The buyers’ risk appetite has significantly increased, immediately changing the way orders are placed and the selected price range. Today’s market still had many swinging rhythms, but they were all in the green zone and became more excited towards the end.

After a session of touching the bottom with a “pulling leg” candle and a session of tug-of-war balance, the market started to accelerate upward. The most obvious change was from passively waiting for prices to actively blocking around reference prices, and today is to buy and push prices up. This nature is a change in the assessment of risks: when afraid of a further price drop, either don’t buy, or wait for very low prices, and it’s okay if you don’t match. When less afraid, buy at the dips during the session. When no longer afraid of cheap prices, buy by straight matching, and finally, for fear of missing out, switch to competing for prices.

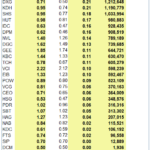

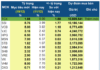

Today’s liquidity was quite good, with a matching order of about 16.9k billion on the two exchanges, gradually increasing. The new information is that the Vietnamese market has not been considered for a change in ranking, which is theoretically not good, but the way the market reacts shows that the information itself is not inherently good or bad. When the psychology is excited, supply and demand will be the deciding factor.

The VN30 blue-chips group today led the strong rise at the end, and the representative index of this basket also increased the most. In recent sessions, capital has been focusing clearly on this group when the weight is high above 50% of the HSX floor. In fact, if you look at the index, VNI from the end of September to the beginning of October failed to exceed the peak of 1300, but VN30 has exceeded the peak and the recent decline was just a retest of the old resistance zone. The wave on VN30 is much clearer, both in momentum and liquidity.

Today’s market also widely spread forecasts of Q3/2024 business results. In fact, this information is old, but the interesting thing is that when the psychology needs to find a fulcrum, it doesn’t matter whether it is old or new, but whether it meets the needs or not. Everyone starts talking about this stock will increase profits well, and that stock will suddenly increase, which no one cares about yesterday or at the beginning of the week. Such psychological developments always repeat themselves and are still effective.

There is now a phenomenon of accepting the pursuit of high prices, so the opportunity to buy at low prices is decreasing. This is not necessarily a disadvantage because the purchase at the dip has a low cost. There will always be intraday fluctuations even when the market is excited. Consensus has not yet occurred.

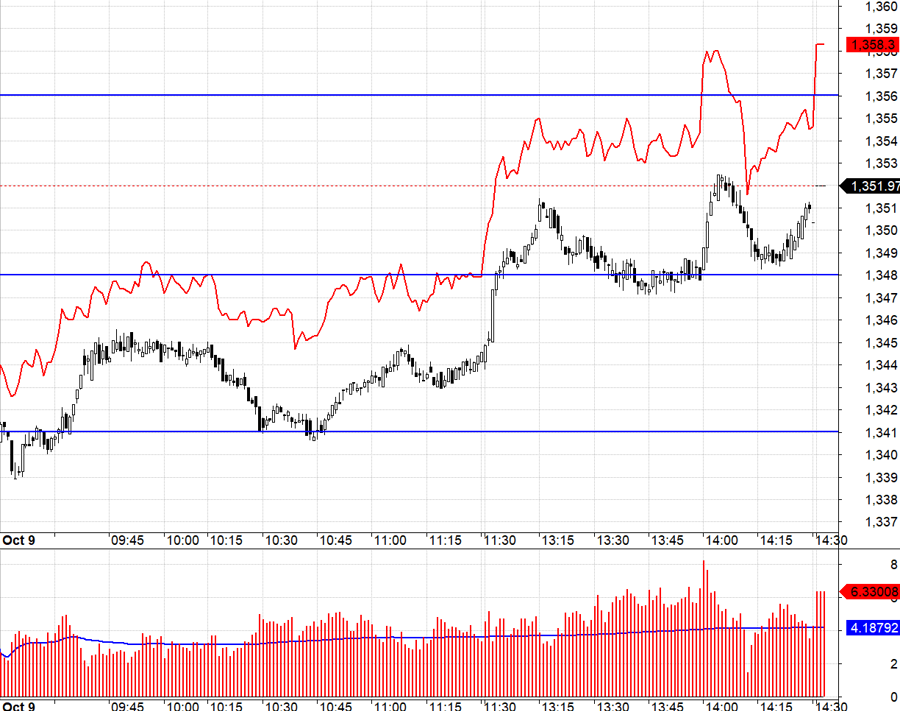

Today, the derivatives market continued to maintain a wide basis difference. In the last 2.5 sessions, this signal has shown that expectations are correct with the underlying market. Although a wide positive basis is a disadvantage for Long, when the market has strengthened, there is no other way, and Short is even more risky. In fact, even in the intraday decline, F1 also adjusted very little.

The threshold of 1341.xx of VN30 well supported the index, which is a good Long entry point with a stop loss when VN30 falls through this level. VN30 has surpassed 1348.xx and failed to reach 1356.xx, but the basis has widened more favorably.

Today’s strong rise is a signal of greater consensus from the sell-off signals and a change in the buying side’s will to enter orders. The market has established a short-term bottom of this adjustment phase, and this is also just a normal adjustment. The strategy continues to be to buy, Long/Short flexibility with derivatives, prioritizing Long.

VN30 closed today at 1351.97. The nearest resistance tomorrow is 1357; 1367; 1376; 1380; 1388; 1397. Support 1348; 1341; 1333; 1325.

“Stock Blog” is personal and does not represent the opinion of VnEconomy. These views and assessments are those of individual investors, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues related to the investment opinions and views posted.