## Major Shareholders of CHS Engage in a Possible Private Deal

On October 1, 2024, Mr. Nguyen Thanh Duc reported the purchase of 1.76 million shares of Ho Chi Minh City Public Lighting Joint Stock Company (UPCoM: CHS), increasing his ownership from 1.51 million shares (5.3%) to 3.26 million shares (11.49%) as of September 25.

On September 25, CHS shares witnessed a matching volume trade equivalent to Mr. Duc’s purchase, valued at nearly VND 23 billion, corresponding to VND 13,000/share. At the close of this session, CHS share price stood at VND 11,800/share.

Previously, LHG registered to sell 1.76 million CHS shares to restructure its portfolio, expecting to reduce its ownership in the Company from 34% (9.66 million shares) to 28% (7.9 million shares).

The number of shares LHG registered to sell matched the number of shares purchased by Mr. Duc, indicating a high possibility that major shareholder Nguyen Thanh Duc acquired CHS shares from LHG in a private deal.

## Related Parties of NO1’s Chairman Sell via Matching Transactions

On the first day of October, Ms. Nguyen Thi Thom and Mr. Le Xuan Hoang sold via matching transactions 601,250 shares (2.51%) and 749,250 shares (3.11%), respectively, of 911 Group Joint Stock Company (HOSE: NO1). Following these transactions, neither Ms. Thom nor Mr. Hoang remained as shareholders of the Company.

In terms of connections, Ms. Thom and Mr. Hoang are both related to the wife of Chairman Luu Dinh Tuan. The NO1 Chairman personally holds 5 million shares, representing a 20.83% stake.

On October 1, NO1 recorded more than 1.35 million shares traded via matching transactions, equivalent to the total number of shares sold by Ms. Thom and Mr. Le Xuan Hoang. The transaction value was nearly VND 11 billion, corresponding to VND 7,942/share, which was 6% lower than NO1’s closing price on this date.

Also, on October 1, Mr. Nguyen Manh Hai reported the purchase of 1.35 million new NO1 shares, representing a 5.63% stake, matching the volume of the matching transactions. Through this transfer, Mr. Hai officially became a major shareholder of the Company.

## NED’s Supervisory Board Members Plan to Fully Divest

Citing personal financial arrangements, the Supervisory Board (SB) of Tay Bac Power Investment and Development Joint Stock Company (UPCoM: NED) and their relatives simultaneously registered to sell all their holdings from October 8 to November 6, 2024.

Specifically, Mr. Luu Van Ho, NED’s SB Chairman, registered to offload his entire stake of over 2.02 million NED shares, representing a 4.99% interest in the Company. Similarly, Mr. Tran Van Phuc, a member of NED’s SB, intends to sell his entire 2.02 million shares, constituting a 5% stake.

Additionally, Mr. Tran Van Trung, the brother of Ms. Tran Thi Trinh, who is also a member of NED’s SB, plans to offload his entire 2 million shares, equivalent to a 4.94% stake.

If successful, the Supervisory Board and related parties will divest a total of 14.93% of NED’s capital, with a provisional value based on NED’s closing share price on October 3, amounting to over VND 41 billion.

This divestment move by the Supervisory Board follows Mr. Tran Van Ngu’s purchase of 1.53 million shares on September 20, 2024, increasing his ownership in the Company from over 4.67 million shares (11.54%) to over 6.2 million shares, representing a 15.32% stake.

## NTP Share Price Doubles Year-to-Date, Chairman’s Son Plans to Sell

Mr. Dang Quoc Minh, Secretary and Head of Administration of NTP Plastic Joint Stock Company (HNX: NTP), has recently registered to sell 1 million NTP shares from October 1 to 29, 2024, through matching or auction orders, aiming to reduce his holdings.

If this transaction is successfully executed, Mr. Minh’s ownership in NTP will decrease from 3.92% to 3.15%.

Starting 2024 at around VND 32,000/share (adjusted), NTP’s share price peaked at VND 74,000 in mid-August, marking a 125% increase in about eight months. Trading volume from May to October also surged, averaging approximately 500,000 shares/session, multiple times higher than in previous months. Currently, NTP’s price is trending downwards towards the VND 61,000 level. If Mr. Minh sells at this price, he is expected to collect around VND 61 billion.

Mr. Dang Quoc Minh is the son of Chairman of the Board of Directors, Mr. Dang Quoc Dung, who holds a 6.87% stake in NTP. Mr. Minh became an NTP shareholder in 2019 after purchasing 910,000 shares, initially owning 1.02%. A series of transactions in 2019 and 2020 increased his ownership to 3.57%, equivalent to 3.5 million shares.

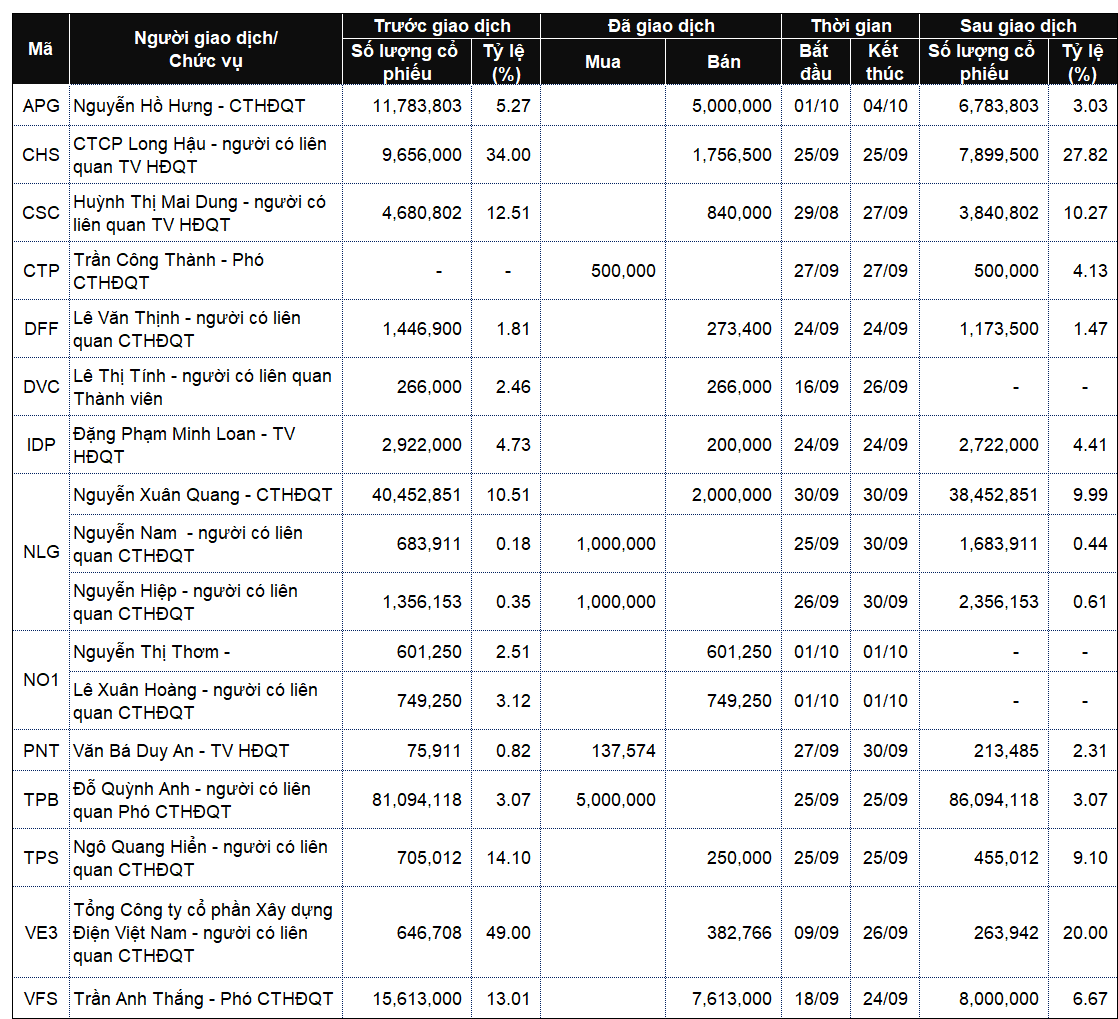

## Company Leadership and Related Parties Transactions from September 30 to October 4, 2024

|

Company Leadership and Related Parties Transactions from September 30 to October 4, 2024

Source: VietstockFinance

|

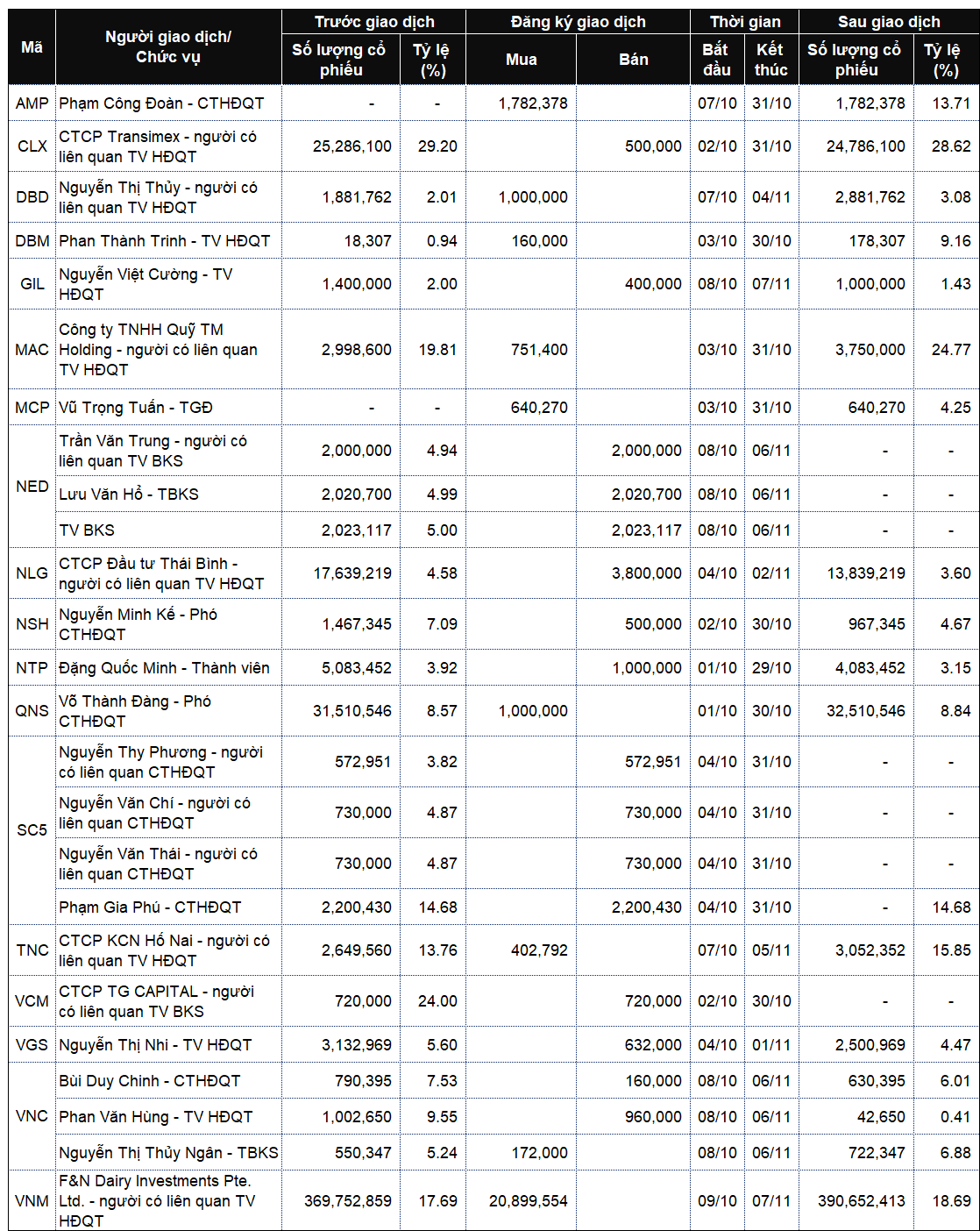

|

Company Leadership and Related Parties Registration from September 30 to October 4, 2024

Source: VietstockFinance

|

Thanh Tú

The Unrelenting Rally: Six Sessions, Six Ceiling-Smashing Successes, Yet Construction Stocks Fail to Breach the 4,000 VND Mark

VE9, the stock symbol for VNECO 9 Investment and Construction JSC, surprised investors with a streak of six consecutive daily price limit increases from September 18 to September 25. Despite this impressive run, the stock’s value remains modest.

Sure, I can assist you with that.

## LPBank Postpones Extraordinary General Meeting, A Range of Important Matters Awaiting Discussion

I hope that suits your needs and captures the essence of what you are trying to convey.

The upcoming Extraordinary General Meeting of LPBank’s shareholders is scheduled for November 15, 2024. This pivotal gathering will be a significant milestone for the bank, setting the tone for its future trajectory and strategic direction. With a comprehensive agenda covering critical topics, the meeting promises to be a cornerstone event, shaping LPBank’s path ahead.