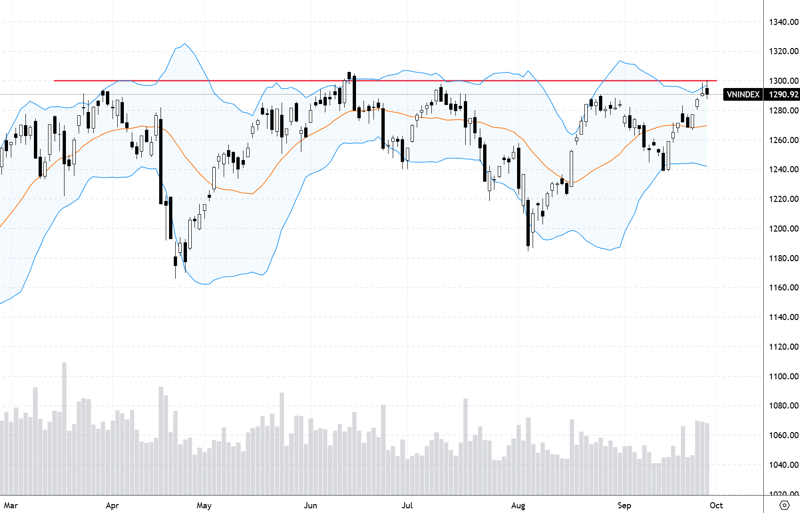

The VN-Index made two attempts to surpass the 1,300-point peak in just five sessions last week, but both fell short. The strong liquidity in these failed attempts left a more distinct impression of distribution activities…

Experts continue to hold divergent views on the short-term market outlook. The pessimistic view from last week proved accurate as the VN-Index experienced two fairly strong corrective sessions at the end of the week. This perspective persists in anticipating market distribution and awaits the bottom of this corrective wave, which is expected to be relatively deep. Conversely, more optimistic opinions maintain that, despite the substantial liquidity and evident downward pressure last week, the selling force seemed to be exhausted by Friday. The anticipated adjustment threshold is primarily around the 1,250-1,260-point level.

Despite differing short-term perspectives, experts generally remain positive about the market’s subsequent trend. The current adjustment does not affect the prevailing uptrend, and the opportunity to surpass the 1,300-point peak remains viable.

Nguyen Hoang – VnEconomy

The market had a rather disappointing trading week, with three unsuccessful attempts to surpass the 1,300-point peak. Each time it approached this threshold, selling pressure pushed it down, and it declined in the last two sessions. Average weekly liquidity also significantly increased, with high volumes in the downward sessions. This week’s performance was quite different from the previous one. Does this indicate large-scale market distribution?

As the leading banking group still maintains a positive signal without significant selling pressure, I tend to believe that the market is merely undergoing a short-term shakeout at the 1,300-point level before potentially returning to conquer it.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Looking at the weekly VN-Index candle, it has formed a bearish engulfing pattern with higher liquidity than the previous period. The daily chart witnessed an SFP on Thursday, breaking the accumulation base of the previous five sessions with large volume. Additionally, since September 29, the index has not produced any attractive candles; the green candles with high volume also feature long wicks, and the red candles mostly have above-average volume. Based on these observations, I assess a high probability that the market is undergoing large-scale distribution.

Nghiem Sy Tien – Investment Strategy Executive, KBSV Securities

The market sentiment has turned more negative after the continuous upward momentum was halted around the 1,300-point mark. Such a development is understandable as investors hold high expectations, especially with the banking group taking the lead. The supply-demand correlation became evident in the final trading session, with a sharp drop in liquidity and the index closing at the session’s lowest point, signaling a contraction from the buying side.

However, I believe these signals indicate profit-taking activities rather than redistribution around the peak. While liquidity above VND20,000 billion is positive in the current context, it is not significant enough to confirm a distribution session. The market is likely to continue fluctuating to shake off short-term trading positions and return to a balanced state to attract proactive buying force again.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Last week, the market once again failed to conquer the psychological threshold of 1,300 points and experienced stronger selling pressure. However, with only one session of intense selling, I believe it is premature to conclude that the market is being distributed. Conversely, as the leading banking group has maintained a positive signal without significant selling pressure, I tend to believe that the market is merely undergoing a short-term shakeout at the 1,300-point level before potentially returning to conquer it.

Money Flow Trend: A Retreat to Gain Momentum for Peak Conquest?

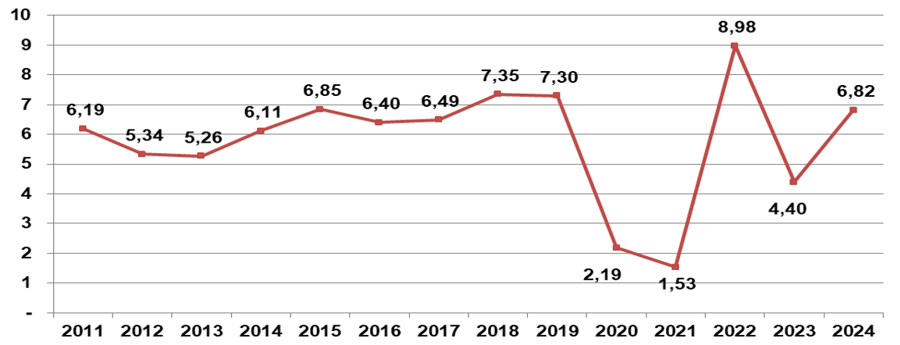

Despite Super Typhoon Yagi, Q3/2024 GDP Still Rose by 7.4%

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

The short-term trend is being challenged as the banking group undergoes profit-taking. This group has large capitalization and high liquidity, which causes the overall market liquidity to increase as well. However, to conclude that the market is undergoing large-scale distribution, I think it is not yet the right time.

Le Duc Khanh – Director of Analysis, VPS Securities

The strong resistance level of 1,300 points remains a challenging milestone for the market. It is common for the index to undergo corrective accumulation or turn downward to the support region below. In my opinion, the VN-Index requires more time to return to the peak, and there is an opportunity for market recovery next week.

Nguyen Hoang – VnEconomy

Last week, you assessed that the market was moving sideways and had not surpassed the 1,300-point threshold, indicating a typical accumulation retreat. With more negative changes this week, will the market enter a genuine corrective wave? How deep can this correction go?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

As mentioned earlier, I believe the current signals are not overly negative. The market has only experienced one intense selling session, without continued selling pressure in the final session, as evidenced by the declining volume. Simultaneously, the leading banking group has maintained its upward trend. Therefore, I anticipate a short-term correction, and the market may recover next week. Support is expected at the 1,266-1,283 or 1,250-1,260-point region.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

I assess the market trend to remain positive in the medium term. Last week, tense geopolitical news hindered the conquest of the 1,300-point threshold, leading to a retreat. However, with stable domestic and foreign macroeconomic conditions, I think the index’s adjustment range could be 1,250 +/- 10 points.

Many bank stocks have returned to their all-time highs or reached strong resistance levels. I assess that this group will not maintain its role in driving and supporting the market as it did in the previous phase and may even exert additional downward pressure.

Nguyen Viet Quang

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Last week, I predicted that the VN-Index had reached the end of wave 5 and would enter a corrective phase, and the market was undergoing distribution. This scenario unfolded, and the index experienced strong corrective sessions, breaking the previously constructed base. At present, I am paying attention to several support regions: around 1,240 points and 1,200 points. However, these support zones do not guarantee a rebound but require the prerequisite of price reaction at these levels.

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the market will undergo a correction but remain within the 1,265 – 1,275-point range. Two critical support and resistance zones to observe are 1,260 – 1,265 +/- points (the deepest level early next week) and 1,270 – 1,275 points. If the VN-Index surpasses 1,275 points, there is a high chance it will return to the previous peak of 1,300 points and break through in the subsequent upward wave.

Nghiem Sy Tien – Investment Strategy Executive, KBSV Securities

The unfavorable developments this week are insufficient to alter my personal perspective. The overall trading sentiment has turned more negative as the VN-Index’s attempt to surpass the 1,300-point threshold failed, leading to increased profit-taking and reduced positions to safer levels. However, I believe that the previous uptrend was primarily driven by cash inflows from investors, and leverage was not significant. Consequently, the market is unlikely to experience a series of sharp downward sessions. The potential support region where the index may exhibit a recovery reaction is around the 1,255 (+-10) point mark.

Nguyen Hoang – VnEconomy

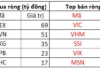

One reason for the VN-Index’s failure to surpass the 1,300-point threshold last week was the weakening of large-cap stocks, including the leading banking group. Stocks like VHM, VIC, GAS, and FPT lacked momentum, while bank stocks underwent evident profit-taking after their impressive gains previously. In our previous discussion, you highly valued the strength of the banking group and its role in pushing the VN-Index beyond the peak. Can this group retain its role while undergoing profit-taking and turning downward?

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

After a considerable upward journey, it is reasonable for the banking group to undergo profit-taking. In terms of valuation, this group remains attractive, so I think it will continue to be the market’s main driver in the coming period. Additionally, stable foreign capital inflows have supported the market. When large-cap stocks achieve consensus, the market will overcome this challenge.

I assess the market trend to remain positive in the medium term.

Nguyen The Hoai

Nghiem Sy Tien – Investment Strategy Executive, KBSV Securities

Some bank stocks have experienced sharp upward moves, so profit-taking is a normal development as investors aim to secure profits. This is not necessarily a negative signal, and the critical aspect lies in the supply-demand correlation of the stock itself. When there is sufficient large inflows sustained over multiple sessions, the stock’s upward momentum will improve, and buying force will rejoin the corrected stock. Additionally, the uptrend of large-cap groups typically persists for an extended period rather than concluding within a few sessions. Therefore, I anticipate that the banking group will continue to play a leading role in driving the index.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In our previous discussion, I did not hold a positive view of the strength of the banking group because the robust and profitable stocks were mostly small and medium-sized ones. Many bank stocks have returned to their all-time highs or reached strong resistance levels. I assess that this group will not maintain its role in driving and supporting the market as it did in the previous phase and may even exert additional downward pressure.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Following the corrective signals last week, I remain optimistic about the banking group’s ability to maintain its crucial role in driving the VN-Index’s upward trend. Although the entire market underwent intense selling last week, the banking group demonstrated resilience, experiencing only mild selling pressure and preserving its upward trend. Moreover, cash flow shifted to small and medium-sized bank stocks. These signals suggest profit-taking by small investors after a robust upward phase rather than large-scale selling. Therefore, I expect this group to avoid a trend reversal and continue its task of leading the index upon market recovery.

In my opinion, the VN-Index needs more time to return to the peak, and there is an opportunity for market recovery next week.

Le Duc Khanh

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the banking group can still recover after a few corrective sessions, but it will then undergo differentiation, with some stocks continuing to rise while others accumulate and correct without further increases. Other groups, such as securities, steel, and oil and gas, may take over to support the market.

Nguyen Hoang – VnEconomy

Amid the unfavorable developments in the underlying market, the VN30 index futures maintained a wide positive basis. Is this an absurdity or a positive signal about market expectations? If you were to participate in derivatives, would you bet on Long or Short at this moment?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Vietnam’s derivatives market is currently quite small, so various factors can influence it. I cannot explain the reason for the nearly seven-point positive basis in the VN30 index futures. Technically, VN30F1M has completed wave 5 and is undergoing a corrective “a” wave, so I would bet on Short. However, I will wait for the second rebound session to identify an optimal entry point.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Currently, the indices are undergoing corrections, but the primary uptrend remains intact. In an uptrend, the futures index’s higher point value relative to the underlying index results in a positive basis, indicating the market’s anticipation of potential future index gains. Therefore, the positive basis reflects the market’s expectation of a continuing uptrend. If I were to participate in derivatives, I would prioritize Short intraday positions due to the short-term correction and Long positions when the market approaches the support level.

I believe that the previous uptrend was primarily driven by cash inflows from investors, and leverage was not significant, so the market is unlikely to experience a series of sharp downward sessions. The potential support region where the index may exhibit a recovery reaction is around the 1,255 (+-10) point mark.

Nghiem Sy Tien

Nghiem Sy Tien – Investment Strategy Executive, KBSV Securities

The VN30 index futures are maintaining a wide positive basis, which may reflect positive expectations for the VN30 index group, particularly the banking stocks. However, the likelihood of VN30 rebounding immediately is not high at this point. While opening a