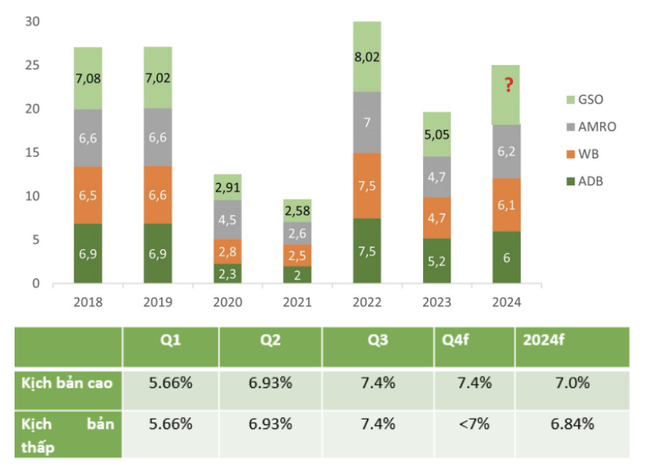

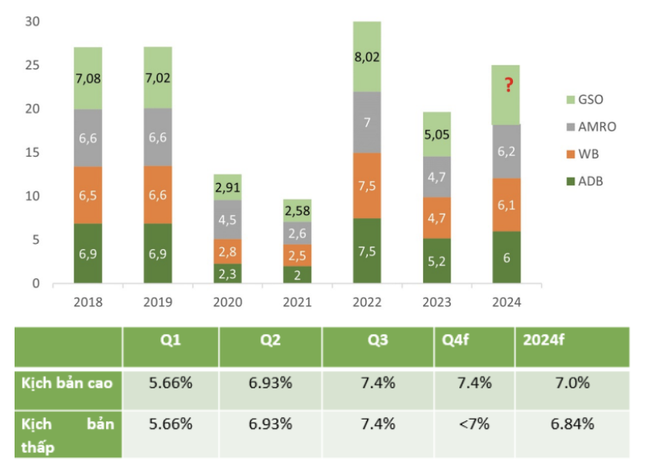

Today (October 15th), the Vepr Economic and Policy Research Institute released its Q3 economic report, updating two growth scenarios for Q4 and the entire year.

In the high scenario, Q4 growth will be flat at 7.4%, and annual growth is expected to reach the new 7% target set by the government.

In the low scenario, Q4 growth is <7%, and GDP fluctuates around 6.84%.

Vietnam’s forecasted/actual growth rates over the years and VEPR’s two growth scenarios for 2024.

Summarizing the current economic picture, Dr. Nguyen Quoc Viet, Vice President of VEPR, stated that GDP growth after nine months reached 6.82%, 1.5 times higher than the same period last year, mainly contributed by the industry and services sectors. On the aggregate demand side, trade is recovering, and foreign direct investment (FDI) inflows are the main growth drivers. The trade surplus reached US$20.8 billion, a high level during 2020-2024.

Tax revenue exceeded the plan, while public spending decreased compared to the same period in 2023, resulting in a continued high budget surplus, creating room for fiscal policies, tax exemptions, reductions, and simplifications, especially in the context of industries and fields affected by Typhoon Yagi.

The USD exchange rate at domestic commercial banks has continuously decreased. The money supply growth rate and credit growth have recovered quite well, positively contributing to promoting growth and investment, although they are still lower than the pre-COVID-19 average.

Dr. Nguyen Quoc Viet, Vice President of VEPR.

“The economy has many positive highlights, but there are still risks and challenges ahead,” said Dr. Viet.

According to Dr. Viet, the Purchasing Managers’ Index (PMI) declined, falling below 50 points in September. The ratio of withdrawing businesses to entering businesses remains high. Domestic consumption and public investment disbursement have not met expectations.

According to economist Pham Chi Lan, Q3 growth still relies on exports and FDI enterprises. For many years, domestic consumption and investment have not significantly contributed to growth.

In addition, the business environment still poses many risks and challenges, and barriers related to business conditions and administrative procedures tend to increase due to the weakening reform momentum from ministries and sectors. Data on the business sector also reflects this situation. In the past nine months, the number of businesses withdrawing from the market has remained high, with 163,700 businesses ceasing operations, a significant increase since 2020.