The VN-Index witnessed a significant decline during the afternoon session, plunging towards the reference point due to strong headwinds from the group of blue-chip stocks. However, bottom-fishing activities became more active at lower price levels, facilitating the recovery of many stocks. Nonetheless, the buying momentum failed to spread sufficiently, dragging today’s overall liquidity to a 14-session low.

Contrary to expectations of a better performance in the afternoon following the morning session’s resilience in the last 30 minutes, selling pressure intensified soon after the break. This pushed the VN-Index into negative territory just 40 minutes into the afternoon session. The breadth turned negative compared to the morning, indicating that selling strength was prevalent across a large number of stocks and not solely focused on blue chips. The index hit its intraday low at 2:20 pm, falling nearly 6 points before staging a mild recovery in the closing minutes. At the close, the VN-Index posted a slight loss of 0.67 points, achieving a balanced state with a relatively even breadth.

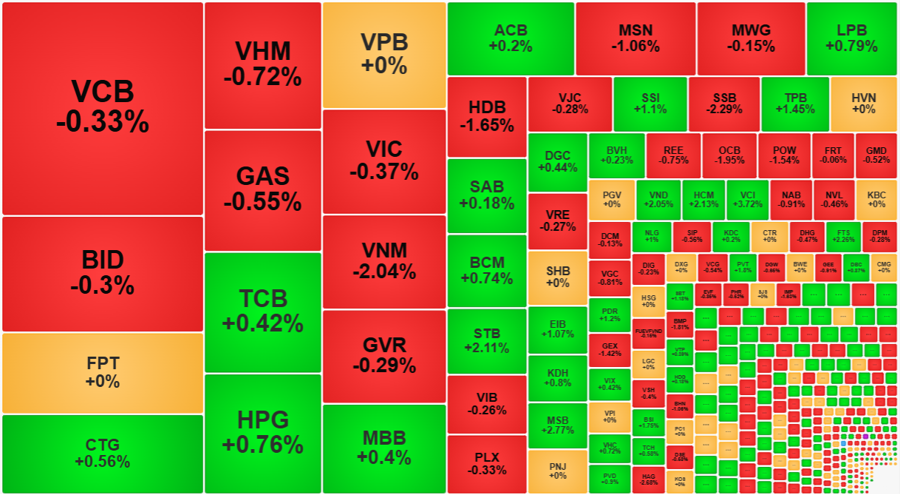

The index’s inability to rebound above the reference point can be attributed to the continued weakness in the largest stocks. Among the top 10 stocks by market capitalization on the VN-Index, VCB fell by 0.33%, BID decreased by 0.3%, VHM dropped by 0.72%, GAS declined by 0.55%, and VIC slipped by 0.37%. Only four stocks posted modest gains: CTG rose by 0.56%, TCB increased by 0.42%, and HPG climbed by 0.76%.

While the large caps didn’t perform exceptionally well, most of them managed to close above their intraday lows, albeit with limited upward momentum. Some stocks, such as VHM, HPG, and TCB, witnessed relatively high liquidity during the ATC session, but it wasn’t sufficient to significantly impact their closing prices. The index remains heavily dependent on the ability of these large caps to provide support. The difference of more than 5 points between the VN-Index’s closing level and its intraday low falls within the range of typical fluctuations.

On a positive note, individual stocks started to fare better relative to the index. The HoSE floor recorded 170 gainers and 202 losers at the close, an improvement from the 122 gainers and 255 losers when the index touched its intraday low. Notably, a significant number of stocks witnessed bottom-fishing activities, with nearly 32% of HoSE-listed stocks rebounding by 1% or more at the close, a much higher proportion than in the morning session. This can be partly attributed to the deeper price declines in the afternoon, which triggered more decisive bottom-fishing purchases.

The securities group stood out during the afternoon session, with a number of blue chips leading the charge: VCI surged by 3.72%, FTS climbed by 2.26%, HCM rose by 2.13%, VND increased by 2.05%, and SSI gained 1%. These stocks witnessed a sudden surge in buying interest compared to the intra-session period. VCI even saw millions of shares bought at the ATC session, with HCM also matching over a million shares during this period. Smaller securities firms posted even stronger gains: ORS jumped by 3.83%, CSI rose by 2.36%, DSC climbed by 2.22%, and VDS increased by 2.05%… In terms of liquidity, VCI, SSI, and HCM were among the top 10 most actively traded stocks on the HoSE floor.

The afternoon plunge resulted in a nearly 47% increase in liquidity on the two exchanges compared to the morning session, reaching VND6,861 billion. However, this figure remains modest compared to the two-week average, as afternoon sessions have averaged over VND9,388 billion per day. This indicates that inflows remain limited, with bottom fishers primarily focusing on lower price levels and adopting a wait-and-see approach. Only a select few stocks, such as those in the securities sector, managed to attract stronger buying interest and reverse their trajectories.

On a positive note, the market witnessed improved differentiation towards the close, despite the index’s evident weakness. Among the 170 gainers, 64 stocks rose by more than 1%, outpacing the morning session’s 58 stocks, despite a more favorable breadth then. On the losing side, out of the 202 losers, 52 stocks fell by more than 1%, slightly higher than the morning session’s 40 stocks. Several stocks faced intense selling pressure: VNM declined by 2.04% with a matching value of VND405.5 billion; MSN fell by 1.06% with a matching value of VND309.8 billion; HDB dropped by 1.65% with a matching value of VND254.7 billion; GEX decreased by 1.42% with a matching value of VND161.5 billion; and OCB slipped by 1.95% with a matching value of VND102.8 billion…

Foreign investors also ramped up their selling pressure in the afternoon, with total selling value on HoSE reaching VND810.2 billion, double that of the morning session. The net selling value increased to VND214.6 billion, bringing the total net selling value for the session to VND337.7 billion. This marks the second consecutive session of substantial net selling by this group. Notable stocks sold by foreign investors include VPB (-VND93.7 billion), HDB (-VND87.8 billion), VCG (-VND41.4 billion), OCB (-VND32.3 billion), GEX (-VND31.1 billion), FPT (-VND24.5 billion), and PLX (-VND21.2 billion). On the buying side, STB (+VND63.6 billion), TCB (+VND40.1 billion), MWG (+VND33.5 billion), EIB (+VND22.1 billion), and FRT (+VND21.7 billion) were among the top net bought stocks.