|

Source: VietstockFinance

|

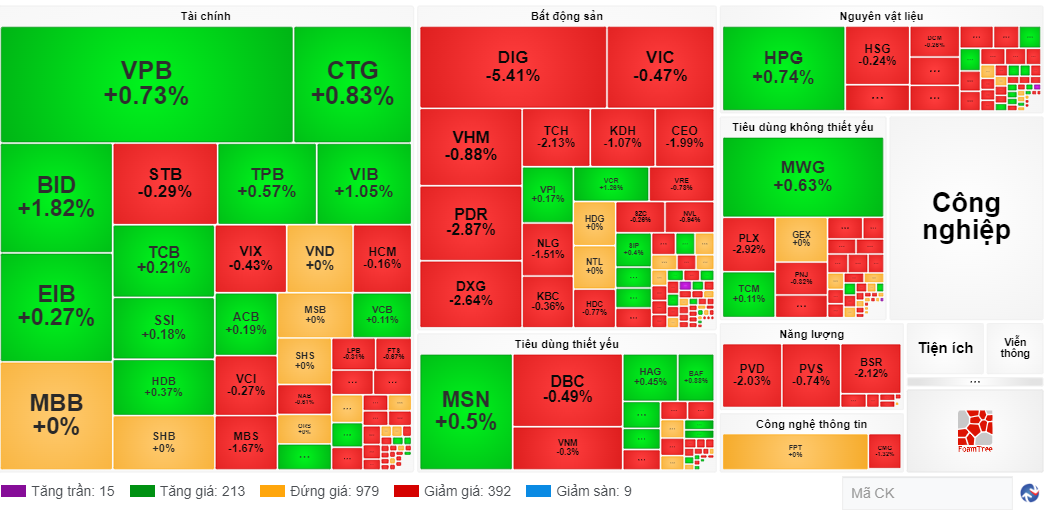

Bears dominated today’s session, with over 500 tickers closing lower against nearly 240 gainers. Most sectors ended in negative territory, except for consumer services, hardware, and banking, which managed to stay afloat.

BID, CTG, VPB, HDB, VIB, MSB, and OCB managed to stay in the green, providing some support to the banking sector. However, the sector still faced significant pressure, with TCB, MBB, ACB, LPB, and STB trading lower.

On the downside, telecom and energy stocks were the biggest losers of the day. BSR led the decline in the energy sector, while other oil and gas stocks like PVS, PVD, and PVC fell over 2%. In the telecom space, VGI, FOX, and CTR all traded lower, with VGI dropping more than 4%.

Today’s trading value exceeded 18.5 trillion VND. Buying interest picked up on the HNX and UPCoM exchanges, while turnover on the HOSE remained unchanged from the previous session.

Morning Session: Sellers Prevail, Banks Support the Index

The market sentiment remained hesitant around the 1,300 level. The VN-Index‘s trend was unclear as it dipped into negative territory in the final minutes of the morning session on October 15. At the midday break, the VN-Index stood at 1,286.33, down 0.01 points. The HNX-Index also struggled, closing at 229.69, a loss of over 1 point.

Banking stocks continued to provide crucial support to the market. BID, CTG, VPB, VIB, VCB, and OCB contributed a combined 2.3 points to the VN-Index‘s performance. However, financial stocks witnessed increased differentiation, with most names closing lower or unchanged.

Source: VietstockFinance

|

By the end of the morning session, decliners outnumbered advancers by a significant margin, with over 400 tickers in the red against nearly 220 gainers. Selling pressure was concentrated in the real estate, energy, and materials sectors.

On a positive note, market liquidity picked up, with the morning session’s trading value surpassing 9 trillion VND across the three listed exchanges.

10:40 AM: Banks Hold the Fort

Buying and selling forces were more balanced in the market, and by 10:30 AM, the number of gainers and losers were almost equal, with 278 tickers in the green and 279 in the red.

The VN-Index maintained its gains of nearly 4 points, thanks to the financial and banking sectors. CTG, BID, EIB, TPB, and VIB posted solid gains. Among the top contributors to the index’s rise, BID added 1.7 points, while CTG, VCB, VIB, ACB, and TCB also pitched in. The banking sector played a pivotal role in propelling the VN-Index higher this morning.

Real estate stocks reversed course and dipped into negative territory. DIG led the decline with a drop of over 5%. Several other names in the sector, including PDR, DXG, and KDH, also traded lower. However, the situation wasn’t entirely bleak, as VPI, HDG, SZC, SIP, and VPH managed to eke out slight gains.

The energy and telecom sectors were the day’s worst performers, with the former falling nearly 2% and the latter dropping over 1%. Healthcare stocks took the lead on the upside, driven by AMV‘s surge to its daily limit and BBT‘s climb of more than 13%.

HPG inched up nearly 1%. For the third quarter of 2024, the Hoa Phat Group (HOSE: HPG) reported a 51% year-over-year increase in after-tax profit, reaching 3,022 billion VND.

Market Open: Buyers Take the Upper Hand

Vietnam’s stock market kicked off the session on October 15 with a slight gain, as the VN-Index rose nearly 3 points in the early minutes of trading. The initial market action followed a familiar pattern, with sellers holding a slight edge.

Essential consumer goods stocks set a positive tone from the get-go, with companies in the livestock industry, such as DBC (+1.3%) and BAF (+2.2%), leading the charge. Other names in the sector, including VNM, MSN, CTP, and KDC, also edged higher.

Financial and real estate stocks moved in unison higher, although the magnitude of their gains was not entirely convincing. In the real estate sector, VHM slipped 0.3%, weighing on the market to some extent. Conversely, several real estate tickers, including VPH, CIG, and OGC, soared to their daily limits right from the opening bell.

On the flip side, energy and information technology stocks leaned towards the red. BSR and PVC in the energy sector, along with FPT in the IT space, traded lower.