|

Source: VietstockFinance

|

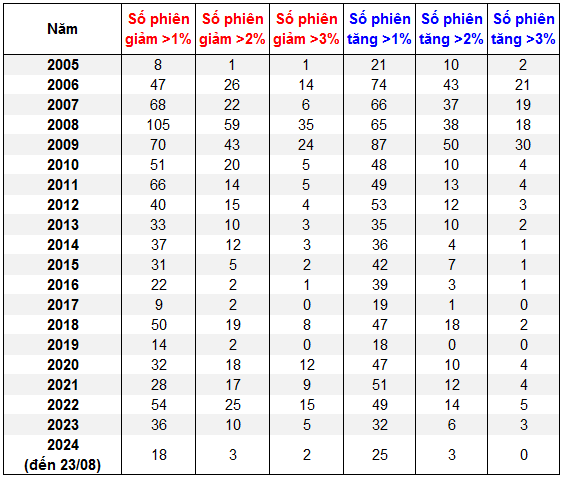

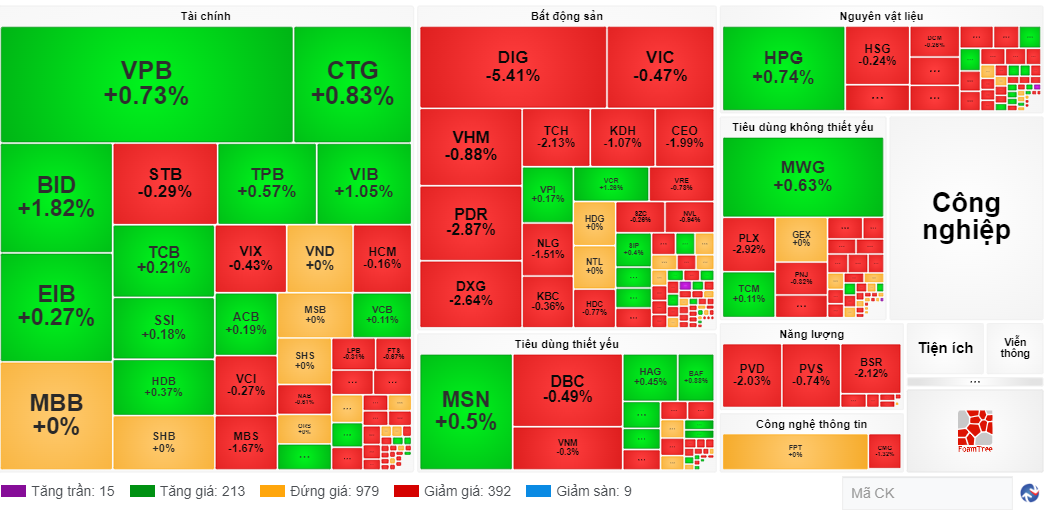

Broad-based selling pressure saw over 500 stocks decline compared to nearly 240 gainers. Most sectors ended in negative territory, with consumer services, hardware, and banking among the few that managed to stay in the green.

BID, CTG, VPB, HDB, VIB, MSB, and OCB managed to stay resilient and closed higher. However, the banking sector still faced significant pressure, with TCB, MBB, ACB, LPB, and STB facing selling pressure.

In the energy sector, BSR led the declines, with other oil and gas stocks such as PVS, PVD, and PVC falling by more than 2%.

Meanwhile, telecom stocks VGI, FOX, and CTR also witnessed a broad-based decline, with VGI tumbling over 4%.

Today’s trading value exceeded VND 18.5 trillion. Buying interest increased on the HNX and UPCoM exchanges, while turnover on the HOSE remained unchanged from the previous session.

AM Session: Selling Pressure Persists, Banks Support the Index

The market sentiment remained hesitant around the 1,300 level. The VN-Index‘s trend was unclear as it fell back into negative territory in the final minutes of the morning session on October 15. At the midday break, the VN-Index closed slightly lower at 1,286.33 points, down 0.01 points. The HNX-Index also struggled, ending the morning at 229.69 points, a loss of over 1 point.

Banking stocks continued to provide crucial support to the market. BID, CTG, VPB, VIB, VCB, and OCB contributed a combined 2.3 points to the VN-Index‘s performance. However, financial stocks witnessed increased differentiation, with most stocks closing in the red or unchanged.

Source: VietstockFinance

|

By the end of the morning session, decliners far outnumbered advancers, with over 400 stocks falling compared to nearly 220 gainers. Selling pressure was concentrated in the real estate, energy, and materials sectors.

On a positive note, market liquidity improved, with the trading value in the morning session surpassing VND 9 trillion across all three exchanges.

10:40 AM: Banks Hold Steady

Buying and selling forces were more balanced in the market, and by 10:30 AM, the number of gainers and losers was relatively similar, with 278 stocks advancing and 279 declining.

The VN-Index maintained its gains of nearly 4 points, supported by the financial and banking sectors. CTG, BID, EIB, TPB, and VIB posted solid gains. Among the top contributors to the index’s rise, BID added 1.7 points, while CTG, VCB, VIB, ACB, and TCB also made notable contributions. The banking sector played a pivotal role in propelling the VN-Index higher in the morning session.

Real estate stocks reversed course and fell into negative territory, with DIG plunging over 5%. Several other stocks in the sector, including PDR, DXG, and KDH, also declined. However, the situation wasn’t entirely bleak, as VPI, HDG, SZC, SIP, and VPH posted modest gains.

The energy and telecom sectors were the worst performers in the market, with the energy sector falling nearly 2% and telecom stocks declining over 1%.

Healthcare stocks took the lead in terms of gains, driven by AMV, which hit the daily limit-up, and BBT, which rose over 13%.

HPG inched up slightly by nearly 1%. For the third quarter of 2024, the Hoa Phat Group (HOSE: HPG) reported a 51% year-on-year increase in after-tax profit, reaching VND 3,022 billion.

Market Open: Buyers Take the Upper Hand

Vietnam’s stock market kicked off the session on October 15 with a slight gain, with the VN-Index rising nearly 3 points by 9:20 AM. The early trading dynamics were familiar, with sellers holding a slight edge.

Stocks in the consumer staples sector brought a positive tone from the start, with companies in the livestock industry, such as DBC (+1.3%) and BAF (+2.2%), leading the way. Several other stocks in the sector, including VNM, MSN, CTP, and KDC, also edged higher.

Financial and real estate stocks moved higher in unison, although the gains were not entirely convincing.

In the real estate sector, VHM slipped 0.3%, exerting some pressure on the market. However, several real estate stocks, including VPH, CIG, and OGC, hit the daily limit-up from the opening bell.

On the flip side, energy and information technology stocks tilted towards declines. BSR and PVC in the energy sector, along with FPT in the IT sector, traded in negative territory.