On October 3, 2024, the Board of Directors of Golden Gate Joint Stock Company met and approved the detailed plan for issuing shares under the employee stock option program as stipulated in Article 7 and Article 8 of the resolutions of the General Meeting of Shareholders on June 27, 2024.

Accordingly, to implement Article 7, Golden Gate will issue 38,474 shares to 211 officers and employees.

At the same time, to implement Article 8, Golden Gate will issue 19,400 shares to 14 officers and employees.

Notably, Mr. Dao The Vinh, CEO of Golden Gate, is also included in this issuance and will be eligible to purchase 4,035 shares. Due to his related interests in this issuance, Mr. Dao The Vinh did not participate in the Board of Directors’ vote, despite being a member of the Board.

In total, Golden Gate will issue 57,874 shares in this round. The issuance price is VND 10,000/share, equivalent to proceeds of nearly VND 580 million.

Golden Gate has not yet listed its shares on the stock exchange, so the shares do not have a trading price. However, according to a valuation certificate issued by International Valuation and Investment Consulting JSC on August 30, 2021, the value of one share of Golden Gate is nearly VND 2 million.

Golden Gate has previously issued bonds secured by 573,372 shares of the company held by Golden Gate Partners JSC. These shares were then estimated to be worth VND 1,120 billion.

Based on the aforementioned price, the value of the shares that Golden Gate is about to issue to its employees is up to nearly VND 116 billion.

In 2024, Golden Gate targets a 12.4% increase in net revenue to VND 7,066 billion and a 16.5% rise in after-tax profit to VND 161 billion.

This year, Golden Gate continues to focus on selectively developing and expanding its network of restaurants nationwide, leveraging its leading brands, developing new labels, and building an enterprise management system, and applying technology to optimize operations.

Previously, in 2023, Golden Gate also closed 39 branches in various provinces and cities, transferring the management of these business locations to two branches in the North and the South. The company commenced and completed the construction of a new food factory in the Thach That – Quoc Oai Industrial Park, Hanoi. The factory, with a capacity of 15,000 tons of food, was officially inaugurated in February 2024.

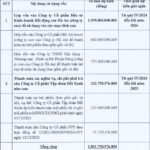

Presenting an Enticing Offer: BAF Proposes the Sale of 65 Million Shares at VND 15,500 Each

The amount of 1,007.5 billion VND raised will be used to purchase feed, additives, and materials for pig farms, totaling 557.5 billion VND, and to invest 450 billion VND in the purchase of piglets, weaned pigs, and breeding pigs. The disbursement is planned for the period between the fourth quarter of 2024 and the fourth quarter of 2025.

The Stock Market Superstar: Defying Gravity as VN-Index Stumbles at 1,300

Since the beginning of the year, this stock has soared by up to 67% in value, with a corresponding market capitalization increase to an impressive VND 17,450 billion.