The buyers’ risk appetite has significantly increased, immediately changing the way orders are placed and the selected price range. Today’s market still saw many swinging patterns, but they remained in the green zone and became more enthusiastic towards the end.

After a session of touching the bottom with a “pulling candle” and a session of tug-of-war balance, the market started to accelerate upward. The most obvious change was from passively waiting for prices to actively blocking around reference prices, and today is about pushing prices up. This nature is a change in the assessment of risks: when afraid of a further decrease in prices, either not buying or waiting for very low prices and not matching is fine. When less afraid, buy at the dips during the session. When the fear of missing out kicks in, buy by straight matching, and finally, when worried that others will take the opportunity away, engage in competitive pricing.

Today’s liquidity was maintained quite well, with the matching order volume of the two exchanges at about 16.9k billion, gradually increasing. The new information is that the Vietnamese market has not been considered for a change in ranking, which is theoretically not positive, but the way the market responded shows that the information itself is not inherently good or bad. When the psychology is enthusiastic, supply and demand become the deciding factors.

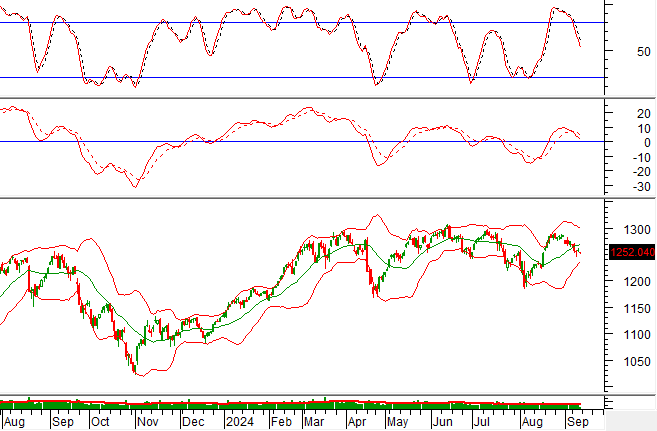

The VN30 blue-chips group today led the strong rise at the end, and the representative index of this basket also increased the most. In recent sessions, capital has been focusing clearly on this group, with a high weight of over 50% on the HSX floor. Actually, if you look at the index, VNI from the end of September to the beginning of October failed to surpass the peak of 1300, but VN30 has surpassed the peak, and the recent decline was just a retest of the old resistance zone. The wave on VN30 is much clearer, both in momentum and liquidity.

Today’s market also widely disseminated forecasts of Q3/2024 business results. Actually, this information is old news, but the interesting thing is that when the psychology needs to find a foothold, whether it’s old or new is not a problem, but whether it can meet the needs or not. Everyone starts talking about this stock will increase profits well, and that stock will surge, which no one cared about yesterday or earlier this week. Such psychological developments always repeat themselves and remain effective.

There is now a growing acceptance of chasing higher prices, so the opportunity to buy at lower prices is diminishing. This is not necessarily a disadvantage because the purchases made during the dips already have a low base price. There will always be intraday fluctuations even when the market is enthusiastic. Consensus has not yet fully occurred.

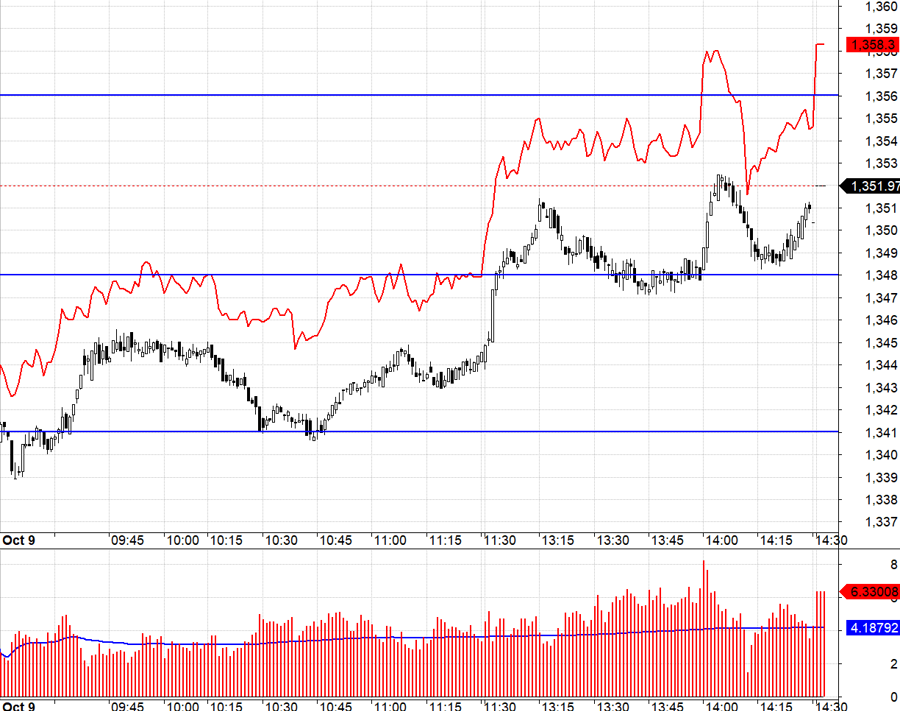

Today, the derivatives market continued to maintain a wide basis difference. In the last 2.5 sessions, this signal has shown that expectations are in line with the underlying market. Although a wide positive basis is a disadvantage for Long, when the market has strengthened, there is no other way, and Short is even riskier. In fact, even during intraday dips, F1 adjusted very little.

The threshold of 1341.xx of VN30 well supported the index, serving as a good entry point for Long with a stop loss when VN30 falls through this level. VN30 surpassed 1348.xx and failed to reach 1356.xx, but the basis widened even more advantageously.

Today’s strong rise is a signal of greater consensus from the sell-off signals and the change in the buying side’s will to enter orders. The market has established a short-term bottom for this correction phase, and this is just a normal adjustment. The strategy remains to look for buying opportunities, Long/Short flexibility with derivatives, and a preference for Long.

VN30 closed today at 1351.97. Tomorrow’s nearest resistance is 1357; 1367; 1376; 1380; 1388; 1397. Support is at 1348; 1341; 1333; 1325.

“Stock Blog” is personal and does not represent the opinions of VnEconomy. The views and evaluations are those of the individual investor, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.