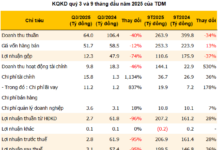

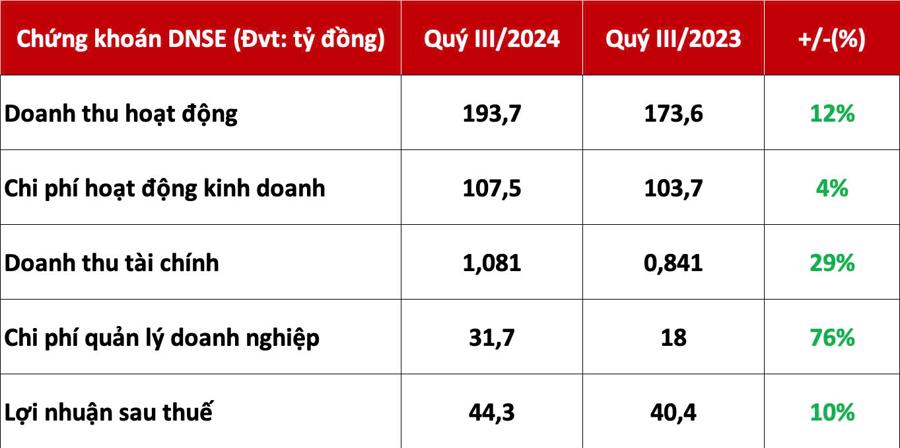

DNSE Securities has released its Q3/2024 financial report, posting impressive results with operating revenue reaching VND 193.7 billion, a 12% increase compared to the same period last year.

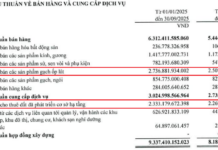

The company’s Q3 margin lending balance witnessed robust growth, surging to VND 3,978.8 billion, representing a 65% increase from the beginning of the year and an 89% jump from Q3 2023. Securities brokerage revenue climbed to VND 33 billion, equivalent to a 39% year-over-year increase, and this segment remains the primary contributor to the company’s operating revenue.

Profit from loans and receivables rose by 19% year-over-year to VND 93.4 billion. Operating expenses increased by 4% from the previous year to VND 107.5 billion. Meanwhile, administrative expenses witnessed a substantial surge, climbing by 76% to reach VND 31.7 billion.

Net profit for the period stood at VND 44.3 billion, reflecting a 10% increase compared to the corresponding period last year. Despite a cautious investor sentiment leading to reduced market liquidity in Q3, DNSE successfully maintained stable revenue growth and sustained its profit trajectory relative to 2023.

For the nine months ended September 30, 2024, DNSE’s securities brokerage revenue reached VND 105.3 billion, marking a significant 115% increase compared to the same period in 2023. Operating revenue and net profit for the nine-month period stood at VND 573.4 billion and VND 148.6 billion, respectively, translating to year-over-year increases of 15% and 14%.

In addition to its impressive financial performance, DNSE also experienced substantial growth in its customer base, capturing 20.21% of new account openings in the market during September 2024.

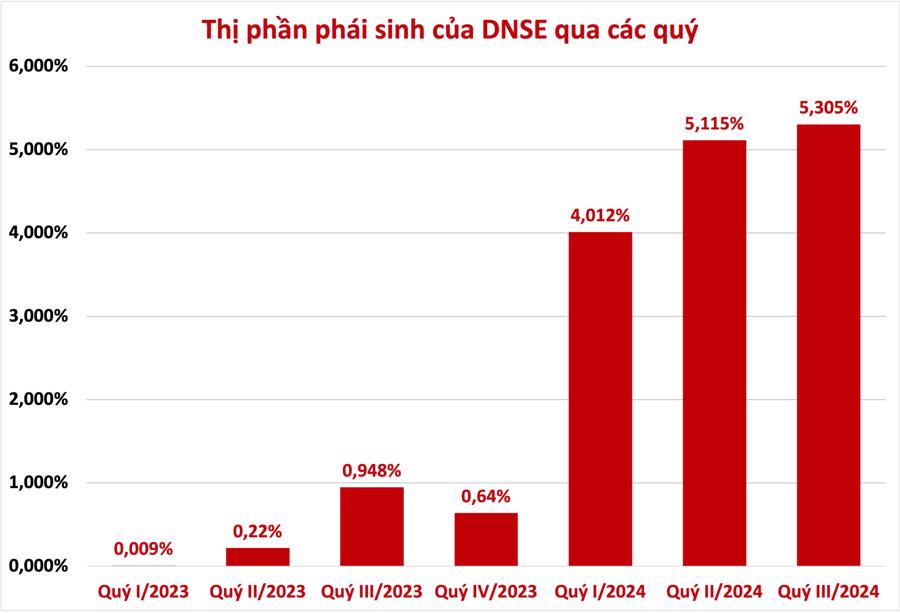

Notably, in the derivatives segment, DNSE has been rapidly ascending the market share rankings. Having occupied the fourth position in the market share rankings for derivatives brokerage in Q2, DNSE advanced to secure third place in Q3/2024 with a 5.3% market share. This segment has been a key focus area for DNSE’s business expansion strategy in 2024.

With a strong customer-centric approach to its research and product development strategies, DNSE has been consistently launching innovative financial products to bolster the growth of its brokerage business.

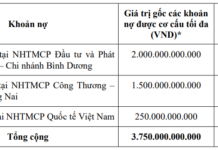

As the leading digital securities company in Vietnam, DNSE introduced a unique transaction-based management and lending system, known as Margin Deal, which offers unparalleled transparency in taxes and fees, effectively mitigating the risk of forced liquidation of well-performing stocks in a client’s portfolio. The company offers flexible margin lending packages with attractive interest rates starting from just 5.99% or 9.99%. Additionally, DNSE provides a range of interest-free loan packages, spanning from 3 to 5 or even 10 days, catering to the needs of short-term traders.

DNSE also offers automated tools that empower investors with flexibility and control over their lending strategies, such as the Fin X package, which allows investors to proactively propose loan packages without any restrictions on the number of stock symbols they can include.

In the derivatives space, DNSE has swiftly captured market share by offering a high-speed, stable trading system that minimizes the number of steps required to execute trades, catering to the immediate needs of derivatives traders. The platform also enables automated profit-taking and stop-loss orders, empowering investors to effectively navigate the rapid fluctuations inherent in the derivatives market, thereby enhancing investment returns and risk management capabilities.

Building on the success of its “Derivatives Arena” contest, which was launched in April 2024 and has since attracted over 9,500 participants and nearly 740,000 derivative contracts, DNSE is committed to extending this initiative until the end of December 2024. This contest has proven to be an effective customer acquisition channel, significantly contributing to the growth in both customer numbers and trading volume. As the company continues to foster this key business segment, the extension of the contest underscores DNSE’s dedication to delivering exceptional experiences for derivatives traders.

Looking ahead to the fourth quarter of 2024, market experts anticipate a strong recovery in consumer demand, coupled with sustained profit margin expansion due to effective management of input costs. The growth prospects for the third and fourth quarters of 2024 appear promising for most sectors, boding well for the stock market and presenting opportunities for securities firms like DNSE to further bolster their performance in the remaining months of the year.