In its latest strategy update report, KBSV Research identifies that the Vietnamese stock market is entering a crucial phase in 2024, buoyed by positive signals from macroeconomic factors and monetary policies.

For the outlook in the second half of 2024, the analysts pinpoint five key factors shaping the trajectory of the Vietnamese stock market:

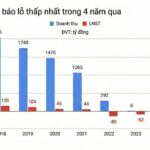

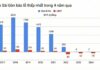

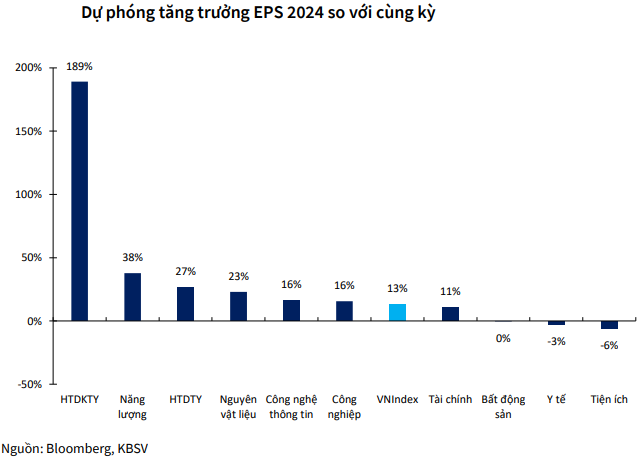

Firstly, listed companies’ profits continue their recovery trend, serving as a supportive factor for the overall market in Q4. KBSV Research forecasts a 13% growth in EPS for listed companies on the HOSE exchange.

Secondly, the Federal Reserve’s interest rate cut boosts global stock markets.

Thirdly, with the Fed’s 50-basis point rate cut, currency pressure has eased significantly. This enables the State Bank to maintain its loose monetary policy, with low-interest rates stimulating credit demand and economic growth.

Fourthly, the US presidential election in November 2024 presents a significant unknown for global stock markets, including Vietnam. A potential Donald Trump re-election could bring about trade policy risks for Vietnam. Trump has previously declared intentions to raise import taxes by up to 10% on goods from several countries, including Vietnam, which could impact exports and, consequently, the economy and stock market.

Fifthly, the weakening of the Chinese economy, confirmed by disappointing macroeconomic indicators, poses a notable latent risk to the Vietnamese stock market due to the high interconnectedness between the two economies.

In summary, KBSV Research maintains its VN-Index expectation at 1,320 points by the end of 2024, corresponding to a market P/E of 15 times.

“In the first half of Q4, the market will fluctuate, especially as the VN-Index approaches the 1,300 threshold amid a lack of supportive information”, the analysts predict, forecasting a clearer upward trend in the latter half of the quarter as financial results are released and Q4 expectations materialize.

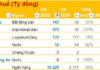

Regarding industry prospects for the latter half of the year, KBSV Research holds a positive outlook for the banking, securities, real estate, industrial real estate, port, and oil and gas sectors. The chosen investment themes for Q4 revolve around economic recovery, progress towards market upgrades, La Nina, public investment, and FDI attraction.

Previously, on September 18, 2024, the Ministry of Finance officially issued Circular No. 68/2024/TT-BTC, amending and supplementing a number of articles of Circular No. 120/2020/TT-BTC on securities trading.

KBSV Research considers this a significant step in meeting the criteria for an upgrade by FTSE Russell, as it allows foreign investors to purchase stocks without requiring sufficient funds at the time of placing orders, with payment allowed on T+1 and T+2.

However, the analysts believe that the earliest the Vietnamese market will receive official news of an upgrade is in March 2025 during FTSE Russell’s internal review, with the effective date one year later.