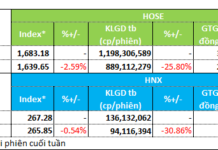

The stock market’s near miss with an upgrade is no longer a significant event for investors. All attention is now on the Q3 earnings season, with forecasts of exceptional growth compared to the same period last year and higher than the previous quarter’s increase. The VN-Index opened positively, and despite occasional dips in sentiment, it closed strongly, gaining nearly 10 points to approach the 1,281 price level.

The breadth was impressive, with 255 gainers and 114 decliners. Except for the energy sector, which faced adjustment pressure, most other industries breathed a sigh of relief. Large-cap real estate stocks performed well, with notable gainers such as VHM, up 2.16%; VIC, up 1.71%; DXG, up 1.31%; SZC, up 3.44%; and KBC, up 1.62%.

The banking sector continued its strong showing, with familiar names like ACB leading the way, up 2.94%; STB, up 1.34%; MBB, up 1.59%; and TCB, up 1.02%. They were joined by VPB and CTG. The transportation group saw VTP actively traded from the start, closing at the ceiling price, while HVN gained 3.19%, and ACB and HAH rose 6.55% and 1.57%, respectively. The materials sector benefited from news about anti-dumping duties on imported steel, with HPG soaring.

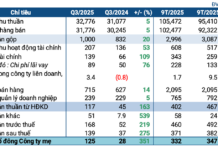

The top stocks contributing to the market’s gains today were VHM, HPG, ACB, BID, MSN, VIC, and FPT, collectively adding 5.81 points to the overall market. Bottom-fishing sentiment strengthened, with total matched transactions on the three exchanges exceeding the previous day’s, reaching VND18,800 billion.

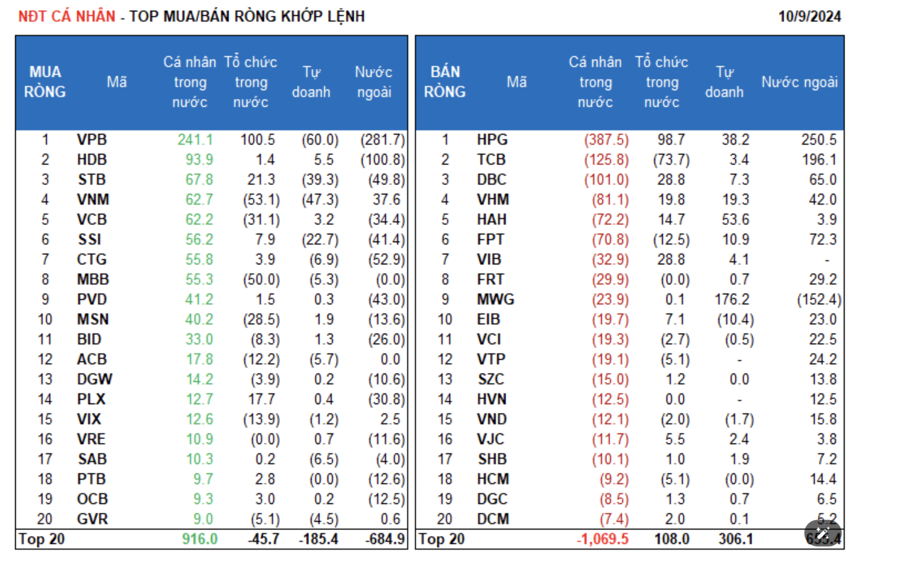

Foreign investors sold a net VND142.9 billion, and their net selling on matched transactions was VND15.2 billion. Their main net buying on matched transactions was in the Basic Resources, Food & Beverage, and Personal & Household Goods sectors. The top net bought stocks by foreigners on matched transactions were HPG, TCB, FPT, DBC, VHM, VNM, FRT, VTP, EIB, and VCI.

On the selling side, their main focus was the Banking sector. The top net sold stocks by foreigners on matched transactions were VPB, MWG, HDB, CTG, STB, SSI, VCB, PLX, and BID.

Individual investors sold a net VND71.3 billion, including net selling of VND148.1 billion on matched transactions.

On matched transactions, they bought seven out of 18 sectors, mainly in the Banking sector. Their top bought stocks included VPB, HDB, STB, VNM, VCB, SSI, CTG, MBB, PVD, and MSN.

On the selling side, they sold 11 out of 18 sectors on matched transactions, mainly in the Basic Resources and Industrials sectors. Their top sold stocks included HPG, TCB, DBC, VHM, HAH, FPT, FRT, MWG, and EIB.

Proprietary trading accounts bought a net VND53.8 billion, and their net buying on matched transactions was VND143.1 billion.

On matched transactions, proprietary trading accounts bought 12 out of 18 sectors, with the strongest buying in the Retail and Industrials sectors. Their top bought stocks on matched transactions included MWG, HAH, HPG, VHM, FPT, DPR, DBC, BVH, NLG, and HDB. Their top sold stocks were in the Banking sector, including VPB, VNM, STB, SSI, TPB, EIB, CTG, SAB, ACB, and SSB.

Domestic institutions bought a net VND63.7 billion, and their net buying on matched transactions was VND20.1 billion.

On matched transactions, domestic institutions sold 12 out of 18 sectors, with the highest value in the Food & Beverage sector. Their top sold stocks on matched transactions were TCB, VNM, MBB, VCB, MSN, NLG, VIX, FPT, ACB, and VGC. Their main net buying on matched transactions was in the Basic Resources sector, with top buys including VPB, HPG, VIB, DBC, STB, VHM, PLX, HSG, HAH, and TPB.

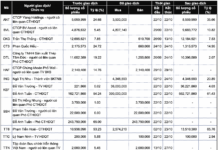

Block trades today totaled VND1,310.4 billion, up 55.8% from the previous session, contributing 7.0% to the total trading value.

Noteworthy block trades today included VIC, with over 5.7 million shares worth VND236.4 billion traded between individual investors. There was also a block trade of 4.8 million HDB shares (valued at VND129.6 billion) between domestic institutions.

The money flow allocation increased in Banking, Retail, Food & Beverage, Agriculture, Software & IT Services, and Courier sectors, while it decreased in Securities, Real Estate, Steel, Chemicals, and Oil & Gas.

On matched transactions, the money flow allocation increased in the large-cap VN30 sector while decreasing in the mid-cap VNMID and small-cap VNSML sectors.