Trading was lackluster this morning, mainly due to investors’ reluctance to buy, with sell-side orders gradually pushing prices down. Except for the first few minutes when the VN-Index was slightly positive, the rest of the session witnessed a continuous downward trend, ending the morning session at the lowest point with four times as many losers as gainers.

Today marks the futures expiry, and caution prevailed after three consecutive losing sessions. The large-cap stocks failed to stabilize the market, despite VCB and VIC trading in the green. The number of declining stocks far outweighed the gainers in the VN30 basket (3 gainers vs 25 losers).

The VN-Index opened at its intraday high, gaining nearly four points, before plunging to a loss of 5.61 points (-0.44%) at the midday break. The drag from the large-cap stocks was evident, and the overall market breadth indicated widespread selling. Specifically, the best breadth for the index this morning was 162 gainers vs 71 losers, but by 10 am, it narrowed to 159 gainers vs 127 losers, and by 11 am, it stood at 108 gainers vs 185 losers. The session ended with only 67 gainers vs 270 losers.

The VN30-Index closed the morning session down 0.42%, with only three stocks in the green: VCB up 0.33%, VIC up 0.24%, and ACB up 0.19%. All other large-cap stocks, except for TCB, which was unchanged, traded in the red. Fortunately, the decline in the large-caps was relatively modest, with HPG leading the losses with a 0.92% drop. However, eight stocks in the basket fell by more than 1%, with SSB and GVR being the weakest performers, down 2.1% and 1.66%, respectively.

Across the HoSE, out of the 270 declining stocks, 78 fell by more than 1%. Only four stocks had notable liquidity above VND 100 billion: MSN decreased by 1.24% with a matching volume of VND 216.9 billion; HDB dropped by 1.11% with VND 137.7 billion; DBC fell by 2.84% with VND 122 billion; and HCM declined by 1.32% with VND 101.6 billion. The trading value on the exchange decreased by over 6% from the previous morning, reaching just over VND 4,766 billion. Many stocks witnessed significant declines coupled with low liquidity, indicating a withdrawal of funds.

Apart from the expiry effect, the contraction in trading activity also reflected investors’ disappointment with the 1300-point region, as the market kept repeating the same patterns. Without a breakthrough, investors, though not ready to “liquidate” their portfolios, lacked the motivation to buy more. Consequently, the market dynamics shifted in favor of sellers, and the extent of the price decline depended on their discretion.

Stocks that went against the downward trend this morning mostly had modest trading volumes, ranging from a few hundred million to a few billion dong. Out of the 67 gainers, 22 stocks increased by more than 1%, with no significant standouts. While YEG, HVH, PVP, MSH, TIP, and NO1 saw strong price movements, their liquidity was limited to a few billion dong at most. YEG, the best performer, had a matching volume of just VND 13.7 billion, which is not sufficient to ensure price reliability due to the low participation.

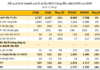

Foreign investors continued their substantial net selling on HoSE, withdrawing another VND 288.8 billion this morning. This marked the fourth consecutive morning session of net selling exceeding VND 100 billion. While no single stock experienced a dramatic sell-off, the selling was spread across numerous stocks. Notable stocks included HDB (-VND 48.3 billion), VHM (-VND 27.2 billion), HPG (-VND 24.5 billion), and DBC (-VND 20.1 billion). On the buying side, STB stood out with a net purchase of VND 72.3 billion. This consecutive net selling has led to a record-breaking week, marking the fourth consecutive week of net outflows.

The VN-Index closed the morning session down 5.61 points, slipping to 1273.87 points. The October low, based on closing prices, was 1269.93 points, and the intraday low was 1264.65 points. Thus, the index has retreated to its recent short-term low, which initially inspired hopes for a more positive market sentiment with the Q3 financial reporting season. However, those expectations have not been met so far.