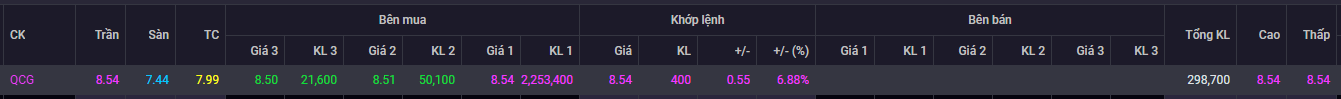

In the morning session of October 15, QCG shares surged to the ceiling price of 8,540 VND per share as soon as the market opened and maintained this price until 11:30 am. While the trading volume was only about 300,000 shares, the buy orders exceeded 2.3 million shares, with almost no selling pressure. Among real estate stocks, QCG is currently the only one that has reached the ceiling price.

|

QCG saw no sellers at the beginning of the October 15 session

Source: SSI iboard

|

In the previous session on October 14, QCG shares also hit the ceiling price with a matching volume of nearly 1.2 million shares, all from matched orders. The upward momentum of this stock has been building since the end of the previous week, October 11, with a 5.51% increase and a matching volume of nearly 1.7 million shares, the highest in the last 10 sessions.

At the beginning of the month (October 1), QCG shares unexpectedly surged 6.09% with a trading volume of nearly 2.4 million shares, the highest since August 2, 2024. However, the share price reversed course and fell the next day.

| Price movement of QCG shares from the beginning of 2024 until now |

The sudden rise in QCG shares took place amid the release of Q3/2024 financial statements by listed companies. This raises the question of whether the company has achieved positive business results in the past three months. Moreover, at the end of August, this stock was removed from the margin trading list by the Ho Chi Minh Stock Exchange (HoSE) due to net losses in the first half of 2024, according to the reviewed semi-annual financial statements.

Ngoc Thuong

The Ever-Rising Bridge of Prices: Green Electric Board

Despite a modest gain of 3.24 points (+0.25%) in the VN-Index this morning, the index traded above the reference level for most of the session, with a clear breadth of advancing stocks. This is a testament to the inflow of funds as investors are willing to buy at higher price levels. Blue-chip stocks are leading the charge in terms of both index points and liquidity, accounting for over half of the market.

The Bottom Fishing Trap: Unveiling the Secrets of Stock Market Profits

Patience among sidelined funds snapped any recovery rhythm today. Only when prices plunged did larger order volumes emerge. Liquidity remains extremely low after last weekend’s session, which could be deemed a positive sign as those most eager to cut losses have already exited.