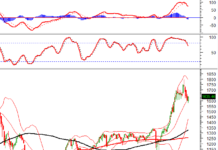

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 693 million shares, equivalent to a value of more than 15.1 trillion VND; HNX-Index reached over 52.7 million shares, equivalent to a value of more than 1,066 billion VND.

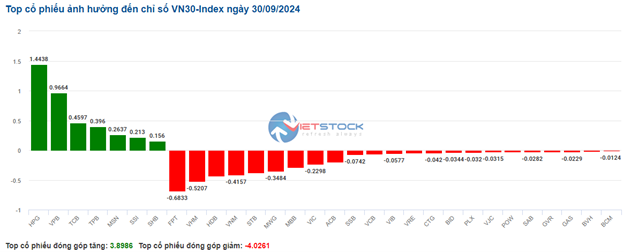

The sellers continued to dominate in the afternoon session, although buying demand appeared but was not able to change the situation, leading to the VN-Index closing in the red. In terms of impact, VCB, VHM, BID, and VIC were the codes with the most negative impact, taking away more than 2.3 points from the index. On the other hand, VPB, HPG, MSB, and MWG were the codes with the most positive impact and contributed nearly 1.6 points to the index.

| Top 10 stocks with the strongest impact on the VN-Index on 30/09/2024 |

Similarly, the HNX-Index also witnessed an unfavorable development, with the index being negatively impacted by the codes NTP (-4.22%), DNP (-8.58%), IDC (-0.86%), VCS (-1.22%)…

|

Source: VietstockFinance

|

The telecommunications sector recorded the sharpest decline in the market at -1.26%, mainly due to the decline in the code VGI (-1.38%), YEG (-0.87%), CTR (-0.47%), and FOX (-1.12%). This was followed by the energy and real estate sectors, which fell by 1.14% and 0.9%, respectively. On the other hand, the information technology sector witnessed the strongest recovery in the market, with green signals appearing in FPT (+0.22%), VTB (+0.97%), and PIA (+0.37%).

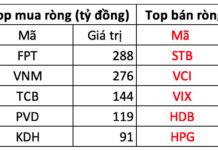

In terms of foreign trading, they net sold over 616 billion VND on the HOSE exchange, focusing on the codes HPG (260.6 billion), STB (109.53 billion), GMD (48.01 billion), and VRE (35.45 billion). On the HNX exchange, foreigners net sold more than 79 billion VND, focusing on the code PVS (31.93 billion), IDC (20.36 billion), SHS (15.57 billion), and MBS (5.57 billion).

| Foreign trading buying – net selling dynamics |

Morning session: Sellers remain dominant

The market continued to “hesitate” before the strong resistance zone. At the midday break, the VN-Index lost 2.8 points, equivalent to 0.22%, to 1,288.12 points; HNX-Index also fell 0.22% to 235.19 points. Sellers are increasingly overwhelming, with 404 codes decreasing and 222 codes increasing.

The matching volume of the VN-Index this morning reached over 363 million units, equivalent to a value of more than 7.6 trillion VND. The HNX-Index recorded a matching volume of nearly 27 million units, with a value of more than 511 billion VND.

In terms of impact, VHM, VCB, and BID are currently the pillars putting the most pressure on the market, taking away more than 1.3 points from the VN-Index. On the other hand, HPG, MSB, and MWG continued to attract positive buying demand in the morning, contributing more than 1 point, helping the overall index not fall too sharply.

The red signal is dominating across all industry groups, except for materials. This was the only group that maintained a green signal in the morning session, thanks to the outstanding performance of steel stocks such as HPG (+1.54%), HSG (+1.67%), NKG (+0.92%), VGS (+1.3%), and TIS (+1.41%). However, most of the remaining stocks in the materials group could not escape the general downtrend, typically NTP (-3.44%), BMP (-3.49%), and RTB (-3.63%).

On the downside, the telecommunications group “bottomed out” with a decline of more than 1%. This was mainly due to the decline in the stocks VGI (-1.23%), VNZ (-3.63%), and FOC (-2.08%). In addition, the real estate sector also exerted significant pressure on the overall market. The red signal dominated the broad market, typically NVL (-3.9%), VHM (-1.27%), VRE (-1.29%), PDR (-1.75%), DIG (-1.51%), TCH (-1.11%), and DXG (-1.51%).

The financial group is witnessing a mixed performance. Specifically, securities stocks are maintaining a positive signal with SSI (+1.27%), VCI (+2.23%), BVS (+2.35%), VDS (+3.2%), BSI (+1.02%),… Meanwhile, sellers are dominating in most banking stocks. Except for MSB (+3.17%), EIB (+1.08%), and VBB (+1%), which are rising significantly, VCB, BID, CTG, TCB, MBB, ACB, HDB, STB,… all fell slightly at the end of the morning session.

Foreigners net sold nearly 342 billion VND on the HOSE exchange in the morning session, with notable selling pressure in the stock HPG (net sold nearly 179 billion VND). On the HNX exchange, foreigners net sold nearly 32.5 billion VND, focusing on selling the stock SHS.

10:30 am: Selling pressure remains present

Cautious trading sentiment caused the main indices to fluctuate around the reference level. As of 10:30 am, the VN-Index fell slightly by 1.71 points, trading around 1,289 points. The HNX-Index fell by 0.15 points, trading around 235 points.

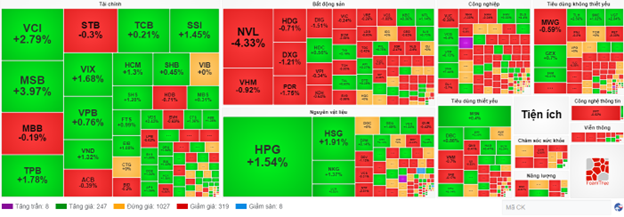

The breadth of the VN30 basket is currently tilted towards the downside with 23 losers and 7 gainers. Among them, FPT, VHM, HDB, and VNM had a significant negative impact on the index, taking away 0.68 points, 0.52 points, 0.44 points, and 0.42 points, respectively. On the supportive side of the index, most banking sector stocks contributed nearly 2 points to the VN30-Index, including VPB, TCB, TPB, and SHB.

Source: VietstockFinance

|

The real estate sector continued to face “headwinds” as most stocks recorded a red signal with the sharpest decline in the market at 0.63%. Specifically, VHM fell by 1.04%, HDG fell by 0.89%, DXG fell by 0.91%, and notably, NVL fell by 4.33% after announcing its reviewed consolidated financial statements for the first half of 2024, with a loss of more than 7,300 billion VND.

The reason for Novaland’s heavy loss was due to the auditor’s opinion requiring a provision for land rent and land use fees to be paid, and an adjustment to reduce financial revenue. Specifically, this provision arises from the provision for land rent and land use fees to be paid, calculated according to the 2017 land price scheme for the 30,106 ha Nam Rach Chiec project in An Phu ward, Thu Duc City, Ho Chi Minh City (Lakeview City project – the investor is Century 21 International Development Co., Ltd.), based on the notification of the tax authority dated January 8, 2021.

Along the same unfavorable line is the telecommunications sector, which continues to face selling pressure in most stocks. Specifically, VGI fell by 0.77%, CTG fell by 0.08%, ELC fell by 0.41%, YEG fell by 0.43%…

In contrast, the materials sector currently witnessed a strong recovery, although the performance was mixed. On the upside, buying demand focused mainly on the three largest steel stocks, HPG (+1.54%), HSG (+1.91%), and NKG (+1.37%). Meanwhile, the plastics stocks, such as BMP (-3.33%), NTP (-2.81%), and AAA (-0.31%), continued to face selling pressure.

Compared to the beginning of the session, the sellers still held the upper hand. There were 319 declining stocks and 247 advancing stocks.

Source: VietstockFinance

|

Opening: Caution at the beginning of the session

At the start of the September 30 session, as of 9:30 am, the VN-Index fluctuated around the reference level, trading around 1,289 points. The HNX-Index also fell slightly, trading around 235 points.

On the morning of September 29, in Da Bac district, Hoa Binh province, Prime Minister Pham Minh Chinh attended the groundbreaking ceremony of the Hoa Binh – Moc Chau expressway (from Km19 to Km53 in Hoa Binh province) with a total investment of nearly 10,000 billion VND.

The Hoa Binh – Moc Chau expressway project in Hoa Binh province has a length of about 34 km and a total investment of 9,997 billion VND. The project is expected to be completed by 2028. The land clearance phase for the 4-lane road project has a total area of about 354.37 ha.

As of 9:30 am, the red signal temporarily dominated the VN30 basket with 21 declining stocks, 2 gaining stocks, and 6 stocks trading sideways. Among them, ACB, BCM, BID, and BVH were the stocks with the sharpest declines. On the other hand, HPG, SHB, TPB, and MSN were the stocks with the strongest gains.

The materials sector was one of the most prominent industries in the market this morning. The stocks in this sector all recorded positive signals, such as HPG (+1.54%), HSG (+1.91%), TVN (+3.41%), NKG (+1.83%), BFC (+0.48%), KSB (+1.03%),…