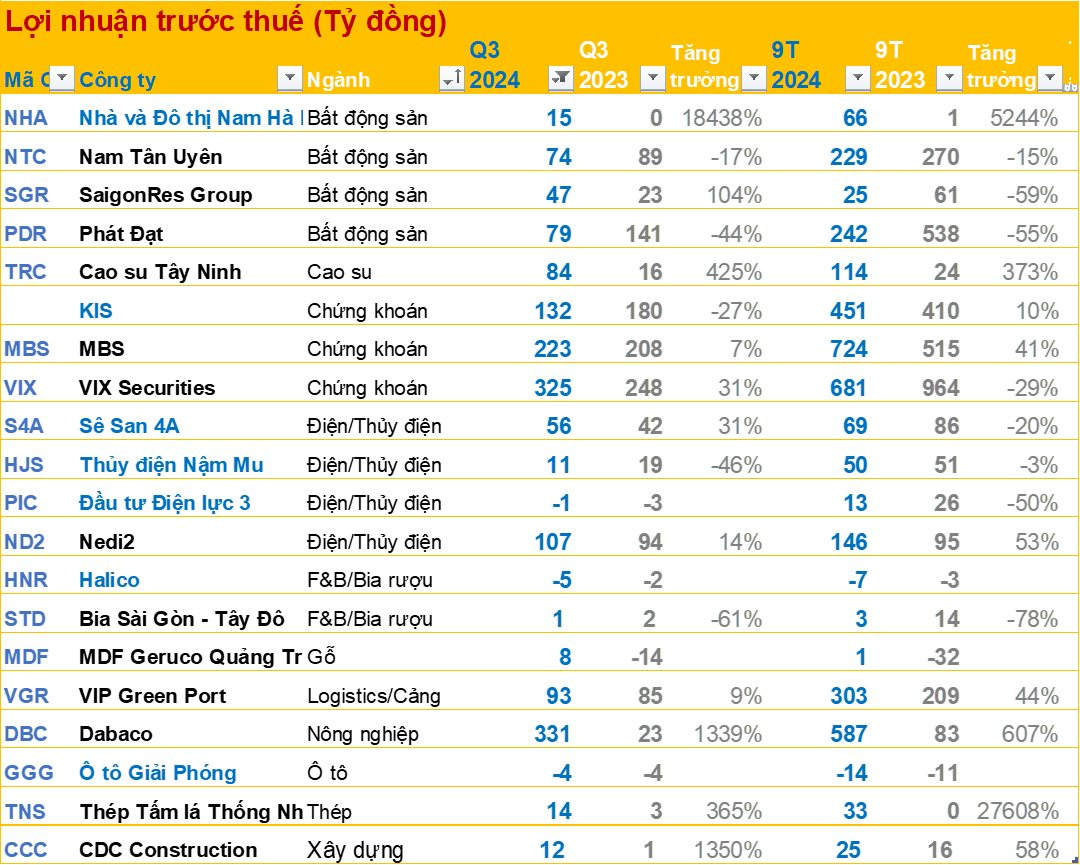

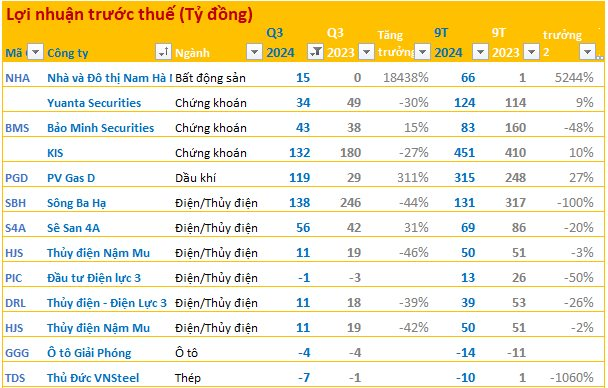

A host of companies recently released their financial statements for the third quarter of 2024 on October 16th, revealing interesting insights into their performance.

Several hydropower companies, including Song Ha Ba, Se San 4A, Thuy Dien – Dien Luc 3, and Thuy Dien Nam Mu, reported significant decreases in their profits for the third quarter of 2024.

Vietnam Oil and Gas Low-Pressure Distribution Joint Stock Company (PGD) recorded a remarkable performance with a near three-fold increase in profit, amounting to nearly VND 119 billion in the third quarter of 2024 compared to the previous year.

Thep Thu Duc – VNSTEEL (TDS) announced a 18% increase in revenue for the third quarter, amounting to VND 385 billion. However, the company incurred a tax loss of nearly VND 7 billion, in contrast to a loss of VND 537 million in the same period last year. For the first nine months of the year, TDS reported a loss of nearly VND 10 billion.

Hanoi Liquor and Beverage Joint Stock Company – Halico (UPCoM: HNR) released its financial report for the third quarter of 2024, showing a slight increase in revenue of 3.4% year-on-year, totaling over VND 22 billion. The company reported a loss of nearly VND 5 billion, triple the amount from the previous year. In the first nine months of the year, Halico recorded a revenue of nearly VND 80 billion, a 13% increase, but incurred a loss of nearly VND 7.5 billion.

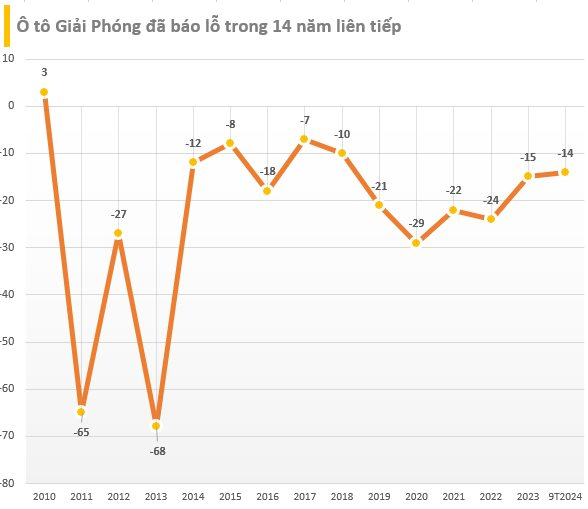

Gia Phong Auto Joint Stock Company (GGG) faced challenges with no reported revenue and a loss of nearly VND 4 billion in the third quarter of 2024. However, for the first nine months, GGG saw a seven-fold increase in revenue year-on-year, totaling over VND 5.3 billion, but ultimately reported a loss of more than VND 14 billion.

Investment in Power 3 (PIC) reported a tax loss of VND 838 million in the third quarter of 2024, while for the first nine months, the company’s tax profit stood at VND 13 billion, reflecting a 50% decrease compared to the previous year.

Thuy Dien Nam Mu (HJS) witnessed a 46% decline in pre-tax profit for the third quarter, amounting to VND 11 billion, and a 3% decrease in pre-tax profit for the first nine months, totaling VND 50 billion.

Nam Ha Noi Housing and Urban Development JSC (NHA) achieved impressive results with a nearly threefold increase in revenue for the third quarter, reaching nearly VND 25 billion. The company’s pre-tax profit soared to nearly VND 15 billion, an astonishing 185-fold increase from the previous year’s figure of just over VND 81 million. For the first nine months of the year, NHA reported a pre-tax profit of VND 66 billion, representing a staggering 5,244% increase year-on-year.

KIS Vietnam Securities experienced a 27% decline in pre-tax profit for the third quarter, amounting to VND 132 billion, but maintained a positive trajectory with a 10% increase in pre-tax profit to VND 451 billion for the first nine months compared to the previous year.

As of October 16th, several companies have disclosed their financial statements for the third quarter of 2024, providing valuable insights into their performance and financial health.