigate and apply trade protection measures on hot-rolled steel products (HRC) from India and China…

This article was published in the Vietnam Economic Magazine, Issue 41-2024, released on October 7, 2024. Please visit the following link to read the full article:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

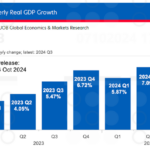

UOB Revises Vietnam’s 2024 Growth Forecast Upwards to 6.4%

The Global Economics and Market Research department of UOB Bank (Singapore) has revised its forecast for Vietnam’s economic growth in 2024, now predicting a robust 6.4% expansion.

The Evolving Landscape of E-commerce: Can the Ministry of Industry and Trade Keep Up?

The Ministry of Industry and Trade is committed to reviewing and refining its e-commerce legislation. It aims to introduce specific regulations governing cross-border e-commerce activities, ensuring a robust and dynamic digital trade environment.