Although the VN-Index only slightly increased by 3.24 points (+0.25%) by the end of this morning’s session, it remained above the reference line throughout, indicating a positive overall trend. This is a result of increased buying activity at higher price levels, with blue-chips leading the way in terms of both points and liquidity, accounting for over half of the market.

The trading dynamics continue to exhibit frequent fluctuations, and this morning was no exception. At its peak, the VN-Index rose 4.8 points above the reference, while at its lowest, it was still up by more than 1 point. Thus, the amplitude of oscillations was relatively small, and even at its weakest, the breadth remained positive with 192 gainers and 136 losers, indicating a predominantly bullish sentiment.

This is a positive development compared to previous sessions, which often witnessed dips below the reference line. Currently, buyers are comfortable with higher price levels, and selling pressure has diminished, as evidenced by the absence of significant sell-offs at red prices. By the end of the morning session, the VN-Index boasted an impressive 218 gainers versus 134 losers, with the winners accounting for 67% of the total trading volume on the exchange.

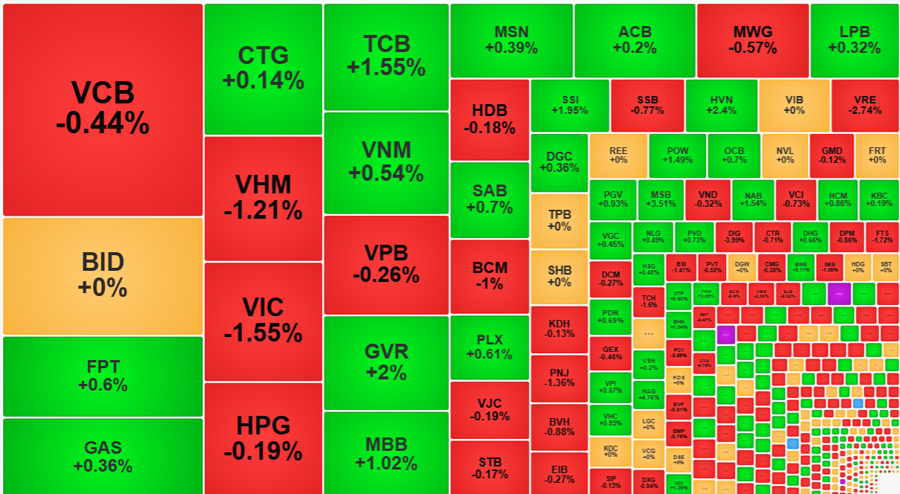

In terms of index contribution, the blue-chip VN30 group was the clear leader, with the VN30-Index closing 0.41% higher. Midcap and Smallcap indices also posted gains of 0.34% and 0.36%, respectively. Within the blue-chip basket, 16 stocks advanced while 11 declined, and their trading volume accounted for approximately 55.7% of the total trading value on the HoSE. Excluding MWG, which fell 1.53%, SSI, down 0.91%, and HDB, down 0.92%, all other blue-chips with liquidity exceeding 100 billion VND in the VN30 basket recorded price increases. Furthermore, 9 out of the top 10 stocks driving the VN-Index’s gains belonged to this elite group.

However, in terms of amplitude, the VN30 group contributed only four stocks to the group of 58 stocks that rose more than 1%. These gainers were primarily from the mid- and small-cap segments, but their impact on the index was limited. Several stocks witnessed robust trading activity and strong liquidity, including DBC, which rose 1.88% with a trading volume of 221.6 billion VND; VTP, which climbed 6.41% with a volume of 186.3 billion VND; KBC, up 1.99% with a volume of 121.4 billion VND; and HAH, which advanced 1.45% with a volume of 113.3 billion VND. Other stocks, such as QCG, SGR, CTR, BMC, SZC, DPG, and KSB, also experienced notable gains of over 2%, albeit with significantly lower trading volumes.

At present, the VN-Index’s upward movement has not been substantial enough to trigger a highly enthusiastic market sentiment. While the index does not fully capture the dynamics of individual stocks, a strong rise in the VN-Index typically boosts investor confidence. This morning, declines in VCB (-0.55%), BID (-0.1%), GAS (-0.28%), and VNM (-0.44%) significantly weighed down the index. Additionally, CTG, TCB, and VPB, which are major bank stocks, lacked momentum.

Nevertheless, the selling pressure has noticeably eased, and investors are reluctant to offload their holdings at red prices, making it easier for stocks to maintain their ground. While the VN-Index ended the session with 134 stocks in negative territory, the majority experienced only minor fluctuations, and only 39 stocks declined by more than 1%. The trading volume of this group accounted for less than 10% of the market, with MWG’s massive 540.3 billion VND sell-off, resulting in a 1.53% price drop, contributing significantly to this figure.

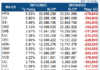

Foreign investors, on the other hand, have stepped up their game, with their net buying value on HoSE surging by 60% compared to yesterday morning, reaching 751.8 billion VND. Their net selling value also increased by approximately 30%, totaling 829.4 billion VND, resulting in a slight net sell-off of 77.6 billion VND. Notable stocks on the sell side included MWG (-123.7 billion VND), STB (-48.2 billion VND), HDB (-47.6 billion VND), SSI (-44 billion VND), VPB (-32.2 billion VND), CTG (-28.3 billion VND), and PVD (-23.6 billion VND). On the buy side, HPG (+111.7 billion VND), TCB (+82.3 billion VND), DBC (+42.8 billion VND), and VTP (+20.2 billion VND) stood out.