The VN-Index weakened significantly in the afternoon session, falling below the reference level due to strong headwinds from the blue-chip group. However, bottom-fishing activities became more active at lower price levels, helping many stocks to recover. The only downside was that the buying interest was not well-spread, dragging today’s liquidity to a 14-session low.

Contrary to expectations of a better performance in the afternoon session, selling pressure intensified after the midday break, pushing the VN-Index into negative territory just 40 minutes into the session. The breadth turned negative compared to the morning session, confirming that selling strength was broad-based and not solely focused on large-cap stocks. The index hit its intraday low at 2:20 pm, falling nearly 6 points before staging a mild recovery in the closing minutes. At the end of the session, the VN-Index posted a slight loss of 0.67 points, finding a balance with a relatively neutral market breadth.

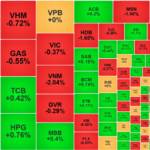

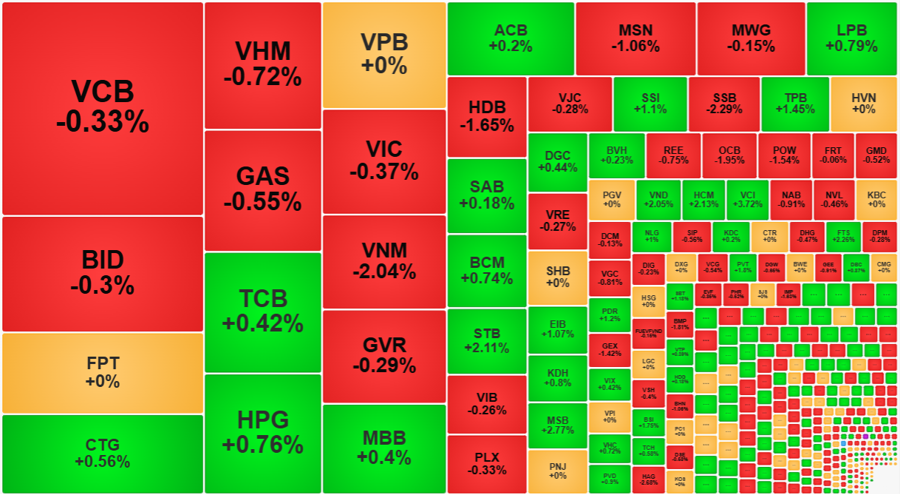

The index’s failure to rebound above the reference level was mainly due to the continued weakness in the largest cap stocks. Among the top 10 stocks by market capitalization on the VN-Index, VCB fell 0.33%, BID declined 0.3%, VHM lost 0.72%, GAS decreased by 0.55%, and VIC slipped by 0.37%. Only four stocks posted modest gains: CTG rose 0.56%, TCB increased by 0.42%, and HPG climbed 0.76%.

In reality, the large-cap stocks weren’t performing that poorly, as the majority of them closed above their intraday lows. However, the rebound magnitude was not significant. Some stocks, such as VHM, HPG, and TCB, witnessed high trading volume during the ATC session, but it wasn’t sufficient to push prices higher. The index remains heavily dependent on the ability of these large-cap stocks to provide support. The more than 5-point difference between the VN-Index and its intraday low is within the typical range of fluctuations.

On a positive note, individual stocks started to show signs of resilience, outperforming the index. The market breadth on the HoSE improved towards the end of the session, with 170 gainers and 202 losers, compared to 122 gainers and 255 losers at the intraday low. Notably, a significant number of stocks witnessed bottom-fishing activities, with nearly 32% of stocks on the HoSE climbing 1% or more from their intraday lows at the close. This improvement can be attributed to the deeper price declines in the afternoon session, which triggered more decisive bottom-fishing purchases.

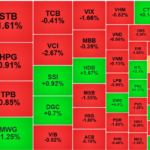

The securities group stood out in the afternoon session, with a number of blue-chip stocks leading the charge: VCI surged 3.72%, FTS gained 2.26%, HCM rose 2.13%, VND increased by 2.05%, and SSI climbed 1%. These stocks witnessed a sudden surge in buying interest during the session, with VCI even attracting million-share buy orders at the ATC session, and HCM also matching over a million shares during this period. Smaller securities stocks witnessed even stronger gains: ORS rose 3.83%, CSI climbed 2.36%, DSC increased by 2.22%, and VDS gained 2.05%… In terms of liquidity, VCI, SSI, and HCM were among the top 10 most traded stocks on the HoSE.

Thanks to the afternoon plunge, liquidity on the two exchanges increased by nearly 47% compared to the morning session, reaching VND6,861 billion. However, this figure is still relatively small compared to the two-week average, as afternoon sessions have been averaging over VND9,388 billion per day. This indicates that inflows remain limited, and investors are primarily bottom-fishing at lower price levels and adopting a wait-and-see approach, with only a select few stocks attracting stronger buying interest and reversing the downtrend, such as the securities group.

On a positive note, the market witnessed improved differentiation towards the end of the session, despite the index’s apparent weakness. Among the 170 gainers, 64 stocks rose more than 1%, outperforming the morning session (58 stocks) despite a more favorable breadth earlier in the day. On the downside, out of the 202 losers, 52 stocks fell more than 1%, slightly higher than the morning session (40 stocks). Some stocks faced intense selling pressure: VNM declined by 2.04% with a matching value of VND405.5 billion; MSN fell 1.06% with a matching value of VND309.8 billion; HDB dropped 1.65% with a matching value of VND254.7 billion; GEX decreased by 1.42% with a matching value of VND161.5 billion; and OCB fell 1.95% with a matching value of VND102.8 billion…

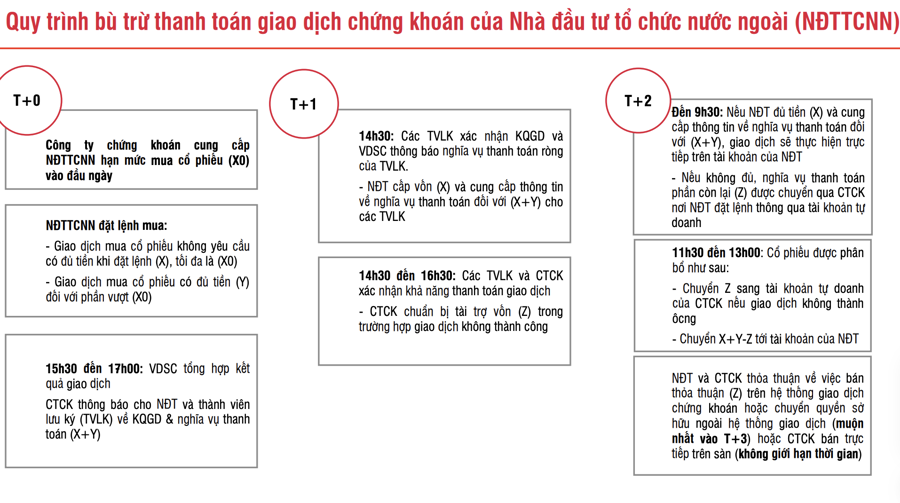

Foreign investors also increased their selling pressure in the afternoon session, with net selling on the HoSE reaching VND810.2 billion, double that of the morning session. The net selling value rose to VND214.6 billion, bringing the total net selling for the day to VND337.7 billion. This marks the second consecutive session of significant net selling by this group. Notable stocks that were net sold include VPB (-VND93.7 billion), HDB (-VND87.8 billion), VCG (-VND41.4 billion), OCB (-VND32.3 billion), GEX (-VND31.1 billion), FPT (-VND24.5 billion), and PLX (-VND21.2 billion). On the net buying side, STB (+VND63.6 billion), TCB (+VND40.1 billion), MWG (+VND33.5 billion), EIB (+VND22.1 billion), and FRT (+VND21.7 billion) stood out.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to sufficiently spread across the market, resulting in today’s overall liquidity sinking to a 14-session low.

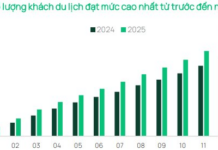

The Golden Conundrum: Where Will Money Flow as Property Prices Rise, Stocks Fluctuate, and Gold Soars?

According to economic experts, the real estate market remains an attractive investment avenue, despite a lack of significant momentum at present. This prediction stands in contrast to the potential decline in gold prices expected later this year.

The Stock Market Observer: Bottom Fishers Out in Force

Today’s market has seen a significant boost in positivity, not just in terms of the upward trajectory of indices, but also in the balance and strength of bottom-fishing forces. A notable shift in investor psychology and risk assessment has occurred, moving from a state of indiscriminate selling to one of price discrimination and consolidation.

Profits Pressure Mounts, Blue-Chip Stocks Stay Resilient

The market showed signs of weakening in the afternoon session as selling pressure began to weigh on prices. Bottom-fishing stocks were aggressively offloaded, putting pressure even on the blue-chip group while pushing mid and small-cap stocks lower. Despite this, the VN30-Index outperformed, propping up the VN-Index, although the gain narrowed significantly.

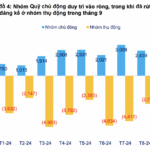

The Individual Investor’s Struggle: How Funds Consistently Come Out on Top

As of early 2024, an impressive 38 out of 61 equity funds tracked by FiinTrade have outperformed the VN-Index, with the top performers surging ahead by over 33%.