Big Invest Group’s Board Members

|

BIG’s leadership registers to purchase a large number of shares

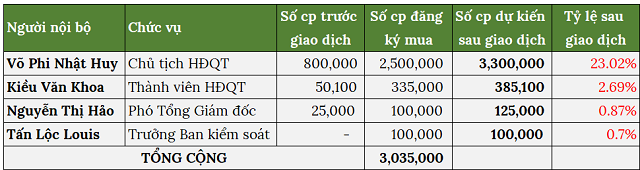

Accordingly, Vo Phi Nhat Huy – Chairman of the Board intends to buy 2.5 million shares. If successful, the Chairman will increase his ownership to over 23%, equivalent to 3.3 million shares. Kieu Van Khoa – Board member registered to buy 335,000 shares, raising his post-transaction ownership to 2.69%.

Meanwhile, Tan Loc Louis – Head of the Supervisory Board and Nguyen Thi Hao – Deputy General Director both registered to buy 100,000 shares, expected to increase ownership to 0.7% and 0.87% respectively. Prior to this, Mr. Tan Loc Louis did not hold any BIG shares.

All four transactions are expected to be executed between October 21, 2024, and November 14, 2024.

Source: HNX

|

Prior to this, Big Invest Group received approval from the SSC for its plan to offer more than 9.3 million shares to professional investors (less than 100 investors) to restructure its debts and improve its financial health. The offered shares will be restricted from transfer for one year from the end of the issuance period.

The offering price is VND 10,000 per share, and BIG is expected to raise over VND 93 billion. This will increase its charter capital to over VND 143 billion, equivalent to more than 14.3 million shares.

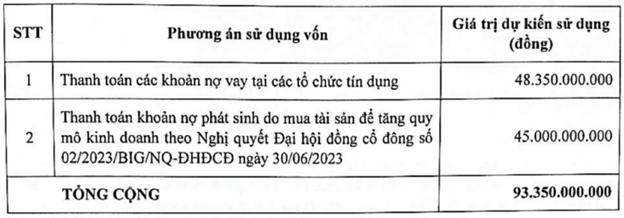

Of the proceeds, Big Invest Group will use more than VND 48 billion to repay debts to credit institutions, and the remaining VND 45 billion to pay off debts incurred from purchasing assets to expand its business scale.

|

Plan for utilizing proceeds from BIG’s private placement

Source: BIG

|

Capital raising through share issuance follows nine months of efficient operations

BIG’s management shared that despite challenges in the overall economy, the company’s flexible management has led to positive business results in the first nine months of 2024.

The construction materials trading segment, which contributes the highest revenue, continues to grow steadily. The second most important revenue contributor, the real estate and services chain, also performed well. Currently, BIG is leasing a chain of hotels nationwide. This strategy was decided upon at the end of 2023, recognizing the strong growth potential of the tourism market. In the first half of 2024, BIG successfully operated a chain of five hotels and buildings for lease in five major cities across the country (Hanoi, Ho Chi Minh City, Danang, Hue, and Lao Cai). In addition, BIG has been actively developing its commercial and agricultural export business to China, leveraging its advantageous location in Lao Cai, which is expected to contribute significantly to revenue in the last quarter.

Providing specific figures, Ms. Tran Thi Mua Thao – CEO of the company, revealed that revenue for the first nine months of 2024 reached approximately VND 180 billion. At the beginning of the year, BIG set a target of VND 256 billion in revenue (up 22%) and over VND 8 billion in after-tax profit (3.5 times higher than in 2023). Thus, BIG has achieved about 70% of its set goals.

According to Ms. Thao, based on the current progress, BIG is likely to exceed the revenue target set by the Board of Directors by about 25%. Profitability has also surpassed the 2023 figures and is on track to exceed the targets set at the 2024 Annual General Meeting of Shareholders.