According to the plan, on March 29th, 29/3 Textile Company will hold its annual shareholders’ meeting in 2024 at the company’s headquarters – 60 Me Nhu Street, Thanh Khe Tay Ward, Thanh Khe District, Da Nang City.

Right before the shareholders’ meeting, on March 6th, the company will advance the cash dividend for the year 2023 with a rate of 20% (1 share receives 2,000 VND). The ex-dividend date is February 23rd, 2024.

Currently, the company has nearly 5.2 million outstanding shares, and the estimated dividend payout this time is over 10 billion VND.

Since its listing on UPCoM in 2019, 29/3 Textile Company has consistently paid annual cash dividends to shareholders, with rates ranging from 10-35%. This is the second consecutive time that the company maintains a dividend rate of 20% for 2022 and 2023.

The estimated profit for 2023 is 24 billion VND, fulfilling the annual plan.

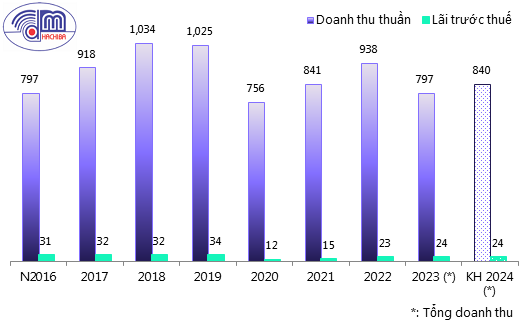

Prior to that, the company’s Board of Directors approved the 2023 production and business results with an estimated total revenue of 797 billion VND, a decrease of 15% compared to the previous year, and achieving 85% of the plan. Pre-tax profit slightly increased by 3% to nearly 24 billion VND, fulfilling 101% of the annual profit target. Average income remained at 8.95 million VND per person per month.

In 2024, 29/3 Textile Company sets a target of 840 billion VND in total revenue, a 5% increase compared to 2023. The estimated pre-tax profit is 24 billion VND, and the dividend rate is expected to be maintained at 20% of the charter capital.

|

Business results of 29/3 Textile Company and plan for 2024

(Unit: Billion VND)

Source: 29/3 Textile Company, the writer synthesized

|

At 29/3 Textile Company, the largest shareholder is the family of the CEO Pham Thi Xuan Nguyet, owning 38.95%; followed by the family of Chairman Huynh Van Chinh, owning 17.5%, and the Board member Lam Trong Luong, owning 9.6%.

The concentrated shareholder structure has resulted in low liquidity for HCB shares. Since the end of 2023, HCB’s stock price has remained at the reference level of 21,000 VND per share, a 21% increase over a year.

| HCB stock price over the past year |