Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 670 million shares, equivalent to a value of more than 15.3 trillion VND; HNX-Index reached over 38.4 million shares, equivalent to a value of more than 694 billion VND.

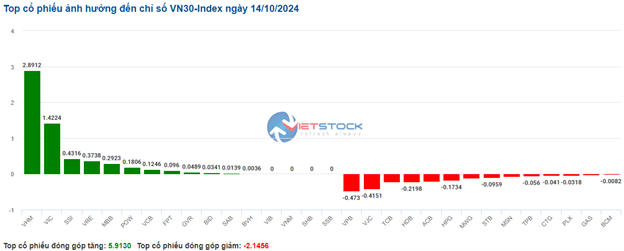

VN-Index opened the afternoon session with a prolonged tug-of-war, with the advantage slightly tilting towards the sellers, causing the index to weaken and close in the red. In terms of impact, FPT, HPG, EIB, and MWG were the most negative stocks, taking away more than 1.7 points from the index. On the other hand, VHM, GVR, MBB, and VIC were the most positive stocks, with an impact of more than 3.4 points on the index.

EIB stock fell to the floor price during the session, then recovered slightly and closed at 18,250 VND/share (down 4.45%). The trading volume of shares surged, reaching over 42.6 million shares in the session.

| Top 10 stocks with the strongest impact on VN-Index on October 14, 2024 |

Similarly, HNX-Index also had an unoptimistic performance, with the index negatively impacted by DTK (-3.23%), PVS (-1.22%), VIF (-3.64%), and KSV (-1.76%)…

|

Source: VietstockFinance

|

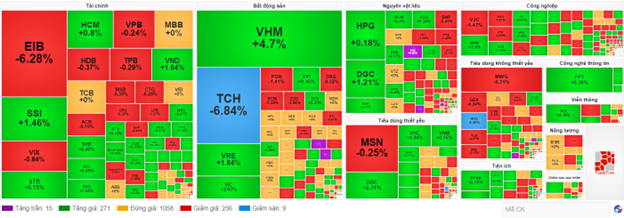

The information technology industry recorded the sharpest decline in the market at -1.34%, mainly due to FPT (-1.43%) and CMT (-0.75%). This was followed by the non-essential consumer goods industry and the energy industry, with decreases of 0.78% and 0.67%, respectively. On the other hand, the telecommunications industry witnessed the strongest recovery in the market, achieving a growth of 2.22% with green signals from VGI (+3.43%), VTK (+0.17%), CAB (+7.55%), and ADG (+5.78%).

In terms of foreign trading activities, they continued to net sell over 662 billion VND on the HOSE exchange, focusing on FPT (185.58 billion VND), VPB (107.63 billion VND), EIB (99.86 billion VND), and HPG (59.4 billion VND). On the HNX exchange, foreign investors net sold more than 22 million VND, mainly offloading PVS (18.55 billion VND), MBS (8.19 billion VND), BVS (2.02 billion VND), and VGS (1.93 billion VND).

| Foreign Trading Activities – Net Buying/Selling |

Morning Session: Selling Pressure Gradually Intensifies

The initial enthusiastic sentiment was quickly dampened, and the upward momentum gradually narrowed towards the end of the morning session. At the midday break, the VN-Index slightly increased by 0.14%, standing at 1,290.2 points; HNX-Index rose by 0.02%, reaching 231.42 points. Despite the balanced index levels around the reference level, the number of declining stocks gradually gained the upper hand, with 332 decreasing stocks compared to 242 increasing stocks at the end of the morning session.

The trading volume of the VN-Index in the morning session reached over 397 million units, equivalent to a value of more than 9 trillion VND. The HNX-Index recorded a volume of over 21 million units, with a value of over 405 billion VND.

VHM continued to be the main pillar supporting the market, contributing nearly 2 points to the VN-Index. It was followed by VIC and GVR, which added approximately 1.5 points to the index. Conversely, the massive selling pressure on EIB was the most significant factor dragging down the upward momentum of the index. Along with VPB and LPB, these three bank stocks took away more than 1 point from the overall market.

The telecommunications group shone with the outstanding performance of VGI, the largest stock by market capitalization in the industry, which rose nearly 4%, temporarily leading the market in the morning session. However, the remaining stocks in the group were not as positive, still dominated by red signals, such as CTR (-1.18%), VNZ (-0.43%), SGT (-2.91%), and FOC (-0.83%).

The real estate group recorded a 1% increase, mainly maintained by the Vingroup trio: VHM (+3.9%), VIC (+1.91%), and VRE (+1.58%). Meanwhile, the majority of the remaining stocks in the industry exhibited a rather negative performance, especially TCH, which hit the floor price right at the beginning of the session, followed by PDR (-1.65%), NLG (-0.99%), NVL (-0.93%), NTL (-1.36%), KBC (-0.72%), DXG (-1.29%), SNZ (-3.6%),…

After the sudden emergence of massive selling pressure on EIB (-5.5%), the banking group also witnessed the gradual spread of this pressure to other stocks in the industry, such as LPB (-1.22%), VPB (-0.97%), ACB (-0.38%), TPB (-0.29%), CTG (-0.28%),… Conversely, securities stocks recovered well into the green territory, notably SSI (+1.28%), SHS (+1.94%), EVS (+1.56%), VFS (+1.54%), and CTS (+0.99%).

Energy and non-essential consumer goods were the two industries with the most significant declines, falling by approximately 0.5%, mainly influenced by stocks such as BSR (-0.42%), PVS (-0.49%), PVD (-1.09%); MWG (-0.78%), PLX (-0.45%), GEX (-1.43%), OIL (-1.57%), and PNJ (-0.52%).

Foreign investors also exerted considerable selling pressure, net selling more than 344 billion VND on the HOSE exchange in the morning session. Notably, FPT was net sold by nearly 111 billion VND, far exceeding the value of other stocks. On the HNX exchange, foreigners net sold over 17 billion VND at the end of the morning session, focusing their selling activities on PVS and MBS stocks.

10:40 am: Lack of “Cooperation” from Bank Stocks Hinders Market Breakthrough

A sense of uncertainty prevailed, and selling pressure slightly outweighed buying interest, causing the main indices to fluctuate around the reference level. As of 10:40 am, the VN-Index rose by 3.96 points, trading around 1,292 points. The HNX-Index increased by 0.26 points, trading around 231 points.

Stocks in the VN30 basket exhibited a mixed performance, with a slight tilt towards the red territory. Among them, VHM, VIC, SSI, and VRE respectively contributed 2.89 points, 1.42 points, 0.43 points, and 0.37 points to the overall index. Conversely, VPB, VJC, TCB, and HDB faced persistent selling pressure, deducting more than 1.4 points from the VN30-Index.

Source: VietstockFinance

|

Real estate stocks witnessed a relatively optimistic performance, with green signals spreading across the industry. Within this group, residential real estate (+1.97%) recorded the most substantial increase in the market, with some notable stocks, including VHM (+4.7%), VIC (+2.75%), QCG (+6.96%), and NHA (+1.47%)…

In a contrasting development, TCH (-6.84%) hit the floor price right at the market open.

Additionally, retail real estate stocks witnessed a decent performance, with VRE rising by 1.84%. Meanwhile, the remaining real estate stocks displayed a somewhat mixed performance, with green and red signals interspersed: SZC increased by 0.53%, SIP by 1.11%, IDC by 0.54%, while KBC declined by 0.18%, BCM by 0.15%, and SZL by 1.17%…

Source: VietstockFinance

|

On the other hand, the telecommunications industry recorded a solid recovery, achieving a growth of 1.73%. Buying interest mainly concentrated on stocks like VGI, which rose by 4.18%, FOX by 0.11%, and YEG by 2.27%…

Conversely, financial stocks continued their “lack of cooperation,” registering a slight decline of 0.04%, mainly due to selling pressure in the banking sector. On the selling side, EIB fell by 6.02%, TPB by 0.29%, VPB by 0.24%, and HDB by 0.37%… On a positive note, securities stocks maintained their green signals, with SSI increasing by 1.46%, SHS by 1.29%, HCM by 0.64%, and VND by 0.99%…

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks standing at reference prices, and the buying and selling sides were relatively balanced. There were 256 declining stocks (including 9 floor stocks) and 271 advancing stocks (including 15 ceiling stocks).

Source: VietstockFinance

|

Opening: Pillar Stocks Spread Positivity

At the start of the October 14 session, as of 9:30 am, the VN-Index recorded a solid increase of over 6 points, climbing to 1,294.77 points. Meanwhile, the HNX-Index also edged higher, reaching 232.15 points.

Green signals temporarily prevailed in the VN30 basket, with 24 advancing stocks, 3 declining stocks, and 3 stocks standing at reference prices. Among them, VHM, POW, VIC, and VRE were the stocks with the strongest upward momentum. On the other hand, PLX, VPB, and VJC led the declining group.

As of 9:30 am, telecommunications service stocks were leading the market with a growth of 3.46%. Typical examples include VGI, which rose by 5.07%, TTN by 2.11%, VTK by 2.16%, and FOX by 0.77%,…

Following closely was the real estate industry

Technical Analysis for October 15: A Creeping Pessimism

The VN-Index and HNX-Index both witnessed declines, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.

Are Stocks Running Out of Steam for the Final Quarter?

The VN-Index is poised to surpass the 1,300-point mark by the end of the year, according to experts. However, they caution that this upward trajectory may not be sustainable in the long run if it is not supported by fundamental factors.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.