Vietnam Real Estate Market Report: Q3 2024 Update

According to the Vietnam Real Estate Brokers Association (VARS), the total retail sales of goods and services consumption in Vietnam for the first nine months of 2024 is estimated at VND 4,703 thousand billion, an increase of 8.8% compared to the same period last year.

Fig 1. Total retail sales and consumption service revenue in Q3 2024

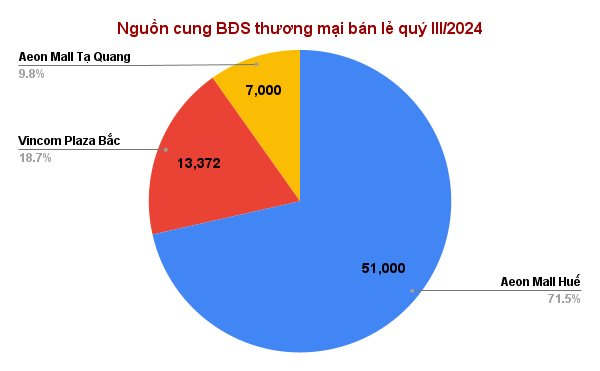

In terms of commercial and retail real estate, the market witnessed an addition of approximately 71,000 sqm of new retail space from three major shopping centers: Aeon Mall Hue (51,000 sqm), Vincom Plaza Bac Giang (13,372 sqm), and Aeon Mall Ta Quang Buu (7,000 sqm). These new malls achieved high occupancy rates of around 90% upon opening.

Fig 2. Commercial and retail real estate supply in Q3 2024

On September 22, at the Conference on Announcing the Planning Period of 2021-2030 and Vision to 2050, and Investment Promotion of Bac Ninh Province in 2024, Aeon Mall Vietnam received a memorandum of understanding for researching and developing the Aeon Mall project in Bac Ninh province with a total expected investment of USD 190 million.

Meanwhile, Vincom Retail aims to expand its presence across Vietnam in 2024, with the opening of six new shopping centers, including two Vincom Mega Malls and four Vincom Plazas, adding approximately 171,000 sqm of retail space. By the end of 2024, Vincom Retail is expected to have 89 shopping centers across 48 provinces and cities. In addition, they are developing a new generation of Vincom Mega Malls, the Life-Design Mall model, integrating shopping, dining, and entertainment experiences.

VARS also noted that new shopping centers are built with a modern, “all-in-one” concept, integrating shopping, entertainment, art appreciation, and experiences, with occupancy rates as high as 90% upon opening. In contrast, older malls have seen a slight increase in vacant retail spaces as demand shifts towards these new, modern malls.

Fig 3. A modern shopping center in Hanoi, Vietnam

“The premium commercial real estate segment in centrally-run cities is experiencing rapid growth compared to other ASEAN countries, with strong long-term growth potential,” the report stated.

Furthermore, the VARS Q3 2024 report noted an increase in rental prices due to the addition of high-quality new supply and the renovation of existing malls. In Hanoi, rental prices outside the city center range from USD 40 to 70 per sqm per month, a 3% increase quarterly, while prices in the central area range from USD 100 to 150 per sqm per month. In Ho Chi Minh City, rental prices in non-central areas slightly increased to USD 48 per sqm per month, while the central area maintained high prices, ranging from USD 150 to 300 per sqm per month.