Spot gold prices on the international market surpassed the historic $2,700 per ounce mark for the first time during Friday’s trading session. Geopolitical risks in the Middle East, uncertainties surrounding the US presidential election, and expectations of global monetary policy easing have fueled gold’s unstoppable rally.

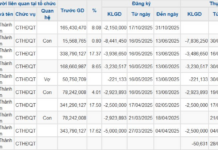

At the close of trading in New York, spot gold prices rose $28.3 per ounce, or 1.05%, to settle at $2,721.8 per ounce, according to data from the Kitco exchange. When converted using Vietcombank’s USD selling rate, this price is equivalent to nearly VND 83.1 million per tael, an increase of VND 900,000 per tael compared to yesterday morning.

This week, world gold prices in VND rose by VND 3.2 million per tael due to both a strong increase in global prices and a sharp rise in the USD/VND exchange rate.

Vietcombank’s USD buying and selling rates at the end of the week were VND 24,950 and VND 25,340, respectively, down VND 30 at each end compared to Friday morning, but up VND 340 compared to last week’s closing rates.

Gold futures prices on the COMEX in New York closed Friday’s session with a gain of 0.8%, reaching $2,730 per ounce.

For the week, gold prices climbed about 2.4%.

“Tensions in the Middle East remain high, especially after Hezbollah declared an escalation of war with Israel, prompting investors to buy gold, a traditional safe-haven asset,” said Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany.

Both Israel and the armed groups Hamas and Hezbollah, Israel’s enemies, have declared their intention to continue fighting in Gaza and Lebanon. This dashed hopes that the death of an Israeli militant leader could hasten an end to the Middle East conflict.

However, in a positive sign, US President Joe Biden declared on Friday that there is an opportunity for the US to mediate between Israel and Iran to temporarily halt the conflict between the two countries. Iran plays a key role in supporting the militant groups fighting against Israel, including Hamas, Hezbollah, and the Houthis.

“The upward momentum in gold prices is also bolstered by concerns surrounding the US presidential election and expectations of monetary policy easing,” Zumpfe added.

Investors in the US financial market are leaning towards the possibility of former President Donald Trump’s re-election. If Trump becomes the next leader of the White House, US public debt and budget deficit could surge, leading to a less sustainable fiscal environment. Such a scenario would favor gold prices as it is considered a hedge against risks when debt and money supply become excessive.

This week, the European Central Bank (ECB) cut interest rates for the third time this year, continuing the trend of global central banks’ easing policies as inflation eases and economic growth prospects deteriorate. Gold, being a non-interest-bearing asset, benefits from a low-interest-rate environment, which supports its upward trajectory.

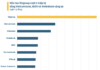

So far this year, gold prices have surged more than 30%, heading towards completing the strongest year since 1979, according to data from LSEG.

Sources familiar with the matter told Reuters that the ECB could cut interest rates again in December unless economic data show significant improvement. Meanwhile, according to data from the CME FedWatch Tool, the market is betting on a 92% chance of the Fed cutting rates at its November meeting.

Max Layton, head of global commodity research at Citi, forecasts gold to reach $3,000 per ounce in the next 6-12 months, as economic uncertainties in the US and Europe drive up gold investment demand.

The US dollar turned lower on Friday after rising from the beginning of the week to an 11-week high on Thursday. The Dollar Index closed down 0.35% at 103.46 points.

However, for the week, the greenback still gained 0.56%, bringing its one-month increase to 2.72%, according to data from MarketWatch.