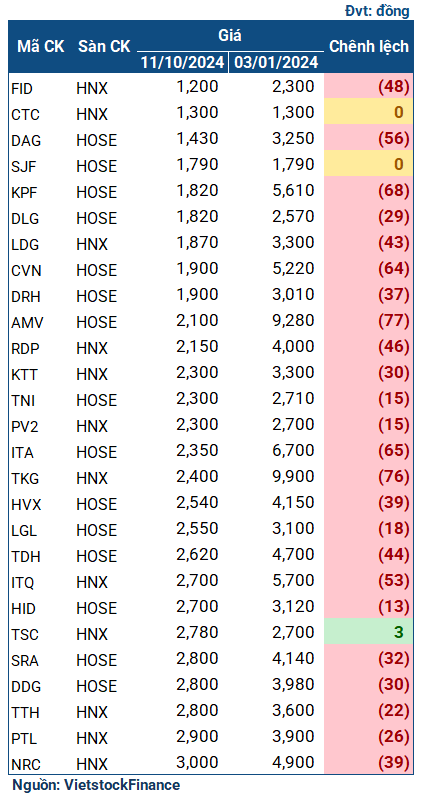

Iced tea is a humble beverage, often associated with affordability in Vietnam. To be fair, let’s consider the price of a cup of iced tea, assuming it’s the cheapest in the market at 3,000 VND. At this price, there are 27 stocks listed on the HOSE and HNX exchanges with market prices equal to or lower than this amount. Among these, the cheapest stock is priced at 1,200 VND, while the most expensive is 3,000 VND per share.

|

Stocks cheaper than a cup of iced tea in the current market

|

Topping this unfortunate list is FID (Vietnam Enterprise Investment and Development JSC). As of October 11, FID’s market price stood at just 1,200 VND per share, a 48% decrease compared to the beginning of the year. The second cheapest stock is CTC (Tay Nguyen Hoang Kim Group), which has maintained a market price of 1,300 VND per share since the start of the year. The most expensive stock on the list, NRC, from Danh Khoi Group, is priced at 3,000 VND per share.

In terms of percentage decrease, the top two losers are AMV (Vietnam-America Pharmaceutical and Medical Equipment Production and Trading JSC) and TKG (Tung Khanh Production and Trading JSC), with a 77% and 76% drop in value since the beginning of the year, respectively. Their current market prices are 2,100 VND and 2,400 VND per share, respectively. Other notable mentions include KPF (Koji Asset Investment JSC) at 1,820 VND per share, down 68%; ITA (Tan Tao Investment and Industry Corporation) at 2,350 VND per share, a 65% decrease; and DAG (Dong A Plastic Joint Stock Company) at 1,430 VND, down 56%.

|

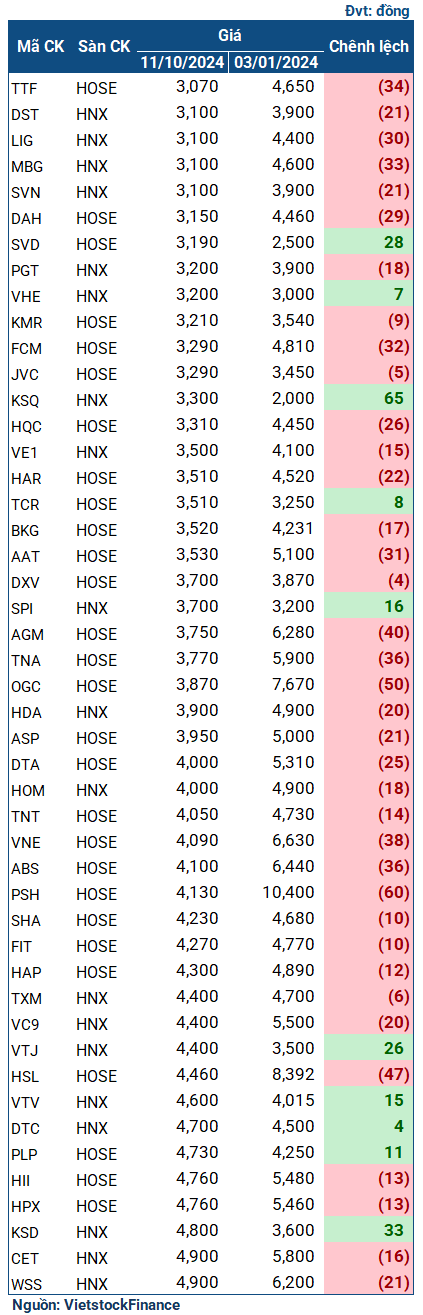

Stocks with a market price below 5,000 VND per share that are currently listed

|

What led to this situation?

Stock prices are influenced by various factors, including a company’s fundamentals, business potential, industry outlook, and market supply and demand dynamics. However, in most cases, extremely low-priced stocks are often associated with deeper underlying issues.

For FID, the company’s stock is currently facing a combination of warnings, scrutiny, and trading restrictions. FID’s internal situation is also less than ideal, with continuous losses, the heaviest being a 4 billion VND loss in 2020. In 2023, despite doubling its revenue from the previous year to over 84 billion VND, FID still incurred a net loss of nearly 3 billion VND (compared to a meager profit of 64 million VND in 2022).

| FID has been experiencing prolonged losses |

In the first half of 2024, FID continued to post a net loss of 2.5 billion VND, with a cumulative loss of over 23 billion VND as of the end of June. The reviewed semi-annual financial statements for 2024 also received a series of qualified audit opinions, mainly related to provisions for personal advances – which FID explained as “advances for handling company matters” – and loan contracts with several joint-stock commercial banks.

FID’s response to continued losses in the first half of 2024 and the qualified opinion from auditors

DAG, of Dong A Plastic Joint Stock Company, is currently in a trading suspension. Similar to FID, DAG is mired in a mess and is going through one of its most challenging phases in the past two decades. According to the audited financial statements for 2023 (released in July 2024), DAG incurred a net loss of up to 600 billion VND, mainly due to a provision for inventory devaluation of up to 404 billion VND, which caused a significant increase in cost of goods sold. This massive loss wiped out the company’s accumulated profits from the previous 16 years, resulting in a negative retained earnings figure of 588 billion VND at the end of 2023 (compared to a positive 19 billion VND at the beginning of the year). The report received three pages of comments from auditors, highlighting bad debts – including loan and tax debts – and expressing doubts about the company’s ability to continue as a going concern.

In the first half of 2024, DAG’s situation did not improve, with a loss of 67 billion VND and equity of just over 27 billion VND. The company generated only 55 billion VND in revenue, equivalent to 6% of the same period last year. The trading suspension can even be considered fortunate for DAG, as it prevented the stock price from falling further.

| The huge loss in 2023 pushed DAG into its most difficult phase in two decades |

ITA, associated with Ms. Dang Thi Hoang Yen (or Maya Dangelas), was recently placed under a trading suspension in late September 2024 due to continued violations of information disclosure regulations.

In reality, ITA’s financial performance in recent times hasn’t been terrible. After a record loss of 260 billion VND in 2022, ITA bounced back with a net profit of over 202 billion VND in 2023. In the first half of 2024, ITA continued to be profitable, with a net profit of nearly 64 billion VND, a 66% increase over the same period, mainly due to the reversal of provisions for doubtful accounts receivable and reduced bank interest expenses, along with cost-saving measures in the second quarter.

Nevertheless, ITA’s stock price has continued to plummet due to various controversies surrounding the company. In 2022, the company faced a petition for bankruptcy proceedings filed by the Ho Chi Minh City People’s Court, related to a debt of approximately 21 billion VND to Cong Ty TNHH Thuong Mai Dich Vu Xay Dung Quoc Linh – which Ms. Yen has consistently denied. This court case also triggered a series of other lawsuits and continues to impact the company’s operations, according to ITA’s explanations in its Q2 2024 financial statements.

| ITA’s stock price has been on a downward spiral since the beginning of the year |

Additionally, ITA has made some shocking statements. Regarding the delay in publishing its audited financial statements for 2023 and the reviewed semi-annual financial statements for 2024, Mr. Nguyen Thanh Phong – CEO of ITA – claimed that HOSE and the State Securities Commission of Vietnam (SSC) had acted unusually, creating difficulties for auditing firms and suspending the practice of auditors working on ITA’s financial statements, leading to the departure of these firms. Ms. Yen asserted that ITA was being targeted by malicious forces attempting a hostile takeover. In the face of potential delisting, ITA issued a statement implying that the SSC and HOSE would be held responsible.

Another notable mention is DDG (Indochine Import Export Industrial Investment Joint Stock Company). DDG’s stock is currently in the warning band and has recently entered the control band due to violations of information disclosure regulations regarding its reviewed semi-annual financial statements for 2024. As of October 11, its market price was 2,800 VND per share, a 30% decrease compared to the beginning of the year. However, compared to its peak in 2023 – just before a series of 19 consecutive sessions of reaching the floor price – the drop is as high as 93%.

| DDG experienced a series of floor price sessions in 2023, plummeting to the iced tea price range |

The main reason for DDG’s predicament is the challenges it faces in its business operations. In 2023, the company suffered a record loss of nearly 206 billion VND (compared to a profit of 44 billion VND in the previous year). In the first six months of 2024, the company’s revenue was just over 120 billion VND, only one-third of the same period last year. While DDG did make a net profit of approximately 6.6 billion VND (compared to a loss of nearly 194 billion VND in the same period last year), this profit was mainly due to the disposal of fixed assets of the parent company.

| Business operation difficulties are the main reason for the decline in DDG’s stock price |

Optimistic investors often say that every rain eventually stops, and that stocks can’t keep falling forever. However, the storm that shareholders of these companies are facing may still have a long way to go.