KBSV Securities has recently provided an assessment of China’s outlook and its potential impact on Vietnam, highlighting the confirmed weakness of the Chinese economy with disappointing macroeconomic indicators.

CHINA’S GOVERNMENT STIMULUS PACKAGES ONLY HAVE SHORT-TERM PSYCHOLOGICAL EFFECTS

China has seen a downward revision in its economic growth forecast by major financial institutions, a persistent slump in the real estate market, and the emergence of deflationary risks—all indicating a clearer downward trend in the country’s economic growth.

Specifically, financial organizations such as Bank of America, Citigroup, and Goldman Sachs have unanimously lowered their GDP growth outlook for China for the full year 2024, with the lowest prediction being 4.7%, falling short of the government’s 5% target.

According to newly released August data, prices of new and secondary real estate fell by 5.5% and 8.6%, respectively, year-over-year, marking the sharpest decline since 2015. The downward trend could worsen as month-over-month data also shows a steep decline. Although the Chinese government has introduced stimulus packages, including lowering policy rates and providing capital to cities to purchase unsold inventory, the disbursement of funds and their impact have been slow.

The issue of oversupply and lack of demand in tertiary markets, coupled with contrasting situations in primary markets, further complicates the local governments’ efforts to purchase unsold properties.

Deflationary pressure is building. According to the NBS report, China’s CPI rose only 0.6% year-over-year in August, marking the third consecutive month of weaker-than-expected growth, while consumer prices remained almost unchanged for most goods and services. The PPI has also been declining since the end of 2022, falling 1.8% in August—the sharpest drop in four months.

Concerns about a deflationary spiral are well-founded as domestic consumers are increasingly limiting their spending on non-essential items. Meanwhile, falling real estate prices and overproduction in China are likely to put downward pressure on commodity prices and domestic consumption.

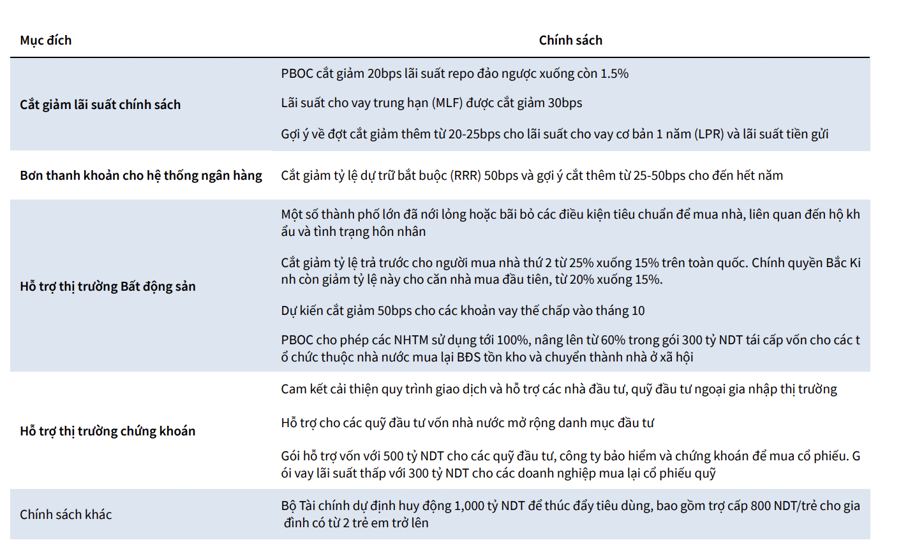

The Chinese government has swiftly introduced a series of stimulus policies, ranging from interest rate cuts to support for the capital, real estate, and stock markets, as macroeconomic data signals deterioration. Such simultaneous moves by the government and the People’s Bank of China (PBOC) are considered unprecedented. Only on rare occasions in the past has the PBOC cut policy rates and the required reserve ratio (RRR) within the same month, with 2008 being an example.

This highlights the urgency in addressing deflationary risks and achieving the 5% growth target.

While the policies aim to ease pressure on various aspects of the economy, KBSV believes that the risks causing China’s current stagnation are more structural, and the government’s stimulus packages are only creating short-term positive psychological effects in the markets.

Meanwhile, questions remain about the clear impact of these measures. The cut in policy rates may not significantly alter the situation. A 0.5 percentage point reduction in mortgage rates could help approximately 50 million households reduce their annual interest payments by about CNY 150 billion, equivalent to a boost in purchasing power of about 0.1% of GDP.

However, actual consumption and borrowing demand pose significant challenges to the policy’s effectiveness due to an aging population, rising unemployment rates in large cities, slowing wage growth, and a bleak real estate market, all of which lead to restricted consumer spending.

Public spending is lagging behind the schedule. In contrast to the aggressive monetary policy, public investment is progressing slower than the budget plan, mainly due to implementation issues at the local government level. The support packages providing capital to cities to purchase unsold inventory for conversion into social housing are also facing disbursement problems.

KBSV attributes this to the imbalance between risk and yield after the conversion of these assets, coupled with the high debt levels of local governments, which delay the purchase of unsold properties, especially in tertiary markets.

SEVERAL VIETNAMESE INDUSTRIES ARE LIKELY TO BE AFFECTED

According to KBSV, the Chinese government’s economic stimulus packages will have positive short-term effects, partially improving consumer sentiment and supporting the real estate market. However, the medium-term decline in China’s economic growth is irreversible due to the structural issues faced by the world’s second-largest economy.

This remains a notable risk factor for the Vietnamese stock market due to the high level of interconnection between the two economies.

The sectors most vulnerable to these risks include aviation and services: Chinese tourists have consistently accounted for a large proportion of international visitors to Vietnam and are among the highest spenders. A decline in China’s growth will impact the income of its citizens, leading them to curtail spending on non-essential items, which will significantly reduce the number of Chinese tourists to Vietnam.

Export goods: As China is the second-largest consumer of Vietnamese goods globally (after the US), a weak Chinese economy will reduce demand for Vietnamese products such as agricultural, aquatic, rubber, and wood products.

Building materials: The surplus capacity and high inventory levels due to the frozen real estate market will result in Chinese building materials flooding the market at low prices. This, coupled with the tendency of major economies like the US and Europe to impose import taxes, creates intense competition for domestic building materials companies.